The Australian share market is experiencing a slight pullback following a bullish surge, fueled by factors such as the U.S. government shutdown and rising gold prices, which led to significant gains earlier in the week. In this fluctuating environment, dividend stocks can offer investors a measure of stability and income, making them an attractive option for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 5.67% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.80% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.22% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.20% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.98% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.53% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.96% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.79% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korvest Ltd operates in Australia, providing cable and pipe support systems, fastening solutions, and galvanising services with a market cap of A$152.52 million.

Operations: Korvest Ltd generates revenue through its Production segment, contributing A$10.58 million, and its Industrial Products segment, which accounts for A$108.99 million.

Dividend Yield: 5%

Korvest Ltd. recently announced a special dividend of A$0.10 and affirmed a final dividend of A$0.40 for the fiscal year ended June 2025, with both payments scheduled for September 5, 2025. Despite a lower-than-top-tier dividend yield of 5.04%, Korvest's dividends are well-covered by earnings (58% payout ratio) and cash flows (51.3% cash payout ratio). However, its dividend history has been volatile over the past decade, raising concerns about reliability despite recent earnings growth and favorable valuation metrics like a P/E ratio of 11.6x compared to the market average of 21.2x.

- Click to explore a detailed breakdown of our findings in Korvest's dividend report.

- The analysis detailed in our Korvest valuation report hints at an inflated share price compared to its estimated value.

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$31.43 billion.

Operations: QBE Insurance Group Limited's revenue is derived from three main segments: International at $10.08 billion, North America at $7.76 billion, and Australia Pacific at $5.83 billion.

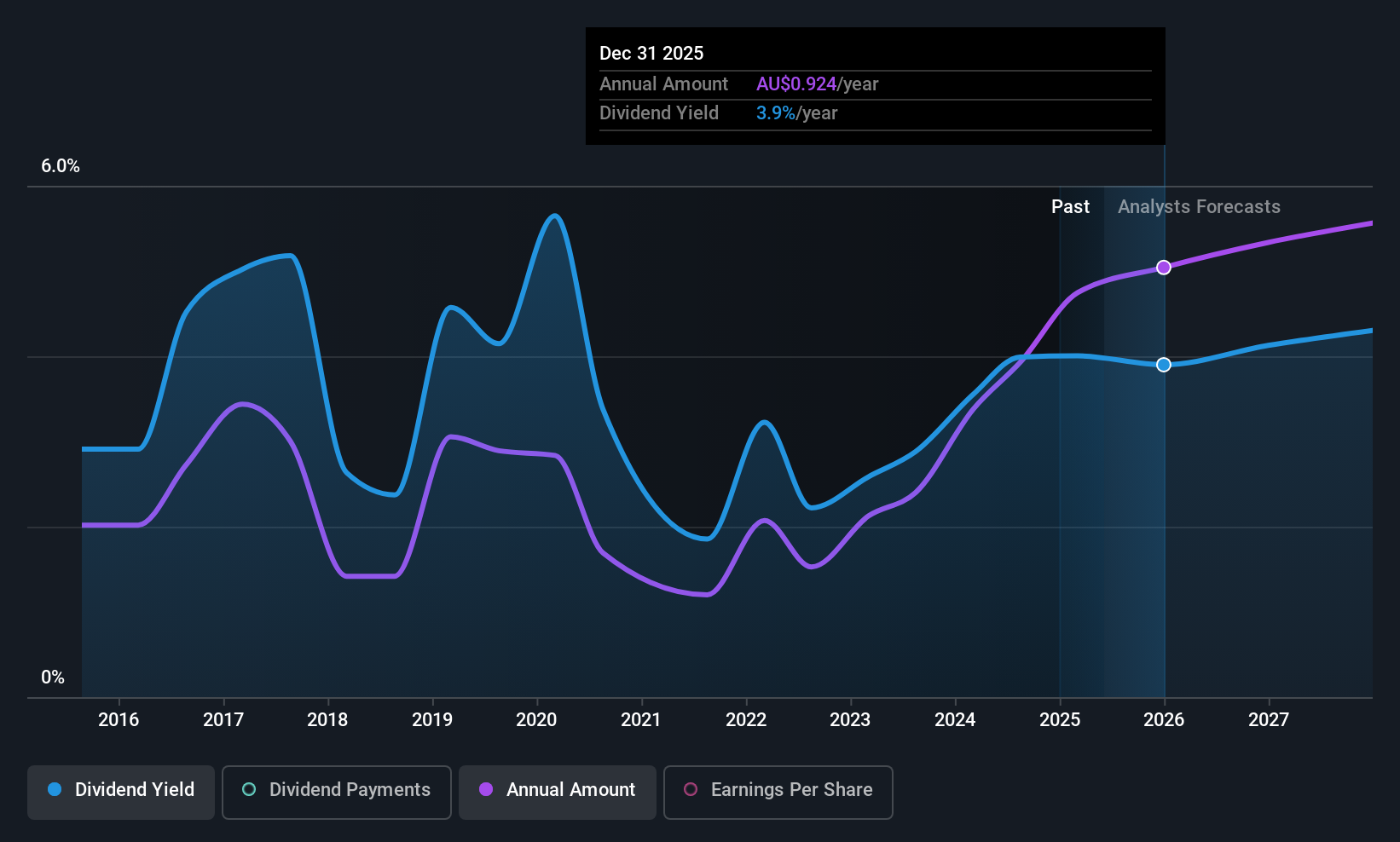

Dividend Yield: 3.8%

QBE Insurance Group's dividend payments are well-supported by earnings and cash flows, with payout ratios of 44.9% and 26.3%, respectively. Despite a modest yield of 3.77%, lower than the top quartile in Australia, QBE offers attractive value, trading significantly below its estimated fair value. However, the company's dividend history is marked by volatility and unreliability over the past decade, which may concern some investors despite recent earnings growth to US$1 billion for H1 2025.

- Navigate through the intricacies of QBE Insurance Group with our comprehensive dividend report here.

- The analysis detailed in our QBE Insurance Group valuation report hints at an deflated share price compared to its estimated value.

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited provides storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$349.20 million.

Operations: Sugar Terminals Limited generates revenue of A$118.51 million from its sugar industry storage and handling services in Australia.

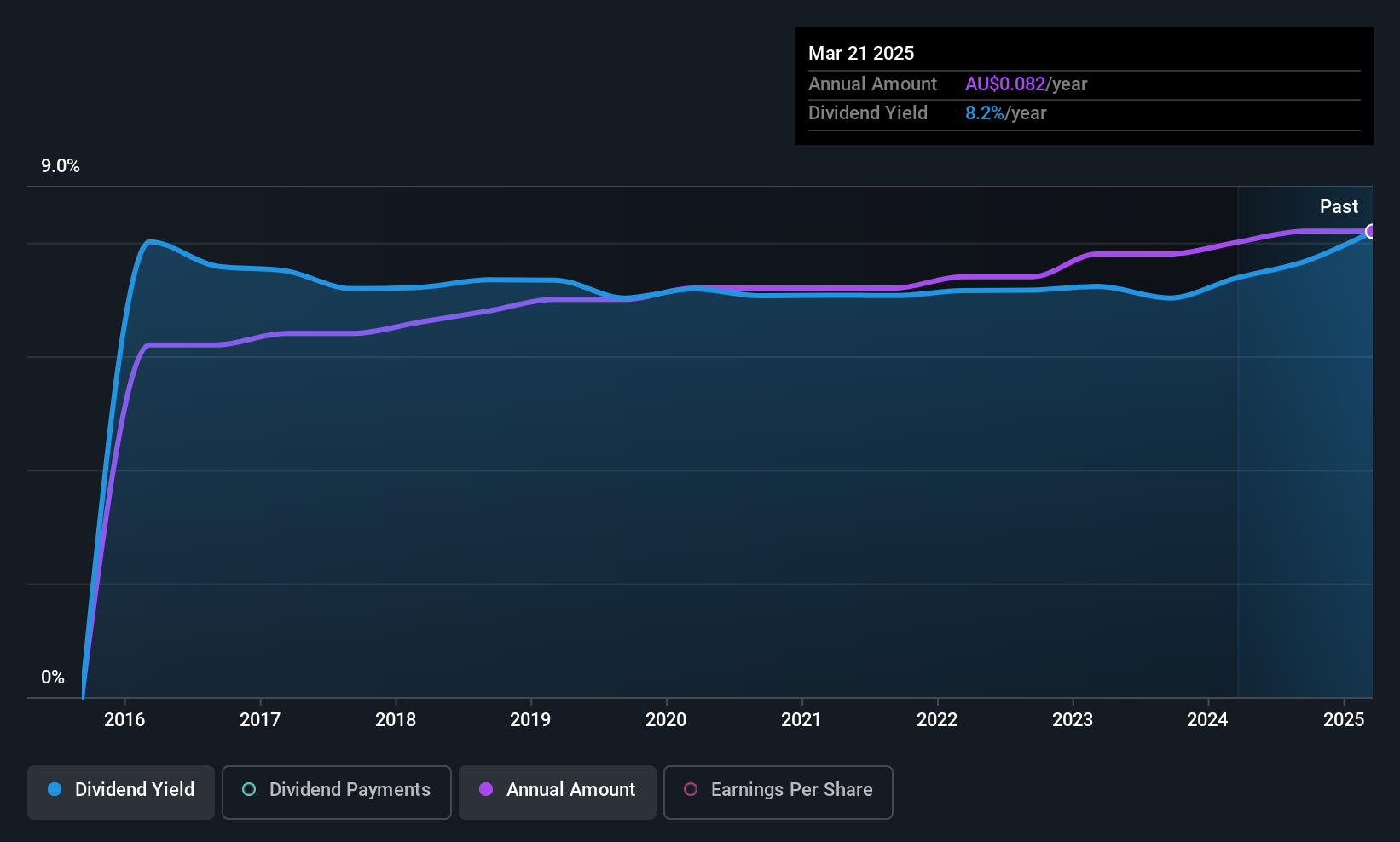

Dividend Yield: 7.9%

Sugar Terminals Limited offers a dividend yield of 7.94%, placing it among the top 25% of Australian dividend payers, yet the sustainability is questionable due to high payout ratios and insufficient cash flow coverage. Recent earnings showed stable sales at A$118.51 million, though dividends were reduced by 4.9% to preserve cash reserves. Leadership changes are underway with Peter Trimble set to become Chair, bringing extensive industry experience as STL transitions towards insourced operations in 2026.

- Unlock comprehensive insights into our analysis of Sugar Terminals stock in this dividend report.

- According our valuation report, there's an indication that Sugar Terminals' share price might be on the cheaper side.

Taking Advantage

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 26 more companies for you to explore.Click here to unveil our expertly curated list of 29 Top ASX Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives