- Australia

- /

- Food and Staples Retail

- /

- ASX:EDV

What Endeavour Group (ASX:EDV)'s Board Changes Could Mean for Its Risk and Governance Strategy

Reviewed by Sasha Jovanovic

- Endeavour Group Limited recently announced that Michael Mike Ihlein will join the Board as an independent Non-executive Director, pending probity and regulatory approval, and that Anne Brennan will retire after the 2025 Annual General Meeting, with Ihlein set to succeed her as Chair of the Audit, Risk and Compliance Management Committee.

- Ihlein’s extensive leadership background, including CEO roles and board service across several major Australian companies, signals a bolstering of Endeavour's financial, governance, and risk management expertise during its ongoing transformation.

- We'll examine how the addition of a seasoned director with deep financial expertise could reshape Endeavour Group's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Endeavour Group Investment Narrative Recap

For Endeavour Group shareholders, belief in the long-term value of Australia's leisure, hospitality, and retail liquor sectors is essential, despite current headwinds in subdued consumer spending and margin pressure. The appointment of Mike Ihlein as incoming Chair of the Audit, Risk and Compliance Management Committee is a positive signal for governance and oversight, but has minimal direct impact on the near-term catalysts, such as a potential rebound in consumer hospitality spending, or the pressing risk of structural revenue slowdown in core retail liquor.

Among recent announcements, Endeavour's FY 2025 earnings results, with net income falling to A$426 million and a reduced dividend, stand out as most relevant, reinforcing the short-term challenge around top-line growth and profit margins. The added financial and governance experience on the board may support management's cost initiatives, yet evidence of a quick recovery in retail liquor sales remains limited.

Yet, while board expertise is improving, investors should also be aware of the ongoing regulatory and policy risks that could...

Read the full narrative on Endeavour Group (it's free!)

Endeavour Group's narrative projects A$13.1 billion in revenue and A$542.7 million in earnings by 2028. This requires 2.9% yearly revenue growth and a A$116.7 million earnings increase from the current A$426.0 million.

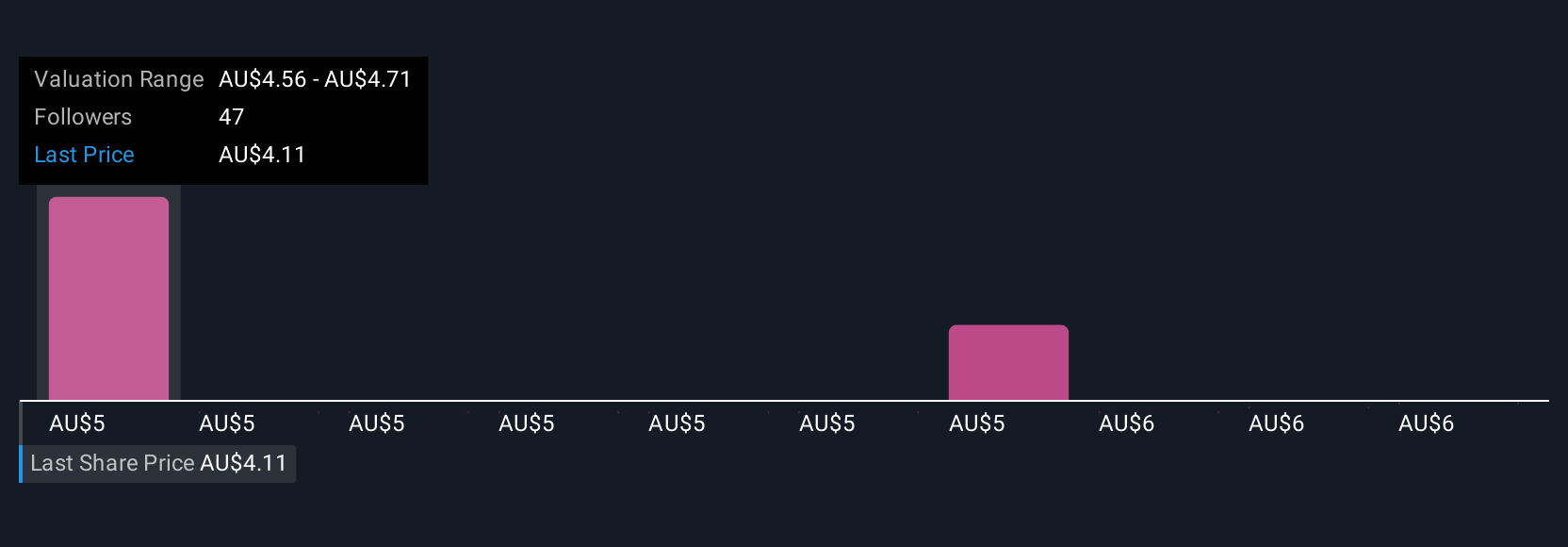

Uncover how Endeavour Group's forecasts yield a A$4.43 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimated Endeavour's fair value between A$4.43 and A$9.82 per share. While some expect substantial rebound, concerns remain heightened around structural shifts in retail liquor spending. Explore more viewpoints for a broader understanding.

Explore 6 other fair value estimates on Endeavour Group - why the stock might be worth over 2x more than the current price!

Build Your Own Endeavour Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Endeavour Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Endeavour Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Endeavour Group's overall financial health at a glance.

No Opportunity In Endeavour Group?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EDV

Endeavour Group

Engages in the retail drinks and hospitality businesses in Australia.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives