- Australia

- /

- Specialty Stores

- /

- ASX:NCK

3 ASX Dividend Stocks Yielding Up To 8.1%

Reviewed by Simply Wall St

Amidst a day of positive momentum on the ASX, with all sectors closing in the green and IT leading the charge, investors are increasingly looking towards dividend stocks as a potential source of steady income. In this environment where market rallies occur even amidst broader uncertainties, identifying stocks with robust dividend yields can be an attractive strategy for those seeking reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.74% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.28% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.96% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.48% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.80% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.66% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.36% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.98% | ★★★★★☆ |

| GWA Group (ASX:GWA) | 6.98% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

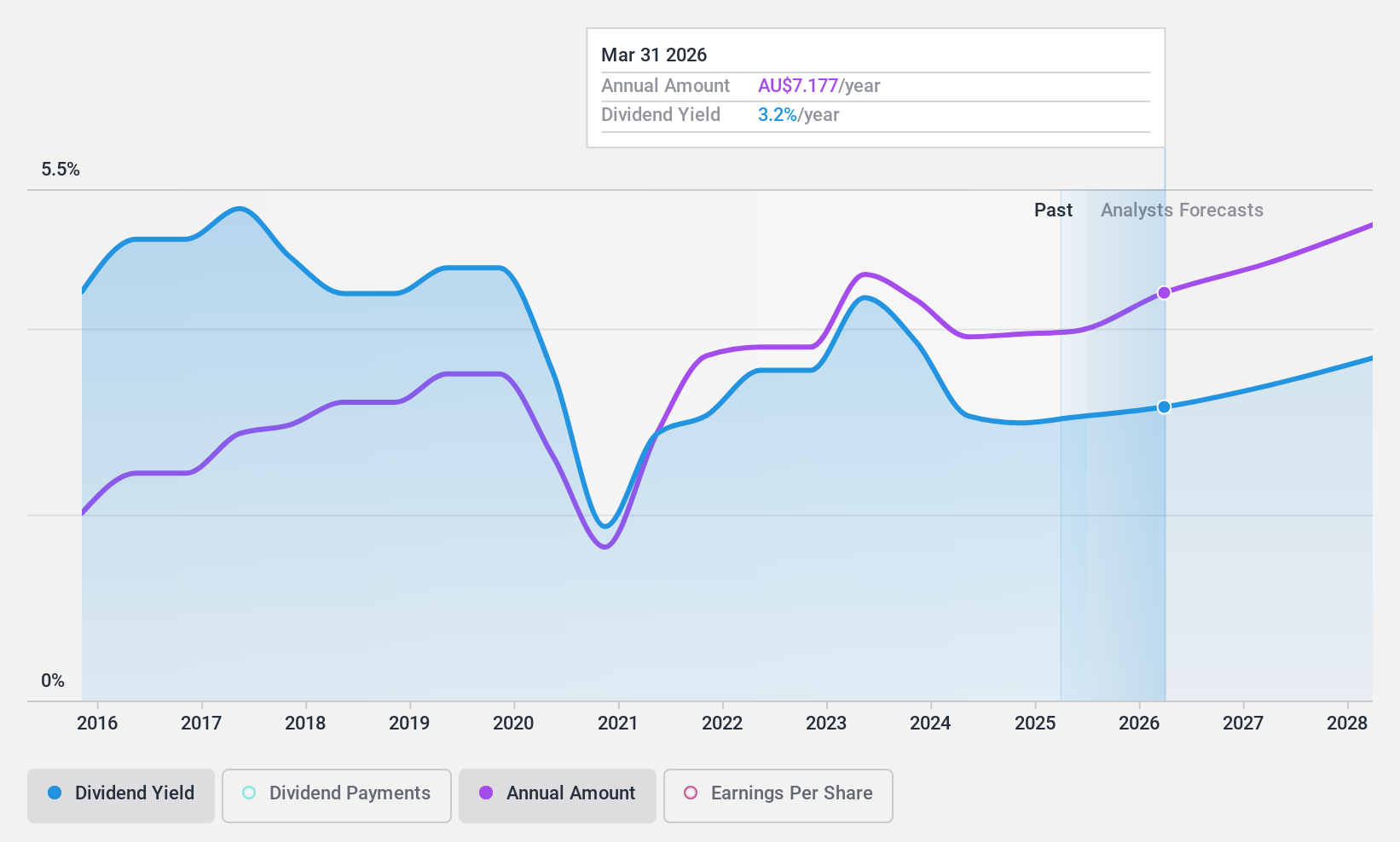

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a diversified financial services company operating across Australia, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of A$65.63 billion.

Operations: Macquarie Group Limited's revenue is primarily derived from its Commodities and Global Markets segment (A$6.29 billion), followed by Macquarie Asset Management (A$4.00 billion), Banking and Financial Services (A$3.19 billion), Macquarie Capital (A$2.54 billion), and Corporate activities (A$1.19 billion).

Dividend Yield: 3.6%

Macquarie Group's dividend payments are currently covered by earnings with a payout ratio of 66.3%, although their history has shown volatility and unreliability over the past decade. The dividend yield stands at 3.58%, which is lower than the top quartile in Australia. Recent strategic moves include a GPU financing deal in Europe, highlighting Macquarie's focus on AI infrastructure investments, potentially impacting future profitability and dividend sustainability positively amidst an evolving risk profile due to higher external borrowing reliance.

- Navigate through the intricacies of Macquarie Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Macquarie Group's share price might be on the cheaper side.

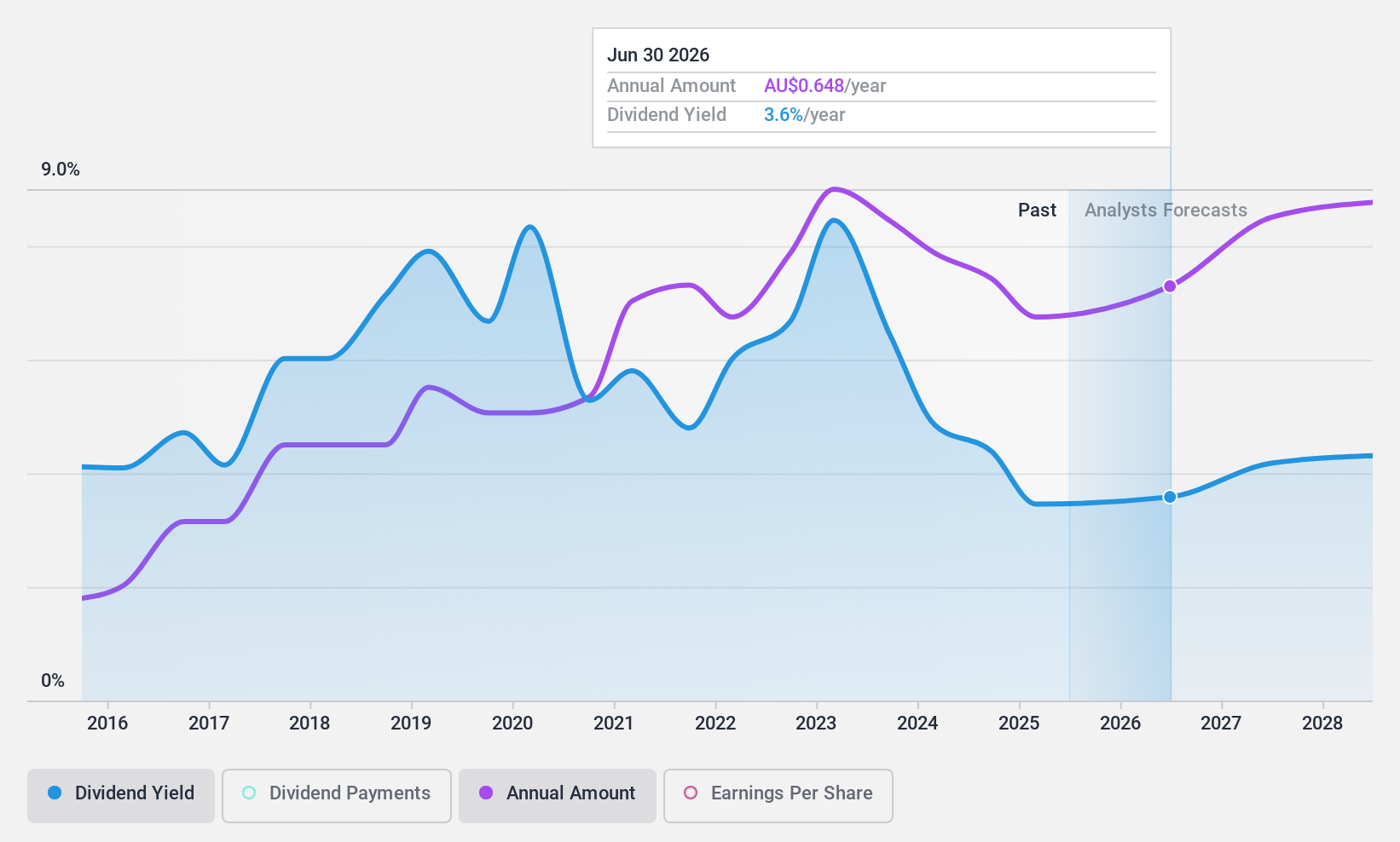

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.40 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates revenue primarily from the retailing of furniture, amounting to A$492.63 million.

Dividend Yield: 3.7%

Nick Scali offers a stable dividend history, with payouts covered by earnings (78.2% payout ratio) and cash flows (63.7% cash payout ratio). Despite a recent decrease in its interim dividend to A$0.30 per share, the 3.66% yield remains reliable over the past decade, although lower than top-tier Australian dividends. Recent earnings showed decreased net income at A$30.04 million for H1 2025 compared to last year, indicating potential challenges in maintaining higher dividends amidst fluctuating profits.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this dividend report.

- According our valuation report, there's an indication that Nick Scali's share price might be on the expensive side.

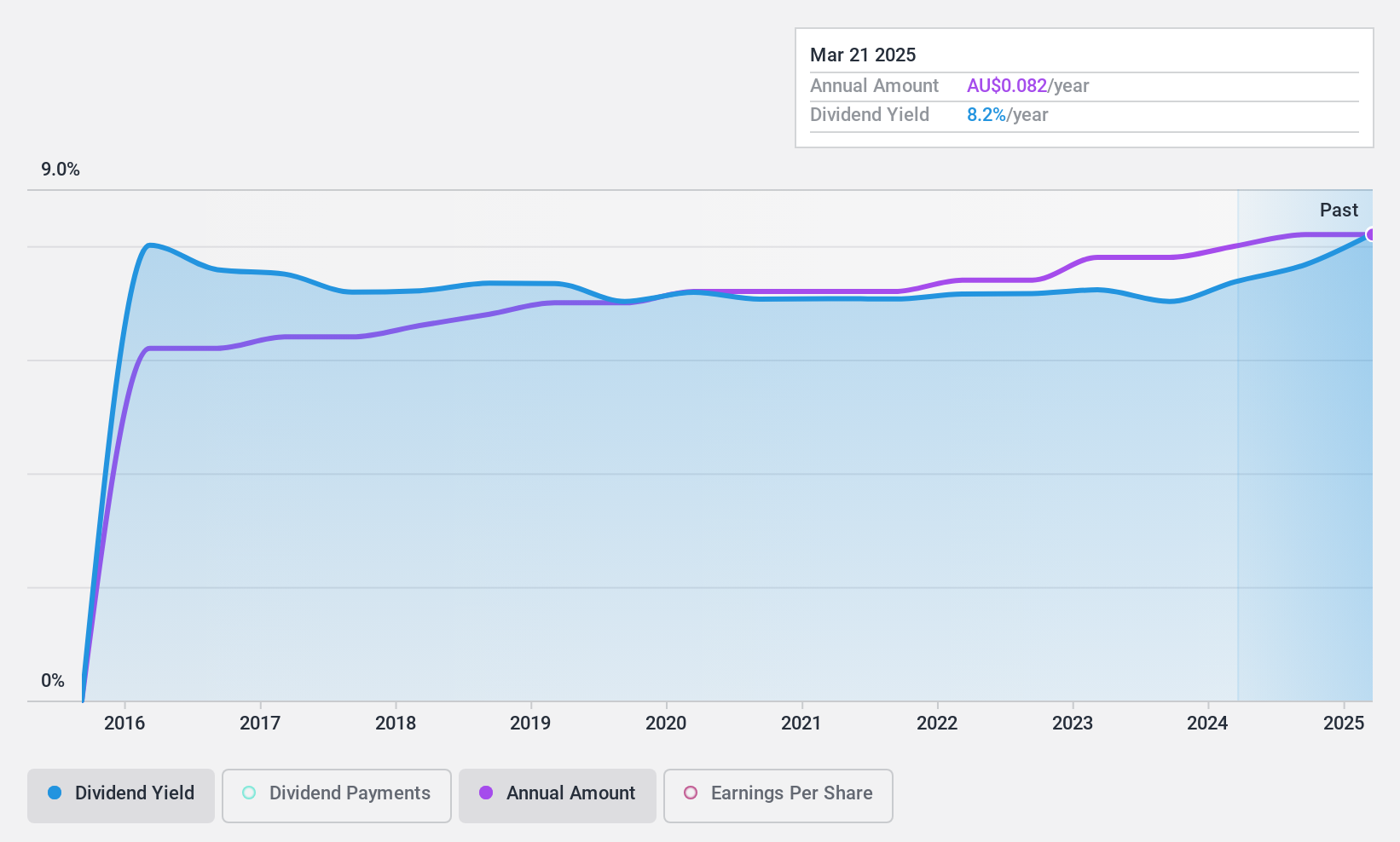

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$363.60 million.

Operations: Sugar Terminals Limited generates revenue primarily from the sugar industry, amounting to A$115.01 million.

Dividend Yield: 8.1%

Sugar Terminals' dividend yield of 8.12% ranks among the top 25% in Australia, yet its sustainability is questionable due to a high payout ratio of 91.4%, indicating dividends are not well covered by earnings. Despite stable and growing dividends over the past decade, recent half-year earnings showed slight declines, with net income at A$15.73 million. Trading significantly below fair value estimates suggests potential undervaluation, but illiquid shares may pose risks for investors seeking reliable dividends amidst fluctuating financials.

- Click to explore a detailed breakdown of our findings in Sugar Terminals' dividend report.

- Our expertly prepared valuation report Sugar Terminals implies its share price may be lower than expected.

Make It Happen

- Click through to start exploring the rest of the 27 Top ASX Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives