- Australia

- /

- Commercial Services

- /

- ASX:MAD

Undiscovered Gems in Australia to Explore This August 2025

Reviewed by Simply Wall St

As global markets experience a wave of optimism, buoyed by expectations of interest rate cuts in the U.S., Australian shares have followed suit, with the ASX 200 futures indicating an upward trend. Amidst this positive market sentiment and potential economic support for commodities, investors might find opportunities in lesser-known small-cap stocks that exhibit strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and international markets, with a market cap of approximately A$1.16 billion.

Operations: The company's revenue is primarily derived from its US operations, amounting to A$67.16 million. Segment adjustments contribute an additional A$177.91 million, with eliminations and corporate activities reducing this by A$6.30 million.

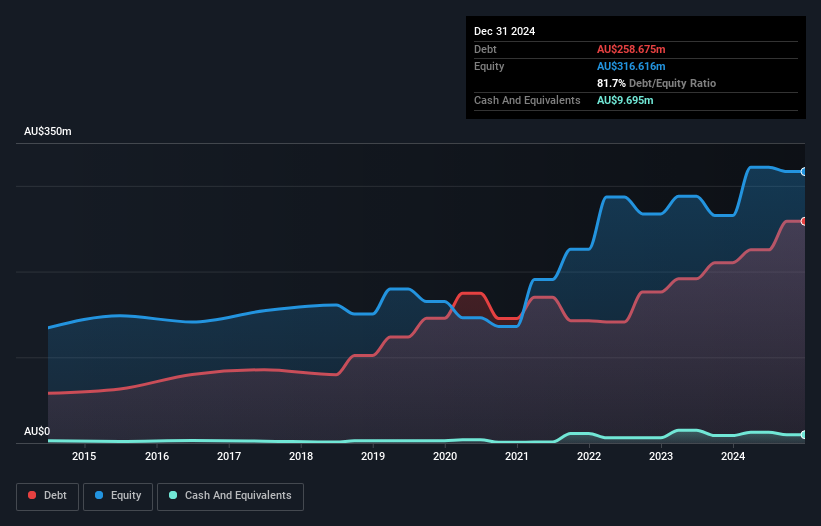

Cobram Estate Olives, a promising player in the olive oil industry, is poised for growth with U.S. expansion and infrastructure enhancements likely boosting production and revenue. Earnings surged 104.8% last year, outpacing the food sector's 5.6%, while the net debt to equity ratio stands at a high 78.3%. Despite financial losses and an $83 million tax liability that might impact future earnings, profit margins are expected to climb from 8.9% to 11.6%. Analysts predict a consensus price target of A$2.62 per share amid varied opinions ranging from A$2.35 to A$2.85 against its current price of A$2.71.

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand, with a market capitalization of approximately A$478.97 million.

Operations: K&S generates revenue primarily from its Australian Transport segment, contributing A$553.12 million, followed by Fuel at A$213.29 million and New Zealand Transport at A$74.99 million.

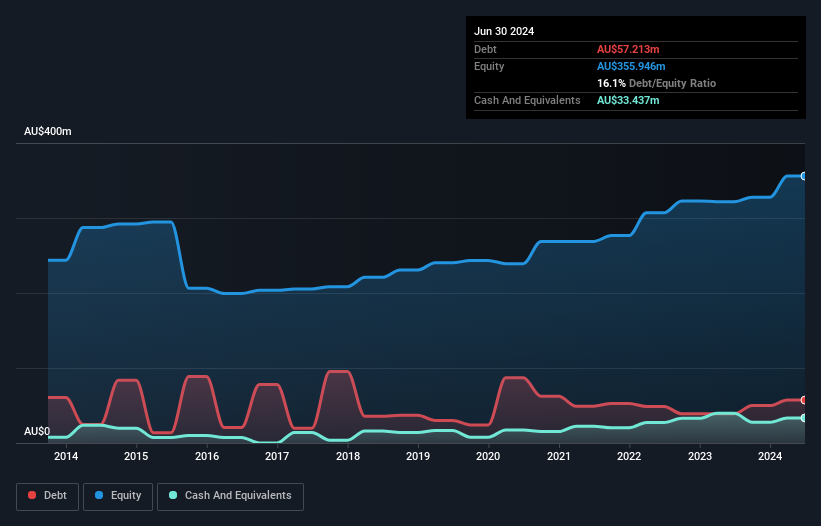

K&S, a promising player in the logistics sector, showcases a solid track record with earnings growing 25.5% annually over the past five years. Despite not outpacing the industry's recent growth of 5.3%, K&S maintains high-quality earnings and profitability isn't an issue, ensuring its cash runway remains robust. The company's net debt to equity ratio sits comfortably at 12.7%, well within satisfactory limits, while interest payments are well covered by EBIT at 9.5 times coverage. Its price-to-earnings ratio of 15.6x undercuts the broader Australian market's 18.7x, suggesting potential value for investors seeking opportunities in smaller firms like K&S.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Mader Group Limited is a contracting company that offers specialist technical services within the mining, energy, and industrial sectors both in Australia and internationally, with a market capitalization of approximately A$1.59 billion.

Operations: Mader Group generates revenue primarily through its staffing and outsourcing services, amounting to A$811.54 million.

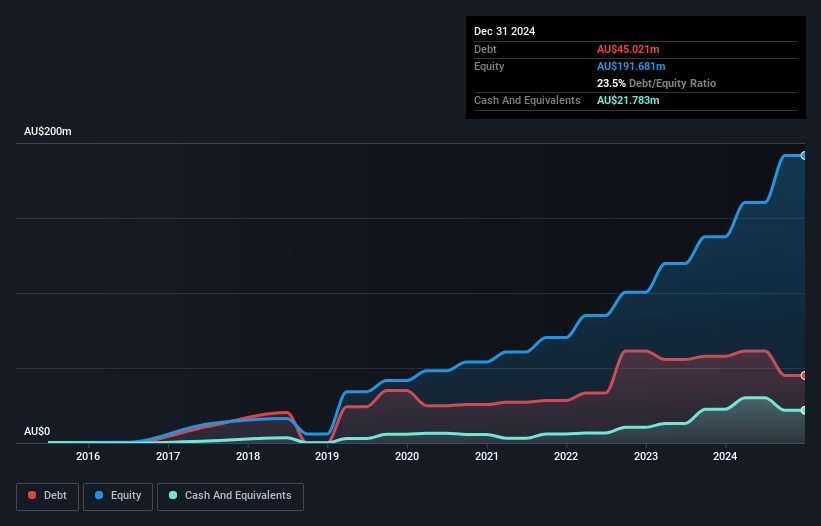

Mader Group, a nimble player in the contracting space, is making strides with a focus on diversifying its revenue streams through expansion into energy and transport logistics. With earnings growth of 15.5% last year surpassing the industry average of 9.4%, Mader is trading at 13.8% below its estimated fair value, presenting an intriguing opportunity for investors. The company's debt to equity ratio has impressively dropped from 84% to 23.5% over five years, while interest payments are well covered by EBIT at a robust 20.5x coverage level. However, potential hurdles like North American market instability and labor challenges could impact profitability despite projected annual revenue growth of 11.8%.

Seize The Opportunity

- Dive into all 46 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives