As the Australian market experiences fluctuations with sectors like real estate showing resilience and others lagging, investors are keenly observing the Reserve Bank of Australia's decisions and their impact on indices. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to bolster their portfolios amidst market uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.09% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.19% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.86% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.88% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.77% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.80% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.50% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.17% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.44% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.53% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$363.28 million.

Operations: Kina Securities Limited generates revenue primarily from its Banking & Finance segment, which includes corporate services, amounting to PGK 441.25 million, and its Wealth Management segment contributing PGK 50.19 million.

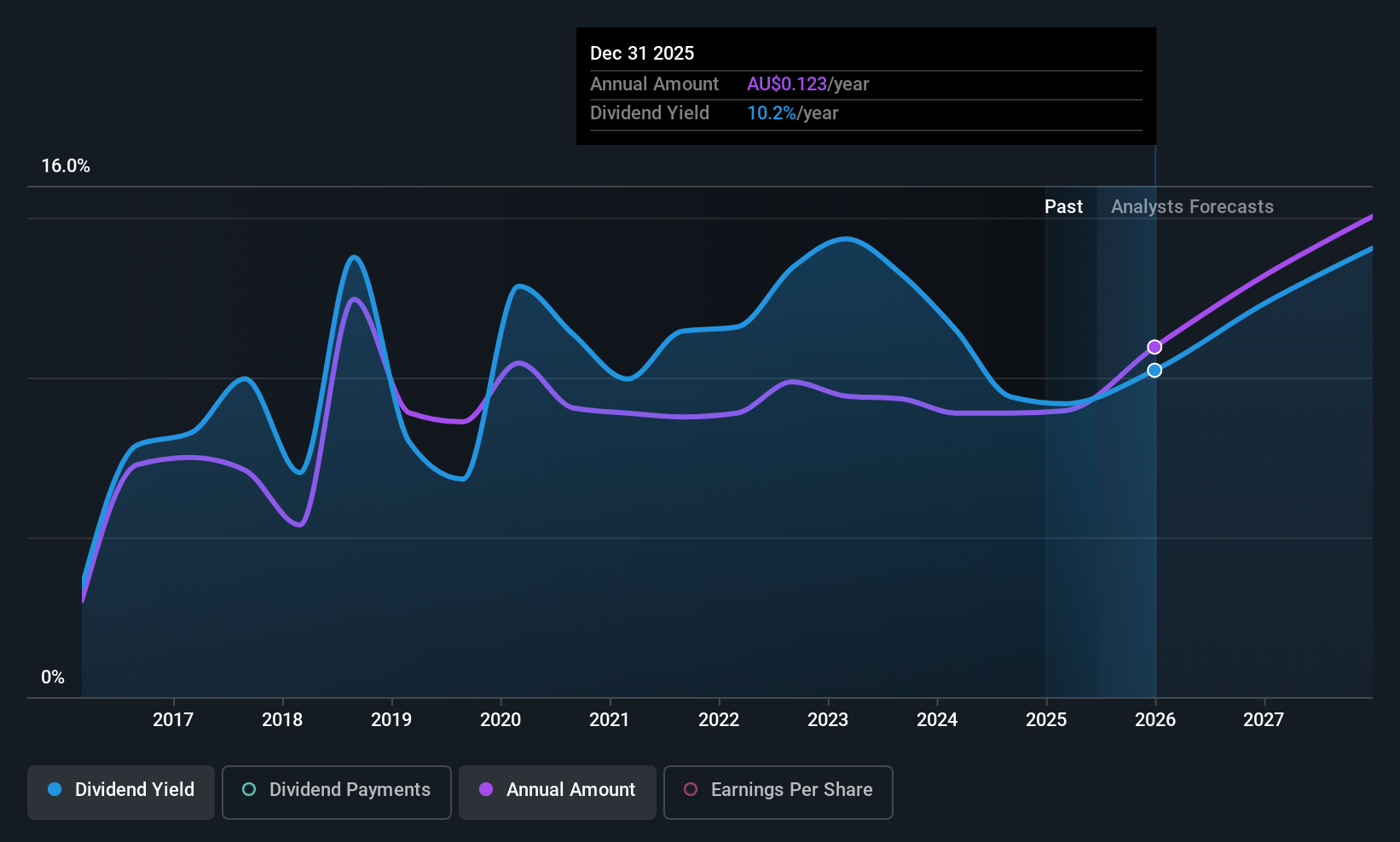

Dividend Yield: 7.5%

Kina Securities offers an attractive dividend yield of 7.5%, placing it in the top quartile among Australian dividend payers. Despite its high yield, the company's dividends have been volatile over the past decade, with significant annual drops. The payout ratio is currently 69.9% and forecasted to be 63.2% in three years, indicating coverage by earnings. Additionally, KSL trades at a favorable price-to-earnings ratio of 8.8x compared to the market average of 21.3x.

- Click here to discover the nuances of Kina Securities with our detailed analytical dividend report.

- The analysis detailed in our Kina Securities valuation report hints at an deflated share price compared to its estimated value.

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia with a market cap of A$238.79 million.

Operations: Lindsay Australia Limited generates revenue through its key segments: Transport (A$586.41 million), Rural (A$168.12 million), and Hunters (A$110.37 million).

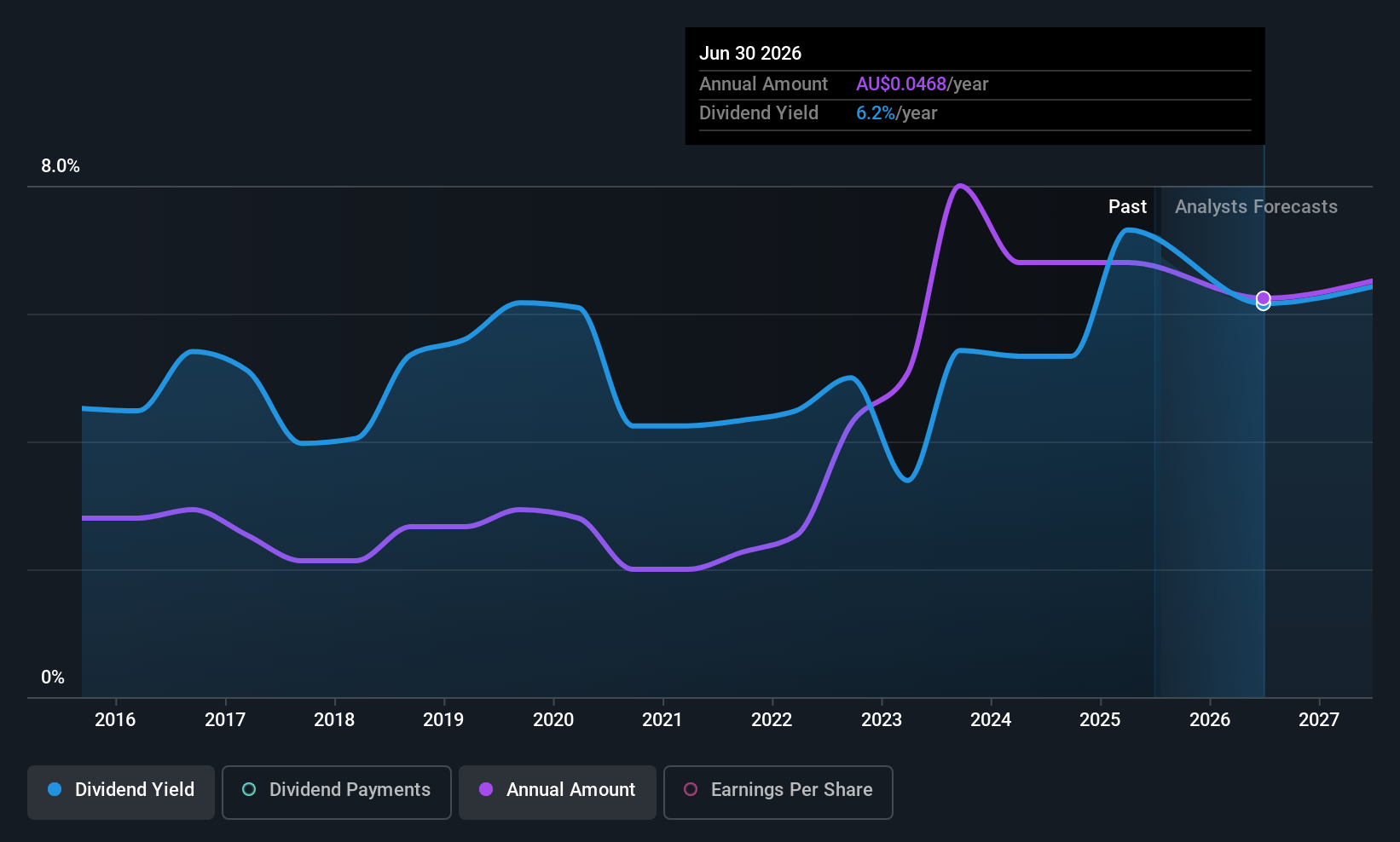

Dividend Yield: 5.8%

Lindsay Australia offers a dividend yield of 5.8%, ranking in the top 25% of Australian dividend payers. Despite its high yield, the company's dividends have been volatile over the past decade, with significant annual drops. The payout ratio is 68.8%, indicating earnings coverage, and a cash payout ratio of 26% suggests strong cash flow backing. However, profit margins have decreased from last year, and shareholders experienced dilution recently.

- Dive into the specifics of Lindsay Australia here with our thorough dividend report.

- According our valuation report, there's an indication that Lindsay Australia's share price might be on the cheaper side.

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited provides storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$352.80 million.

Operations: Sugar Terminals Limited generates revenue of A$118.51 million from its sugar industry segment.

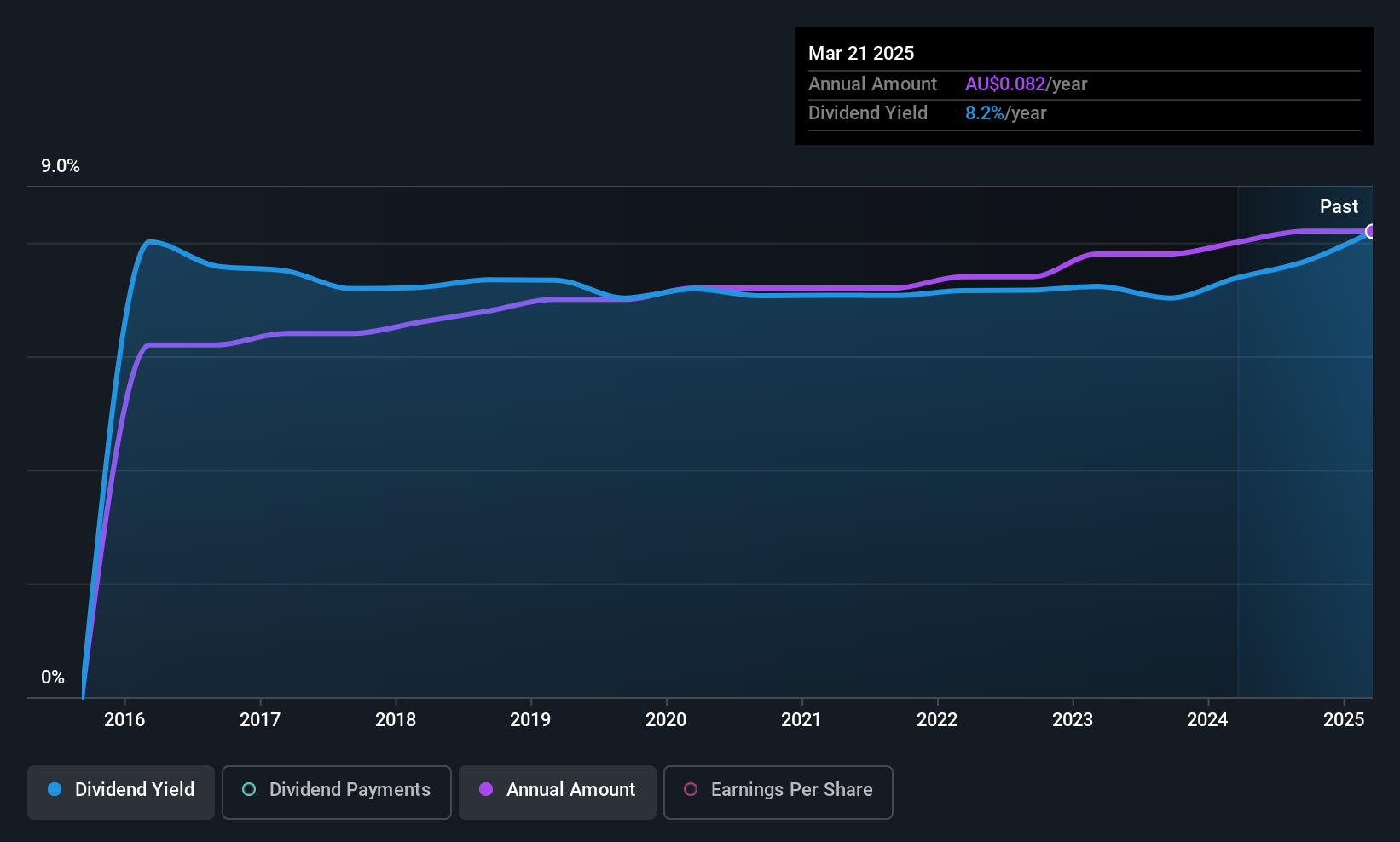

Dividend Yield: 7.9%

Sugar Terminals' dividend yield of 7.86% ranks in the top 25% of Australian payers, but its sustainability is questionable due to a high cash payout ratio of 100.5%. While dividends have been stable and growing over the past decade, recent reductions highlight financial caution. The stock trades at a significant discount to estimated fair value, yet shares remain highly illiquid. Recent board changes could influence strategic direction as new directors bring extensive industry experience.

- Get an in-depth perspective on Sugar Terminals' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sugar Terminals' current price could be quite moderate.

Make It Happen

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top ASX Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kina Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026