- Australia

- /

- Metals and Mining

- /

- ASX:WWI

Betmakers Technology Group And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.5%, but it has risen by 19% over the past year, with earnings expected to grow by 12% annually in the coming years. For those looking to invest in smaller or newer companies, penny stocks—despite being a somewhat outdated term—can still offer surprising value. This article highlights three such stocks that could pair balance sheet strength with long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Betmakers Technology Group (ASX:BET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Betmakers Technology Group Ltd develops and provides software, data, and analytics products for the B2B wagering market across Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally with a market cap of A$81.07 million.

Operations: The company's revenue is derived from two main segments: Global Tote, generating A$54.77 million, and Global Betting Services, contributing A$40.43 million.

Market Cap: A$81.07M

Betmakers Technology Group, with a market cap of A$81.07 million, operates in the B2B wagering market but remains unprofitable, reporting a net loss of A$38.67 million for the year ending June 2024. Despite stable revenues from its Global Tote and Global Betting Services segments totaling A$95.2 million, losses have increased annually by 36.9% over five years. The company benefits from sufficient cash runway exceeding three years if cash flow remains stable and maintains no debt liabilities while covering both short- and long-term obligations with its assets. Recent removal from the S&P Global BMI Index reflects ongoing challenges in profitability and management stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Betmakers Technology Group.

- Assess Betmakers Technology Group's previous results with our detailed historical performance reports.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is involved in the exploration, development, production, and sale of metallurgical coal in Australia with a market cap of A$2.71 billion.

Operations: The company generates revenue of $2.54 billion from its Metals & Mining segment, specifically focusing on coal.

Market Cap: A$2.71B

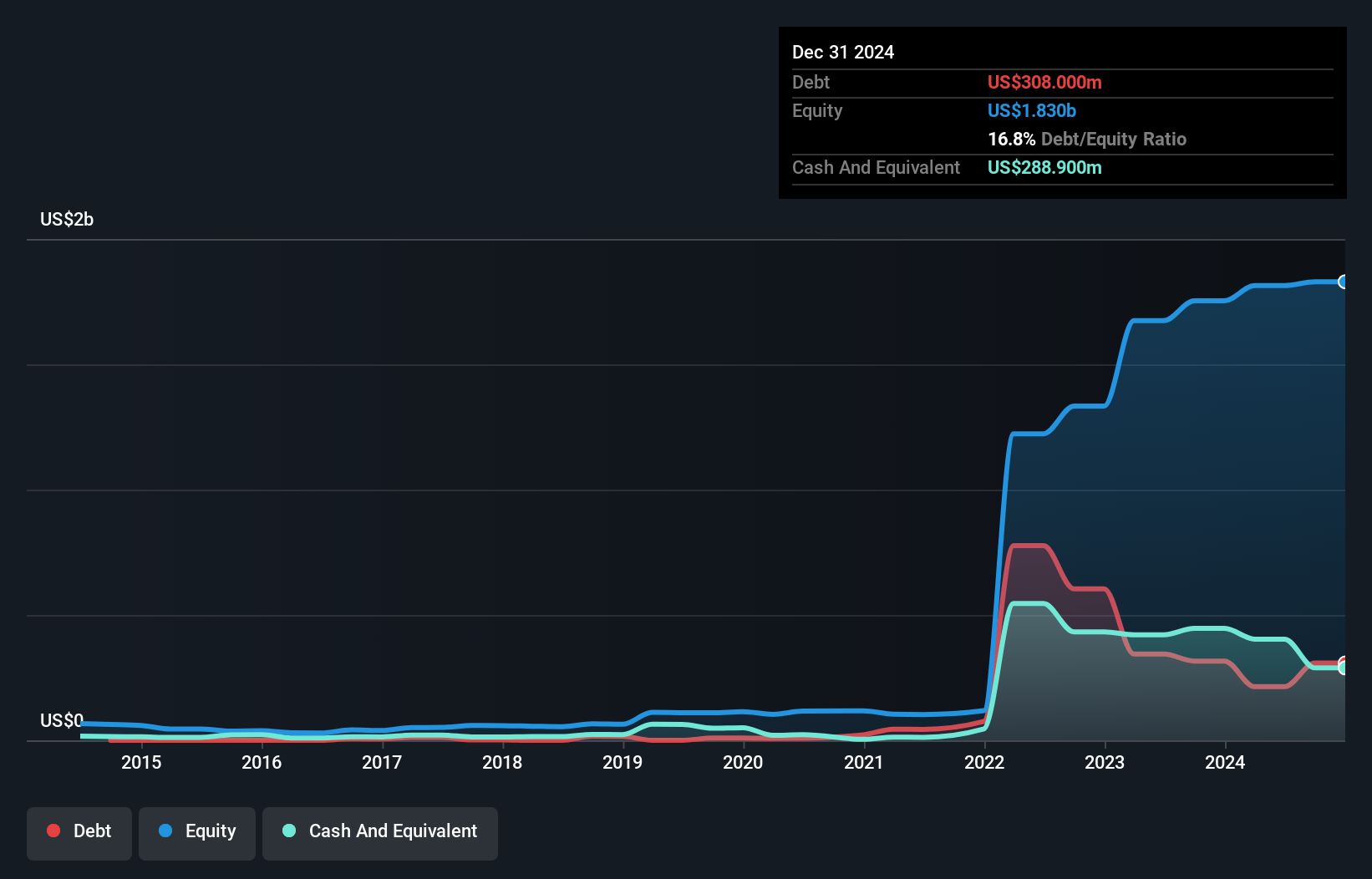

Stanmore Resources, with a market cap of A$2.71 billion, focuses on metallurgical coal production in Australia and reported revenue of US$1.33 billion for the half year ending June 2024. Despite a decline in net income to US$136.3 million from US$340.3 million the previous year, it maintains high-quality earnings and trades at a significant discount to estimated fair value. The company's debt is well covered by operating cash flow, although short-term assets do not fully cover long-term liabilities. While its profit margins have decreased and earnings are forecasted to decline, it benefits from stable weekly volatility and undiluted shareholder equity over the past year.

- Get an in-depth perspective on Stanmore Resources' performance by reading our balance sheet health report here.

- Explore Stanmore Resources' analyst forecasts in our growth report.

West Wits Mining (ASX:WWI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: West Wits Mining Limited is involved in the exploration and development of gold and base metals mining tenements in South Africa and Western Australia, with a market cap of A$40.67 million.

Operations: The company generates revenue from its Mining & Exploration segment, amounting to A$0.03 million.

Market Cap: A$40.67M

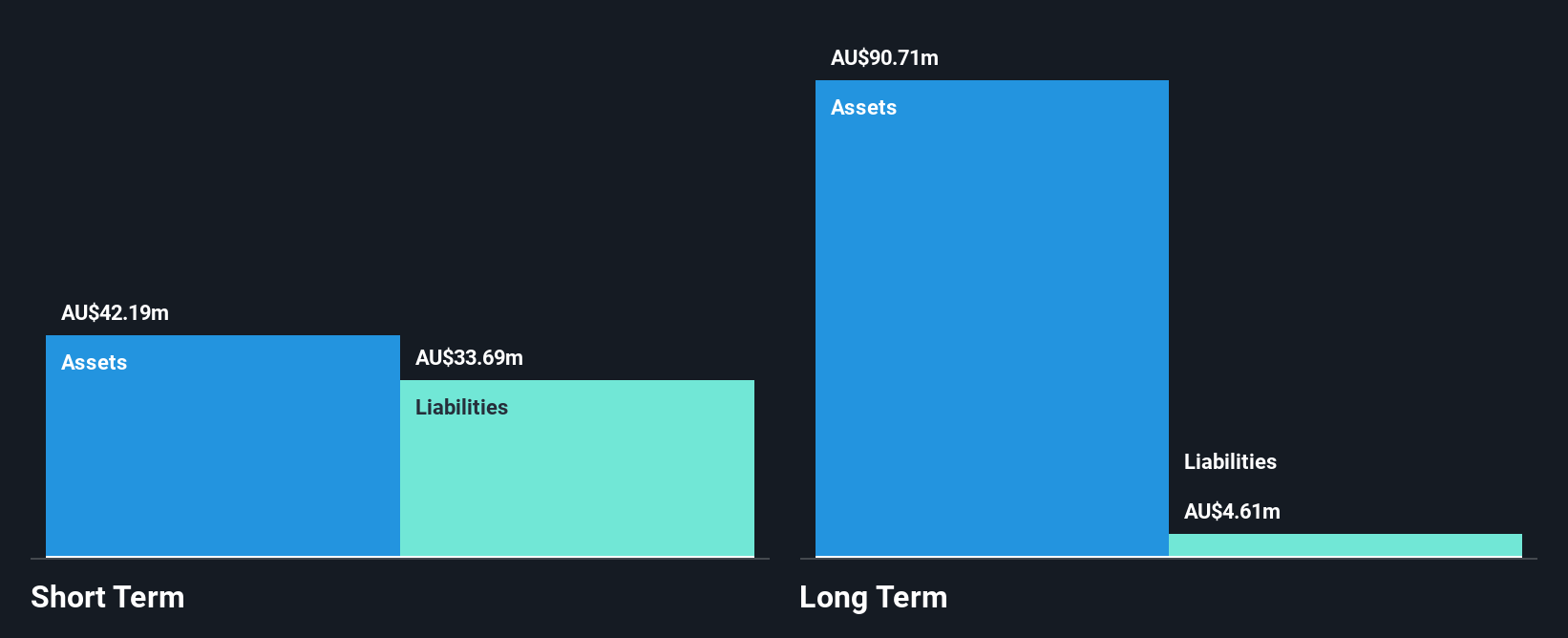

West Wits Mining Limited, with a market cap of A$40.67 million, is pre-revenue and focuses on gold and base metals exploration in South Africa and Western Australia. The company has experienced shareholder dilution over the past year, with shares outstanding increasing by 9.5%. Although it has more cash than total debt and recently raised additional capital through private placements, its short-term assets of A$1.5 million do not cover short-term liabilities of A$2.4 million. West Wits reported a net loss of A$1.68 million for the full year ending June 2024, an improvement from the previous year's loss of A$2.75 million.

- Click to explore a detailed breakdown of our findings in West Wits Mining's financial health report.

- Learn about West Wits Mining's historical performance here.

Key Takeaways

- Click here to access our complete index of 1,031 ASX Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Wits Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WWI

West Wits Mining

Engages in the exploration, development, and production of mineral properties in South Africa and Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives