- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Woolworths Group (ASX:WOW) Faces ACCC Lawsuit Over Misleading Pricing Claims, Potential Impact on Valuation

Reviewed by Simply Wall St

The Woolworths Group(ASX:WOW) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include eCommerce growth and increased customer loyalty, juxtaposed against overvaluation concerns and operational inefficiencies. In the discussion that follows, we will explore Woolworths' financial health, core strengths, areas for improvement, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Dive into the specifics of Woolworths Group here with our thorough analysis report.

Strengths: Core Advantages Driving Sustained Success For Woolworths Group

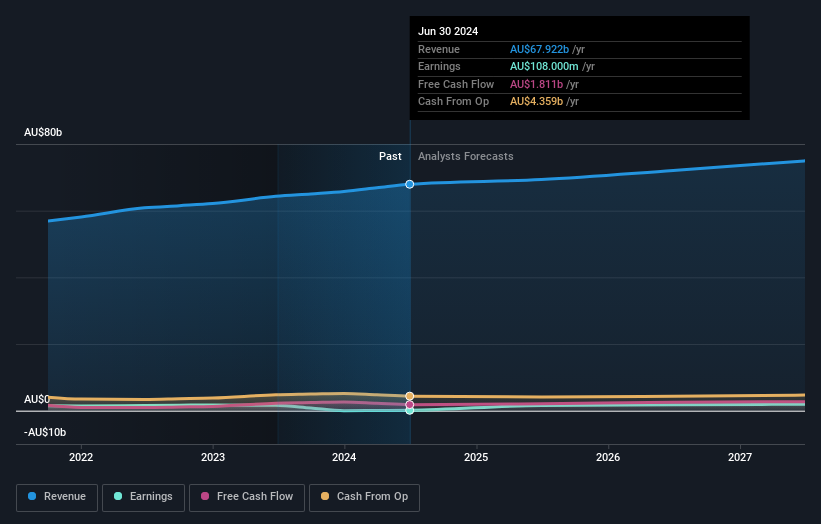

Woolworths Group has demonstrated sales growth, with group normalized sales increasing by 3.7% annually, driven significantly by eCommerce sales, which surged by 18.5%. This growth is further supported by profitability in key segments, particularly in Australian Food, where normalized sales rose by 3.7% and EBIT increased by 6%. The company's digital engagement has also been noteworthy, with weekly visits to digital assets surpassing physical store transactions. Additionally, Woolworths has seen a substantial increase in customer loyalty, with active Everyday Rewards members in Australia reaching 9.8 million. Operational improvements, such as the blueprint provided by the Melbourne, South Regional DC, further underscore the company's strategic advancements.

To gain deeper insights into Woolworths Group's historical performance, explore our detailed analysis of past performance.

Weaknesses: Critical Issues Affecting Woolworths Group's Performance and Areas For Growth

Woolworths faces several challenges. The company is currently trading above its estimated fair value (A$32.98 vs. A$31.67), indicating potential overvaluation compared to its peers and industry averages based on its Price-To-Sales Ratio (0.6x vs. industry average of 0.4x). Additionally, segments like New Zealand Food and BIG W have struggled, impacted by value-conscious customers in a competitive market. Customer experience issues have also emerged, with a rapid change in expectations leading to a decline in sales momentum and customer scores. High costs remain a concern, with approximately $90 million to $100 million in incremental costs expected from the commissioning ramp-up. Furthermore, the company's EBIT declined by 1.3% in the second half of the year, with growth in Australian Food and B2B offset by lower earnings in New Zealand Food and BIG W.

To dive deeper into how Woolworths Group's valuation metrics are shaping its market position, check out our detailed analysis of Woolworths Group's Valuation.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Woolworths has several opportunities to leverage for growth. The expansion of eCommerce is a significant avenue, with group eCom sales for FY '27 nearing $8 billion, reflecting a normalized growth of 18.5%. The company's transformation plans, although still in progress, show promise for future improvements. Leveraging digital tools such as in-store shopping mode and best unit price filters can enhance customer shopping experiences and drive further engagement. Sustainability initiatives and growing adjacencies in platform businesses also present opportunities for Woolworths to strengthen its market position and capitalize on emerging trends.

Threats: Key Risks and Challenges That Could Impact Woolworths Group's Success

Woolworths faces several threats that could impact its success. The competitive market pressures are significant, with the group's full-year financial performance reflecting a challenging operating environment due to elevated cost of living pressures. Economic factors, such as persistent cost of living pressures, have also affected customer spending. Regulatory challenges, including the need to engage constructively with unions, pose additional risks. Operational risks are evident, with availability issues arising from the installation of a new SAP UDF system. These factors collectively present substantial challenges that Woolworths must navigate to maintain its market position and growth trajectory.

Conclusion

Woolworths Group's sustained success is driven by its strong sales growth, particularly in eCommerce and Australian Food segments, and enhanced digital engagement, which have significantly bolstered customer loyalty. However, the company is trading at A$32.98, above its estimated fair value of A$31.67, suggesting potential overpricing relative to peers based on its Price-To-Sales Ratio of 0.6x versus the industry average of 0.4x. This overpricing, coupled with challenges in segments like New Zealand Food and BIG W, high operational costs, and economic pressures, indicates the need for strategic focus on cost management and customer experience improvements. Leveraging opportunities in eCommerce expansion, digital tools, and sustainability initiatives could help Woolworths navigate these challenges and strengthen its market position in the future.

Where To Now?

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:WOW

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives