- Australia

- /

- Food and Staples Retail

- /

- ASX:MTS

Can Metcash’s (ASX:MTS) Steady Dividend Offset Tobacco-Driven Earnings Pressure?

Reviewed by Sasha Jovanovic

- Metcash Limited has reported half-year results to 31 October 2025 showing essentially flat group sales at A$8,477.5 million and net profit of A$142.2 million, while declaring a fully franked interim dividend of A$0.085 per share.

- Beneath the headline stability, a sharp fall in tobacco sales following July’s regulatory changes is reshaping the mix of Metcash’s wholesale earnings and testing the resilience of its core food, liquor and hardware businesses.

- We’ll now examine how the tobacco-led earnings hit, alongside the maintained dividend, reshapes Metcash’s investment narrative for long-term investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Metcash Investment Narrative Recap

To hold Metcash, you need to believe its wholesale model across food, liquor and hardware can offset structural tobacco decline and cost pressures, supporting resilient cash flows and dividends. The latest half-year confirms earnings stability despite the tobacco shock, but also underlines the short term risk that a faster reset in tobacco and any spillover to store traffic could weigh on group margins more than expected.

The reaffirmed fully franked interim dividend of A$0.085 per share is the clearest recent signal that management sees current earnings as sufficiently robust to sustain income for now. For investors focused on catalysts, that dividend stance sits alongside the key question of whether growth in tobacco free food, liquor and hardware volumes can consistently compensate for the regulatory driven erosion in higher margin tobacco wholesale revenue.

But investors should also recognise how quickly regulatory shifts in tobacco can affect wholesale profitability and store economics, especially when...

Read the full narrative on Metcash (it's free!)

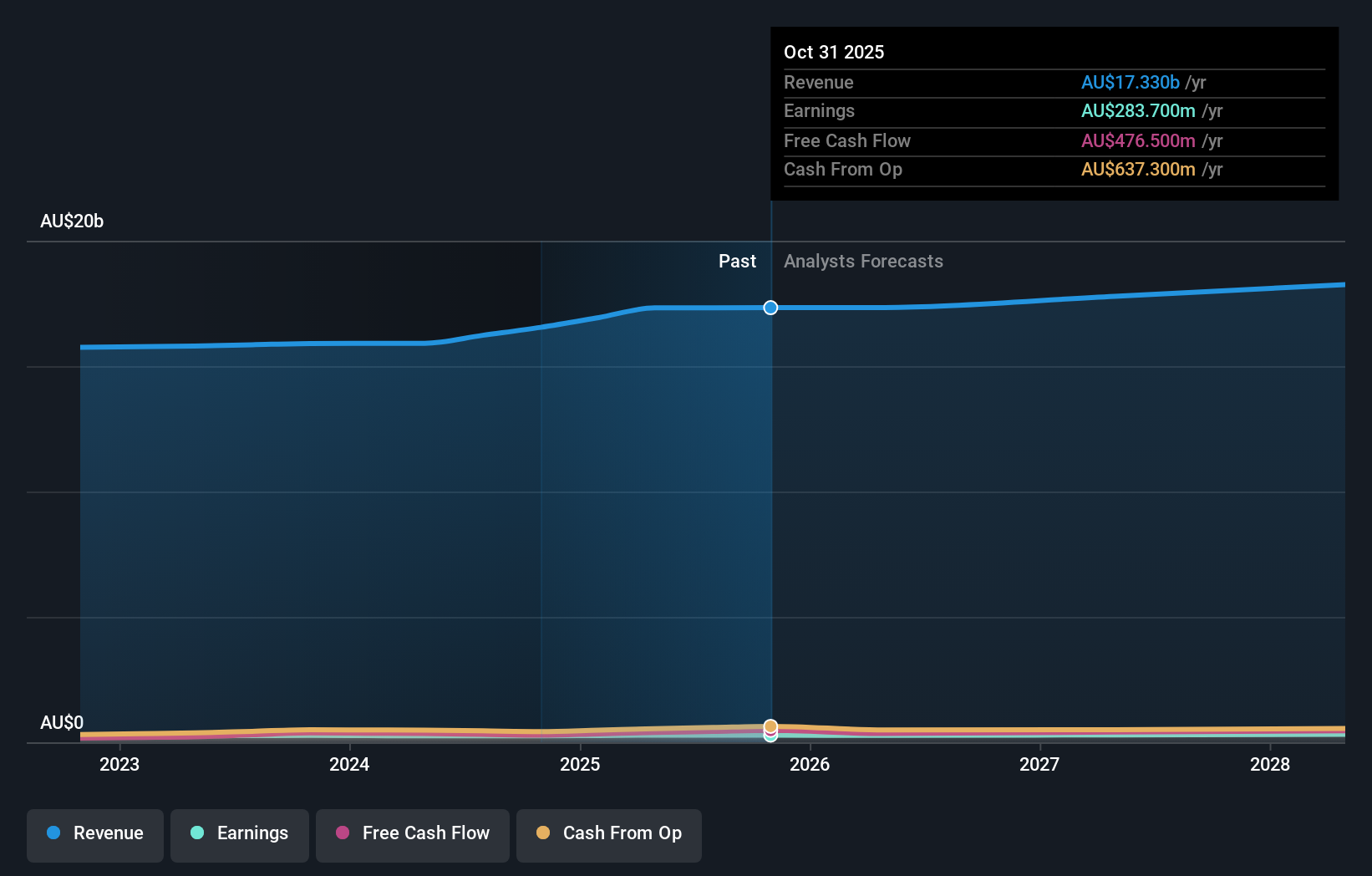

Metcash’s narrative projects A$18.7 billion revenue and A$338.7 million earnings by 2028.

Uncover how Metcash's forecasts yield a A$4.04 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly A$2.66 to A$10.01 per share, showing wide disagreement on Metcash’s worth. You can set those views against the current tobacco driven earnings risk, which may help frame how resilient you think the group’s diversified wholesale model really is over time.

Explore 6 other fair value estimates on Metcash - why the stock might be worth over 2x more than the current price!

Build Your Own Metcash Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metcash research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Metcash research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metcash's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MTS

Metcash

Operates as a wholesale distribution and marketing company in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026