In the last week, the Australian market has been flat, yet it has risen 11% over the past 12 months with earnings expected to grow by 12% per annum in the coming years. In this context, identifying strong dividend stocks can be crucial for investors looking to capitalize on consistent income and potential growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.84% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.63% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.36% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.82% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.60% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.61% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.51% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.88% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 7.41% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.40% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited, with a market cap of A$1.35 billion, is a publicly owned investment manager based in Australia.

Operations: Australian United Investment Company Limited generates revenue primarily from its investment segment, amounting to A$57.76 million.

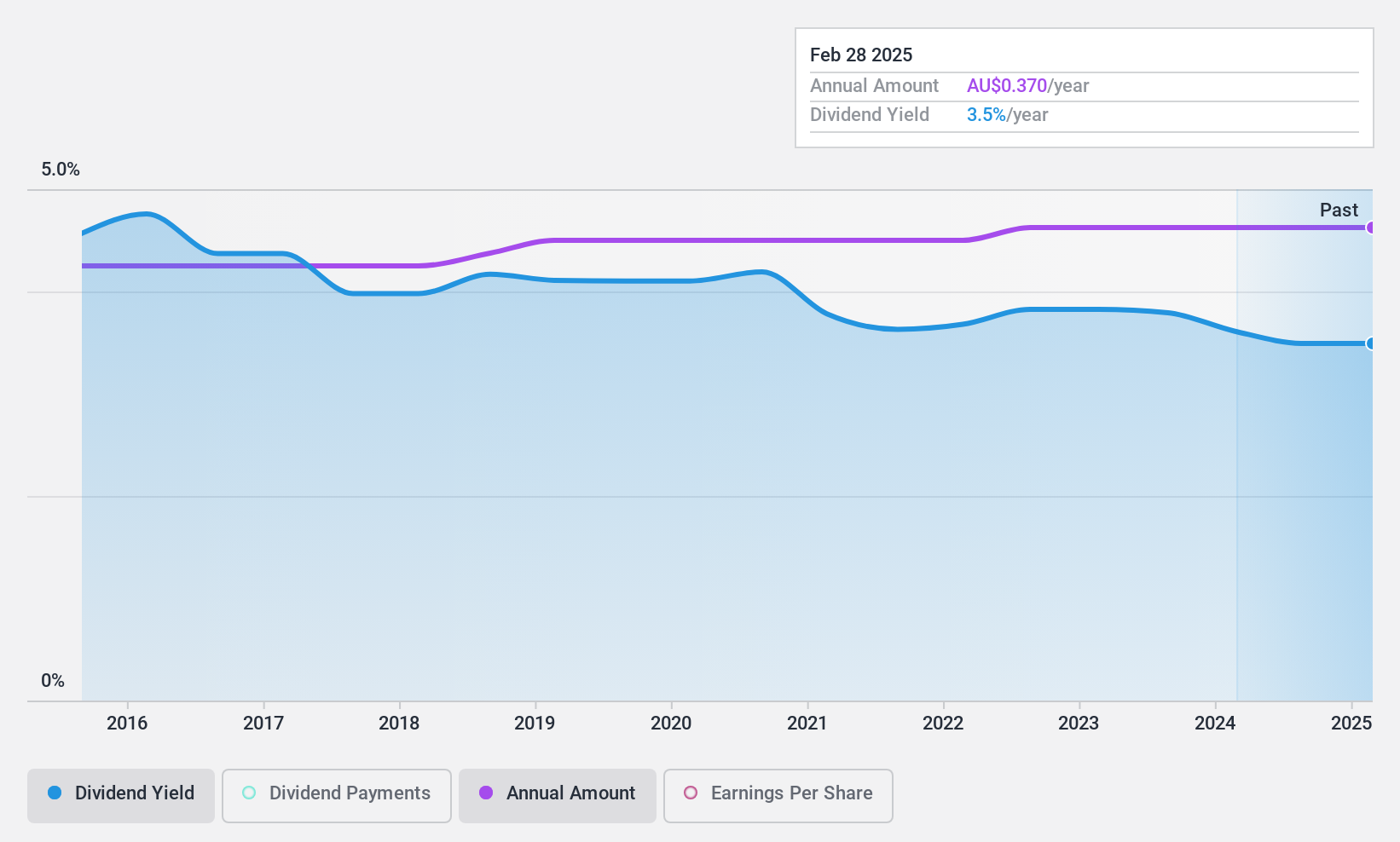

Dividend Yield: 3.4%

Australian United Investment Company Limited (AUI) has announced regular and special dividends totaling A$0.28 per share, with an ex-dividend date of August 26, 2024. Despite stable and growing dividend payments over the past decade, recent earnings of A$49.12 million indicate a decline from last year's A$56.36 million. The high payout ratio (95%) suggests that dividends are not well covered by earnings, raising concerns about sustainability despite reliable historical payouts.

- Get an in-depth perspective on Australian United Investment's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Australian United Investment's current price could be inflated.

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia (ASX:CBA) provides financial services in Australia, New Zealand, and internationally, with a market cap of A$237.07 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (A$12.47 billion), Business Banking (A$8.14 billion), New Zealand operations (A$2.86 billion), and Institutional Banking and Markets (A$2.51 billion).

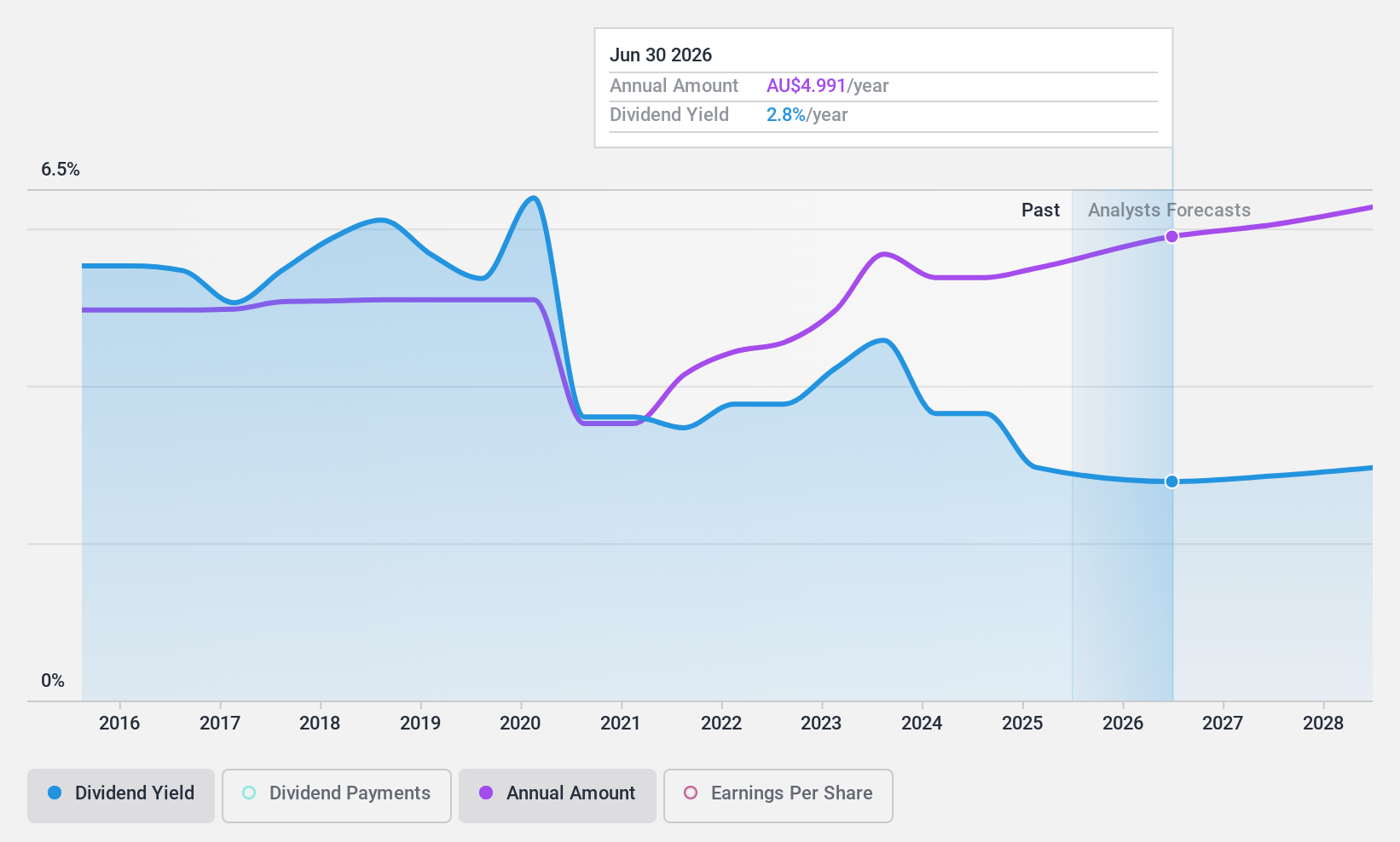

Dividend Yield: 3.3%

Commonwealth Bank of Australia’s dividend yield is relatively low at 3.28%, and its dividends have been volatile over the past decade. The current payout ratio of 82.1% indicates that dividends are covered by earnings, with a forecasted coverage of 78.8% in three years. Recent net income for the year ended June 30, 2024, was A$9.39 billion, down from A$9.99 billion last year, reflecting potential pressure on future payouts despite recent increases in dividend payments to A$2.50 per share.

- Click to explore a detailed breakdown of our findings in Commonwealth Bank of Australia's dividend report.

- The analysis detailed in our Commonwealth Bank of Australia valuation report hints at an inflated share price compared to its estimated value.

Waterco (ASX:WAT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Waterco Limited (ASX:WAT) manufactures, wholesales, and exports swimming pool, spa pool, spa bath, rural pump, and water treatment equipment and accessories across Australia, New Zealand, Asia, North America, and Europe with a market cap of A$187.43 million.

Operations: Waterco Limited's revenue segments include A$244.85 million from Building Products.

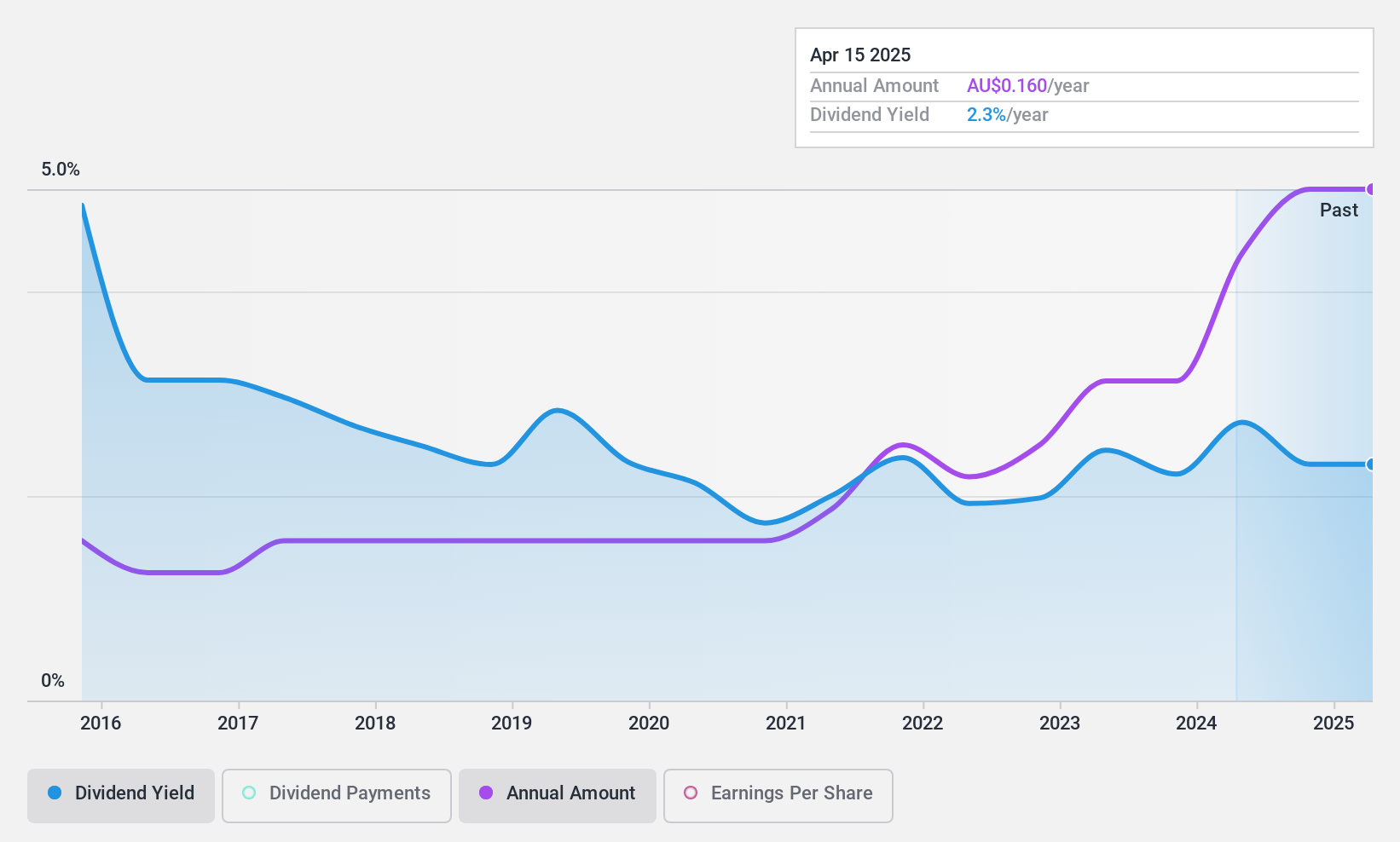

Dividend Yield: 3%

Waterco's dividend yield is modest at 3%, below the top 25% of Australian dividend payers. However, its payout ratios are sustainable, with a cash payout ratio of 25.4% and earnings coverage at 38.1%. Despite past volatility in dividends, recent earnings growth (27.7%) and a final dividend announcement of A$0.08 per share for FY2024 indicate positive momentum. The company also reported significant revenue growth to A$244.85 million and net income improvement to A$13.85 million for the year ended June 30, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Waterco.

- Our valuation report unveils the possibility Waterco's shares may be trading at a premium.

Summing It All Up

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top ASX Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waterco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAT

Waterco

Manufactures, wholesales, and exports equipment and accessories in the swimming pool, spa pool, spa bath, rural pump, and water treatment industries in Australia, New Zealand, Asia, North America, and Europe.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives