- Australia

- /

- Commercial Services

- /

- ASX:MSG

Here's Why We Think MCS Services (ASX:MSG) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in MCS Services (ASX:MSG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for MCS Services

How Fast Is MCS Services Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that MCS Services grew its EPS from AU$0.0017 to AU$0.0083, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

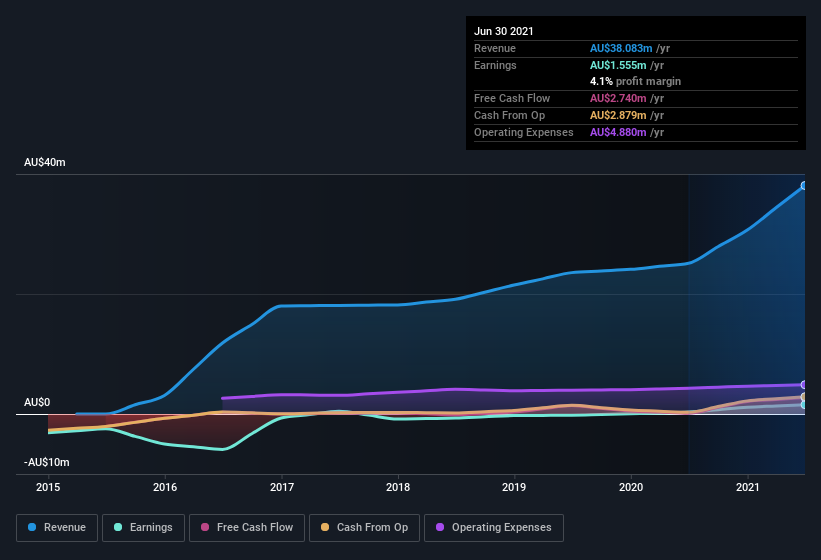

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. MCS Services shareholders can take confidence from the fact that EBIT margins are up from 0.7% to 5.2%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

MCS Services isn't a huge company, given its market capitalization of AU$12m. That makes it extra important to check on its balance sheet strength.

Are MCS Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While MCS Services insiders did net -AU$4.8k selling stock over the last year, they invested AU$592k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Richard Batrachenko who made the biggest single purchase, worth AU$365k, paying AU$0.03 per share.

On top of the insider buying, we can also see that MCS Services insiders own a large chunk of the company. Indeed, with a collective holding of 54%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only AU$12m MCS Services is really small for a listed company. So despite a large proportional holding, insiders only have AU$6.6m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Paul Simmons is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under AU$273m, like MCS Services, the median CEO pay is around AU$390k.

MCS Services offered total compensation worth AU$253k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does MCS Services Deserve A Spot On Your Watchlist?

MCS Services's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe MCS Services deserves timely attention. What about risks? Every company has them, and we've spotted 1 warning sign for MCS Services you should know about.

The good news is that MCS Services is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MSG

Flawless balance sheet slight.

Market Insights

Community Narratives