- Australia

- /

- Hospitality

- /

- ASX:BET

Betmakers Technology Group (ASX:BET) Is In A Strong Position To Grow Its Business

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Betmakers Technology Group (ASX:BET) has seen its share price rise 225% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So notwithstanding the buoyant share price, we think it's well worth asking whether Betmakers Technology Group's cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Betmakers Technology Group

How Long Is Betmakers Technology Group's Cash Runway?

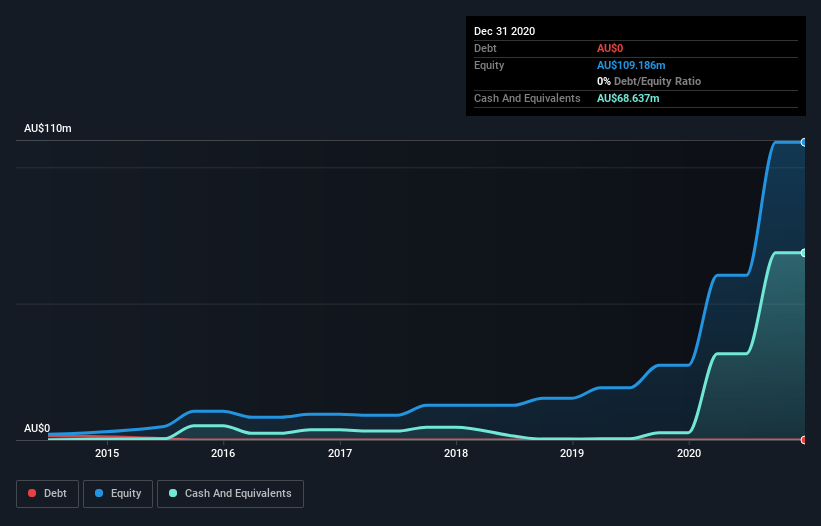

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2020, Betmakers Technology Group had cash of AU$69m and no debt. In the last year, its cash burn was AU$1.8m. So it had a very long cash runway of many years from December 2020. Notably, however, the one analyst we see covering the stock thinks that Betmakers Technology Group will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

How Well Is Betmakers Technology Group Growing?

One thing for shareholders to keep front in mind is that Betmakers Technology Group increased its cash burn by 207% in the last twelve months. While that certainly gives us pause for thought, we take a lot of comfort in the strong annual revenue growth of 64%. In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Betmakers Technology Group Raise More Cash Easily?

While Betmakers Technology Group seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of AU$904m, Betmakers Technology Group's AU$1.8m in cash burn equates to about 0.2% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Betmakers Technology Group's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Betmakers Technology Group is burning through its cash. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. There's no doubt that shareholders can take a lot of heart from the fact that at least one analyst is forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Taking a deeper dive, we've spotted 3 warning signs for Betmakers Technology Group you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading Betmakers Technology Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Betmakers Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BET

Betmakers Technology Group

Engages in the development and provision of software, data, and analytics products for the B2B wagering market in Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives