- Australia

- /

- Hospitality

- /

- ASX:BET

This Is Why We Think Betmakers Technology Group Ltd's (ASX:BET) CEO Might Get A Pay Rise Approved By Shareholders

Shareholders will be pleased by the robust performance of Betmakers Technology Group Ltd (ASX:BET) recently and this will be kept in mind in the upcoming AGM on 26 April 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

Check out our latest analysis for Betmakers Technology Group

Comparing Betmakers Technology Group Ltd's CEO Compensation With the industry

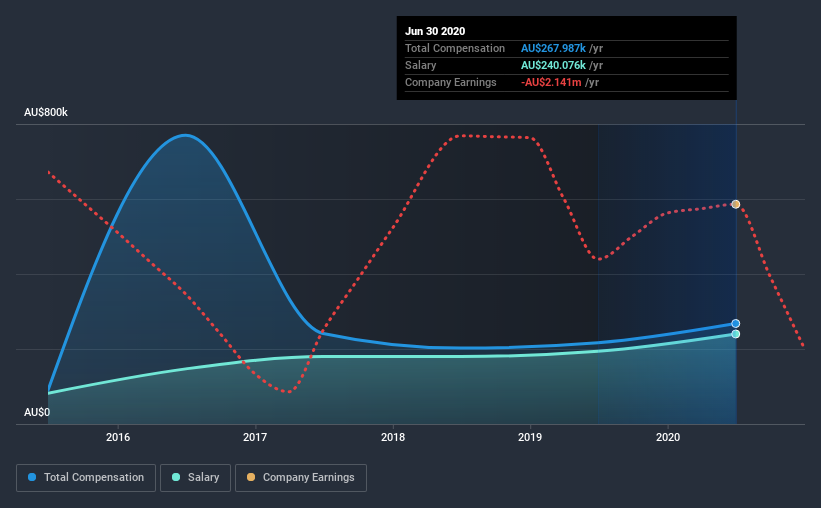

According to our data, Betmakers Technology Group Ltd has a market capitalization of AU$1.0b, and paid its CEO total annual compensation worth AU$268k over the year to June 2020. That's a notable increase of 24% on last year. In particular, the salary of AU$240.1k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$517m and AU$2.1b had a median total CEO compensation of AU$1.3m. Accordingly, Betmakers Technology Group pays its CEO under the industry median. Furthermore, Todd Buckingham directly owns AU$18m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$240k | AU$194k | 90% |

| Other | AU$28k | AU$23k | 10% |

| Total Compensation | AU$268k | AU$217k | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. Betmakers Technology Group pays out 90% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Betmakers Technology Group Ltd's Growth

Betmakers Technology Group Ltd's earnings per share (EPS) grew 5.0% per year over the last three years. Its revenue is up 63% over the last year.

We like the look of the strong year-on-year improvement in revenue. With that in mind, the modestly improving EPS seems positive. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Betmakers Technology Group Ltd Been A Good Investment?

Boasting a total shareholder return of 1,022% over three years, Betmakers Technology Group Ltd has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Betmakers Technology Group (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Betmakers Technology Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Betmakers Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BET

Betmakers Technology Group

Engages in the development and provision of software, data, and analytics products for the B2B wagering market in Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives