- Australia

- /

- Commercial Services

- /

- ASX:SPZ

Smart Parking (ASX:SPZ) delivers shareholders enviable 55% CAGR over 5 years, surging 14% in the last week alone

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Smart Parking Limited (ASX:SPZ) share price. It's 800% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 27% in thirty days. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since it's been a strong week for Smart Parking shareholders, let's have a look at trend of the longer term fundamentals.

Our free stock report includes 2 warning signs investors should be aware of before investing in Smart Parking. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

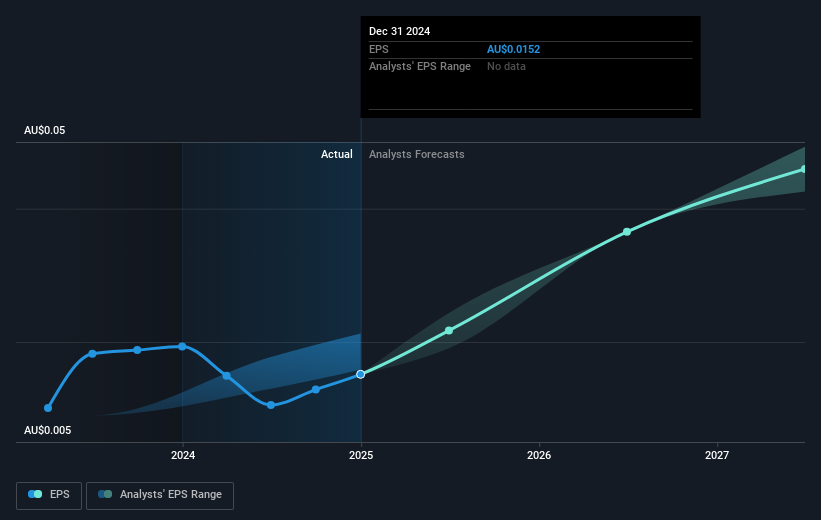

During the five years of share price growth, Smart Parking moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Smart Parking share price has gained 386% in three years. In the same period, EPS is up 16% per year. This EPS growth is lower than the 69% average annual increase in the share price over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Smart Parking's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Smart Parking's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Smart Parking's TSR, at 809% is higher than its share price return of 800%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Smart Parking shareholders have received a total shareholder return of 87% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 55% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Smart Parking better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Smart Parking you should know about.

Smart Parking is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

If you're looking to trade Smart Parking, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SPZ

Smart Parking

Engages in the design, development, and management of parking management solutions in New Zealand, Australia, Germany, and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives