- Australia

- /

- Consumer Durables

- /

- ASX:BUD

Buddy Technologies (ASX:BUD) Share Prices Have Dropped 84% In The Last Three Years

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Buddy Technologies Limited (ASX:BUD), who have seen the share price tank a massive 84% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. Shareholders have had an even rougher run lately, with the share price down 33% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Buddy Technologies

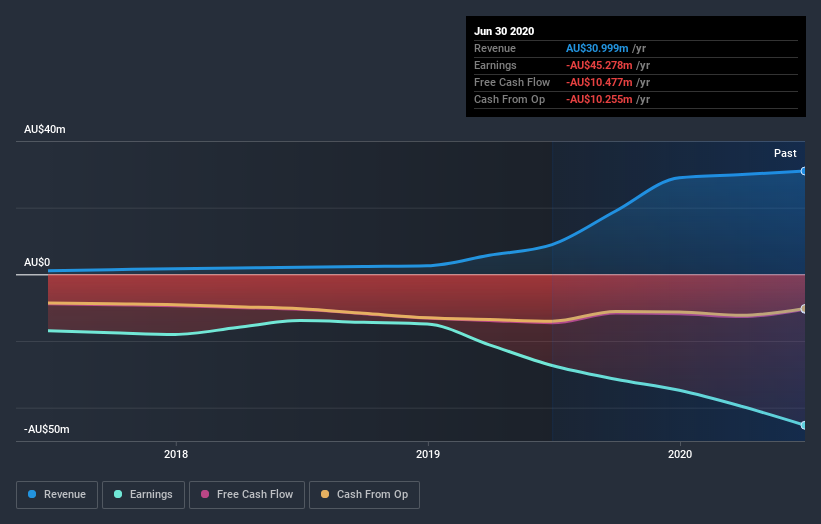

Because Buddy Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Buddy Technologies saw its revenue grow by 104% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 22% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Buddy Technologies' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Buddy Technologies has rewarded shareholders with a total shareholder return of 48% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Buddy Technologies you should be aware of, and 1 of them makes us a bit uncomfortable.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Buddy Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Buddy Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Buddy Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BUD

Buddy Technologies

Buddy Technologies Limited operates as an IoT and cloud-based technology company in Australia.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives