- Australia

- /

- Commercial Services

- /

- ASX:MSG

Should You Be Adding MCS Services (ASX:MSG) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MCS Services (ASX:MSG). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for MCS Services

MCS Services' Improving Profits

MCS Services has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. MCS Services' EPS skyrocketed from AU$0.006 to AU$0.0077, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 29%.

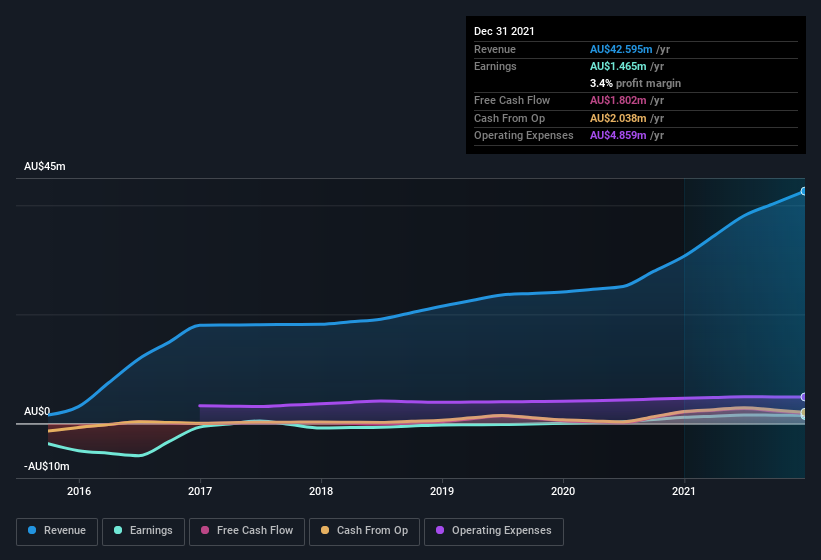

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note MCS Services achieved similar EBIT margins to last year, revenue grew by a solid 39% to AU$43m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since MCS Services is no giant, with a market capitalisation of AU$8.5m, you should definitely check its cash and debt before getting too excited about its prospects.

Are MCS Services Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that MCS Services insiders own a meaningful share of the business. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only AU$8.5m MCS Services is really small for a listed company. So this large proportion of shares owned by insiders only amounts to AU$4.1m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like MCS Services with market caps under AU$284m is about AU$406k.

The MCS Services CEO received AU$253k in compensation for the year ending June 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is MCS Services Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into MCS Services' strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that MCS Services has underlying strengths that make it worth a look at. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with MCS Services , and understanding it should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MSG

Flawless balance sheet slight.

Market Insights

Community Narratives