- Australia

- /

- Professional Services

- /

- ASX:MMS

We Ran A Stock Scan For Earnings Growth And McMillan Shakespeare (ASX:MMS) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like McMillan Shakespeare (ASX:MMS), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for McMillan Shakespeare

McMillan Shakespeare's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years McMillan Shakespeare grew its EPS by 12% per year. That's a pretty good rate, if the company can sustain it.

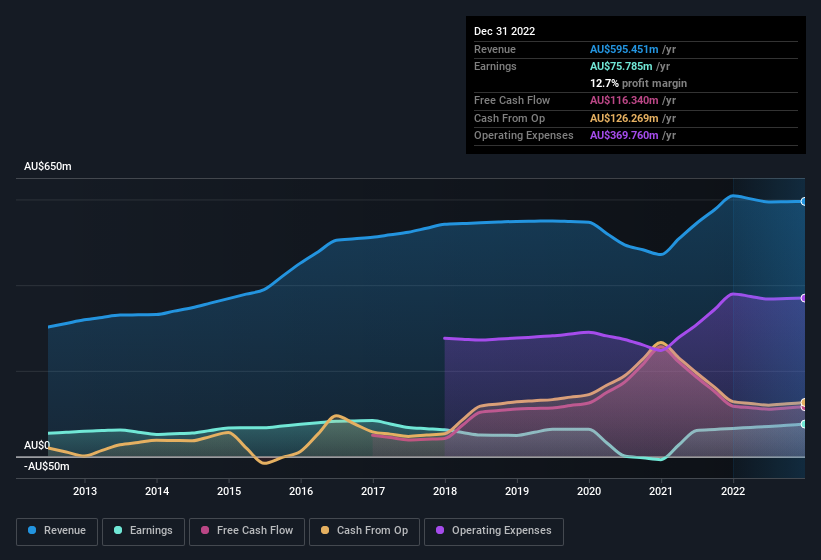

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. McMillan Shakespeare's EBIT margins are flat but, worryingly, its revenue is actually down. While this may raise concerns, investors should investigate the reasoning behind this.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of McMillan Shakespeare's forecast profits?

Are McMillan Shakespeare Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did McMillan Shakespeare insiders refrain from selling stock during the year, but they also spent AU$136k buying it. That's nice to see, because it suggests insiders are optimistic.

The good news, alongside the insider buying, for McMillan Shakespeare bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at AU$73m. That's a lot of money, and no small incentive to work hard. Those holdings account for over 6.0% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because McMillan Shakespeare's CEO, Rob De Luca, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between AU$587m and AU$2.3b, like McMillan Shakespeare, the median CEO pay is around AU$1.5m.

The CEO of McMillan Shakespeare only received AU$603k in total compensation for the year ending June 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does McMillan Shakespeare Deserve A Spot On Your Watchlist?

One important encouraging feature of McMillan Shakespeare is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with McMillan Shakespeare , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of McMillan Shakespeare, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MMS

McMillan Shakespeare

Provides salary packaging, novated leasing, disability plan management, support co-ordination, asset management, and related financial products and services in Australia and New Zealand.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives