- Australia

- /

- Consumer Durables

- /

- ASX:FWD

Fleetwood Limited's (ASX:FWD) P/E Is Still On The Mark Following 26% Share Price Bounce

Fleetwood Limited (ASX:FWD) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

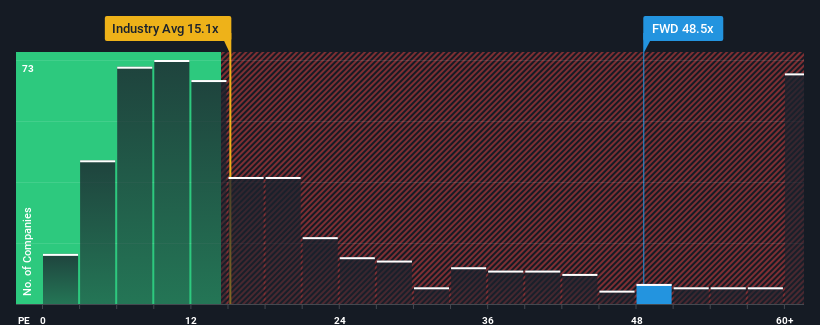

After such a large jump in price, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 17x, you may consider Fleetwood as a stock to avoid entirely with its 48.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Fleetwood could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Fleetwood

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Fleetwood would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 76% per year over the next three years. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Fleetwood's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Fleetwood's P/E?

Shares in Fleetwood have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fleetwood maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Fleetwood that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FWD

Fleetwood

Designs, manufactures, sells, and installs modular accommodation and buildings in Australia and New Zealand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives