- Australia

- /

- Commercial Services

- /

- ASX:STG

Investors Continue Waiting On Sidelines For Straker Limited (ASX:STG)

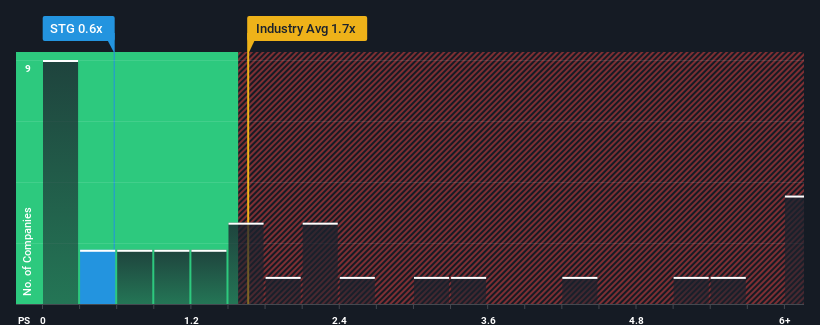

Straker Limited's (ASX:STG) price-to-sales (or "P/S") ratio of 0.6x might make it look like a buy right now compared to the Commercial Services industry in Australia, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Straker

How Has Straker Performed Recently?

While the industry has experienced revenue growth lately, Straker's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Straker's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Straker?

In order to justify its P/S ratio, Straker would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.5% per annum as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 4.7% per annum growth forecast for the broader industry.

With this information, we find it odd that Straker is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Straker's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Straker's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for Straker that you need to take into consideration.

If you're unsure about the strength of Straker's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STG

Straker

Engages in the provision of language services and technology solutions in the Asia Pacific, Europe, the Middle East, Africa, and North America.

Flawless balance sheet and slightly overvalued.