- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Revenues Tell The Story For Woolworths Group Limited (ASX:WOW)

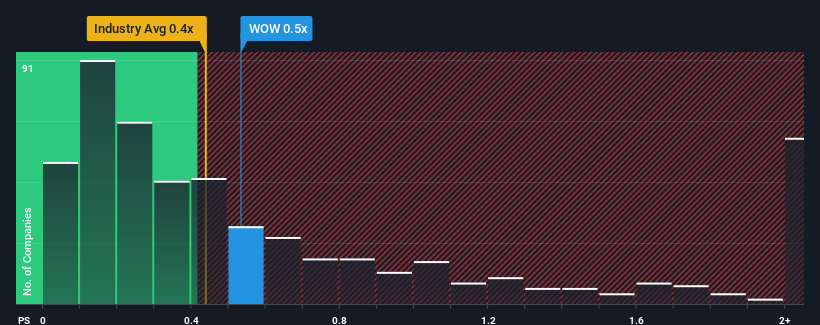

There wouldn't be many who think Woolworths Group Limited's (ASX:WOW) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Consumer Retailing industry in Australia is very similar. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Woolworths Group

What Does Woolworths Group's P/S Mean For Shareholders?

Recent revenue growth for Woolworths Group has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Woolworths Group.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Woolworths Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. The latest three year period has also seen a 22% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.3% per year as estimated by the analysts watching the company. With the industry predicted to deliver 3.0% growth each year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Woolworths Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Woolworths Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Woolworths Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WOW

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives