- Australia

- /

- Hospitality

- /

- ASX:ALL

Investor Optimism Abounds Aristocrat Leisure Limited (ASX:ALL) But Growth Is Lacking

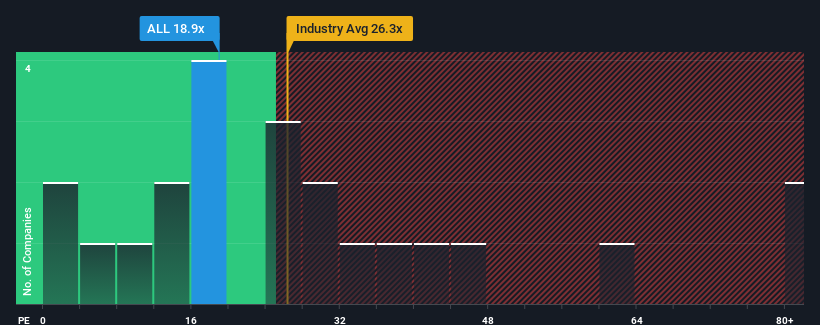

With a median price-to-earnings (or "P/E") ratio of close to 19x in Australia, you could be forgiven for feeling indifferent about Aristocrat Leisure Limited's (ASX:ALL) P/E ratio of 18.9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Aristocrat Leisure certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Aristocrat Leisure

How Is Aristocrat Leisure's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Aristocrat Leisure's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's bottom line. Pleasingly, EPS has also lifted 264% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 6.6% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 17% per year, which is noticeably more attractive.

In light of this, it's curious that Aristocrat Leisure's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Aristocrat Leisure currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Aristocrat Leisure with six simple checks.

If you're unsure about the strength of Aristocrat Leisure's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ALL

Aristocrat Leisure

Operates as a gaming content and technology company in Australia and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives