- Australia

- /

- Commercial Services

- /

- ASX:MAD

Undervalued Small Caps With Insider Action In Global Markets July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by muted responses to new U.S. tariffs and mixed economic signals, small-cap stocks have shown resilience, with the Russell 2000 Index posting modest gains despite broader market challenges. In this environment, identifying promising small-cap investments involves looking for companies that demonstrate strong fundamentals and potential for growth amid geopolitical shifts and evolving trade dynamics.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.1x | 6.2x | 49.71% | ★★★★★☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 22.08% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.5x | 7.0x | 27.63% | ★★★★★☆ |

| A.G. BARR | 19.5x | 1.8x | 46.18% | ★★★★☆☆ |

| Hemisphere Energy | 5.2x | 2.2x | 8.71% | ★★★★☆☆ |

| Sagicor Financial | 10.2x | 0.4x | -168.74% | ★★★★☆☆ |

| CVS Group | 44.4x | 1.3x | 39.97% | ★★★★☆☆ |

| Seeing Machines | NA | 2.7x | 47.71% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 12.12% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.4x | 0.7x | 4.58% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

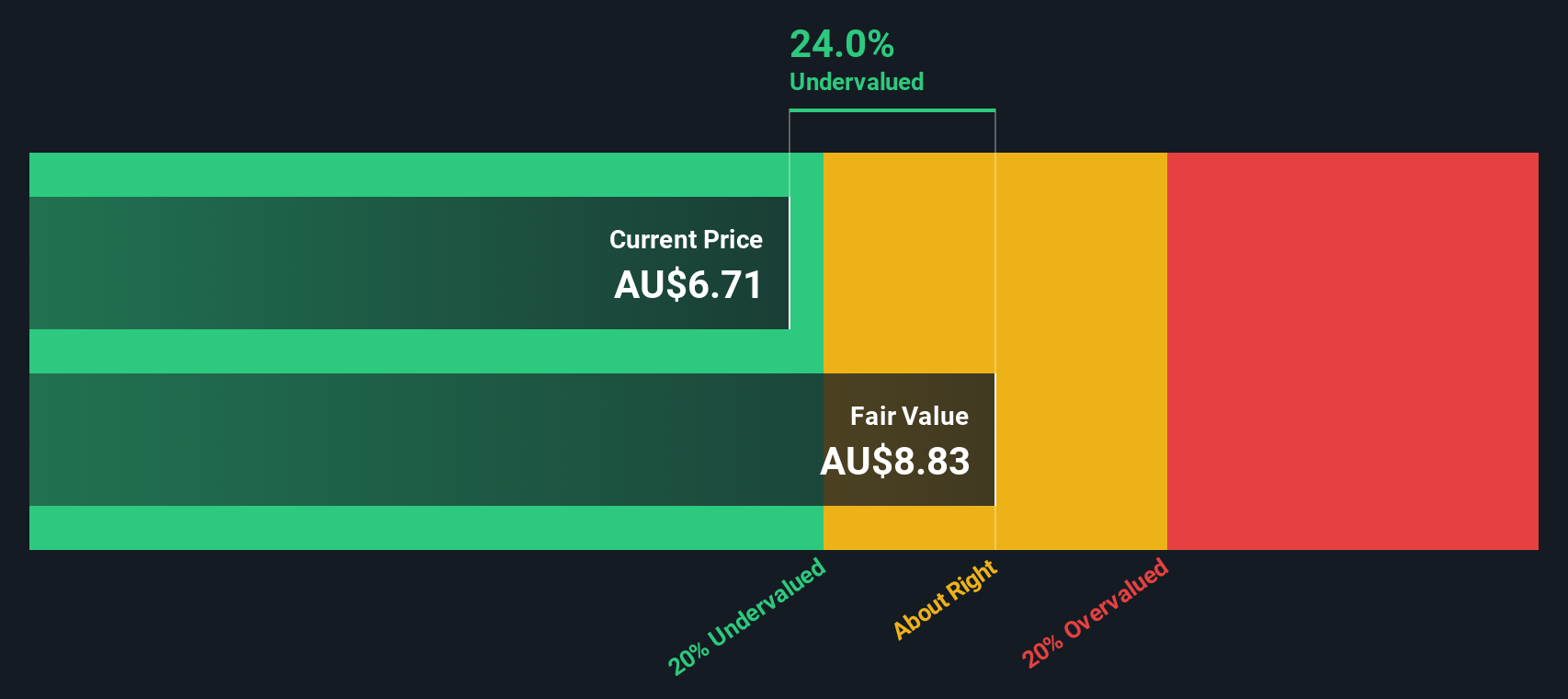

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group operates in the staffing and outsourcing services sector, with a focus on providing skilled labor solutions, and has a market capitalization of A$1.14 billion.

Operations: Staffing & Outsourcing Services generated A$811.54 million in revenue. The gross profit margin was 19.11%, with cost of goods sold amounting to A$656.44 million. Operating expenses were A$81.25 million, including sales and marketing expenses of A$2.87 million and general & administrative expenses of A$77.61 million, while non-operating expenses totaled A$21.68 million, resulting in a net income margin of 6.43%.

PE: 27.4x

Mader Group, a small cap company, has recently seen insider confidence with Luke Mader purchasing 83,500 shares valued at A$498,495. This activity suggests potential belief in the company's prospects. Despite relying entirely on external borrowing for funding—considered higher risk—their earnings are projected to grow by 13% annually. Such growth forecasts may indicate potential value for investors seeking opportunities in smaller companies with room to expand.

- Unlock comprehensive insights into our analysis of Mader Group stock in this valuation report.

Understand Mader Group's track record by examining our Past report.

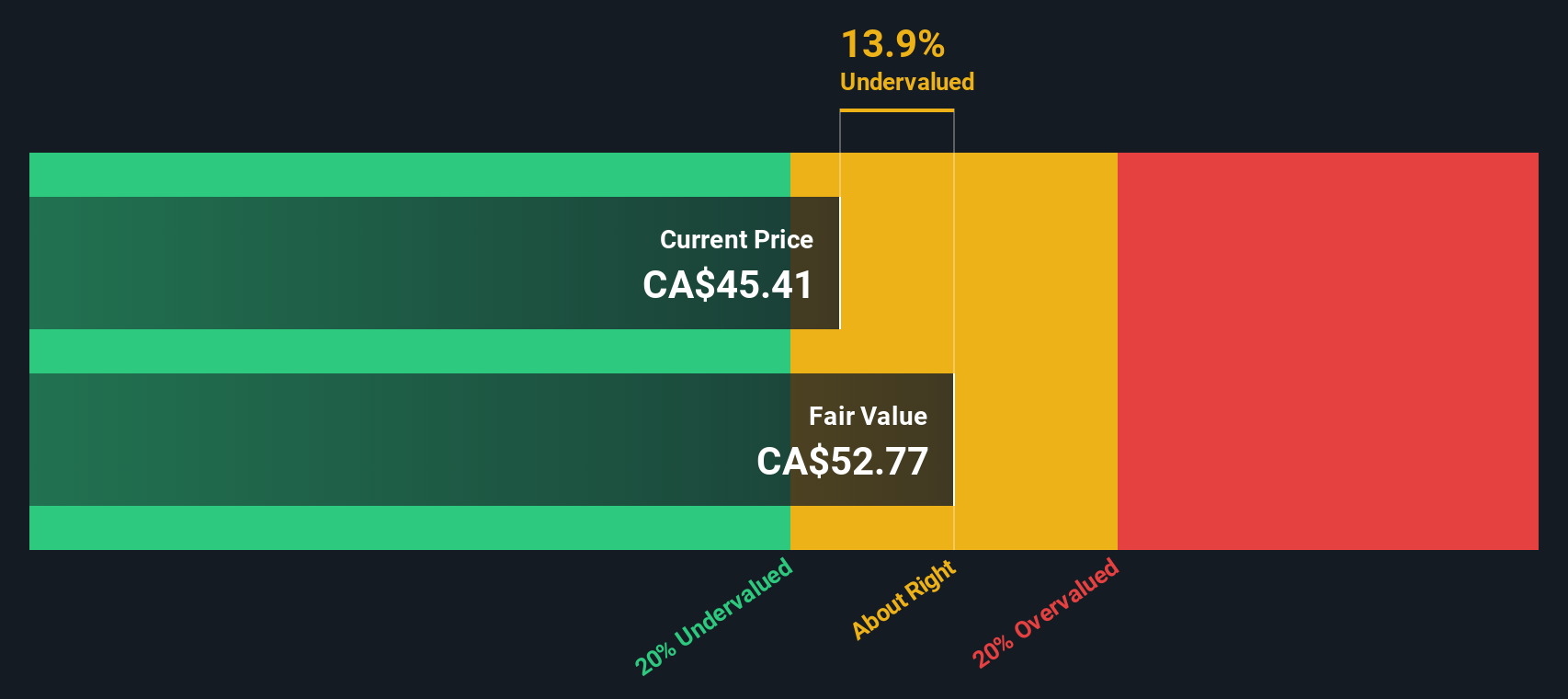

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions specializes in non-destructive excavation services and related infrastructure solutions, with a market cap of approximately CA$1.22 billion.

Operations: Badger Infrastructure Solutions generates revenue primarily through its operations, with a recent figure of $756.02 million. The company's gross profit margin has shown variability, recently recorded at 29.37%. Cost of goods sold (COGS) represents a significant portion of expenses, with operating expenses also impacting overall profitability. Net income margin was noted at 6.53%, reflecting the company's ability to convert revenue into net income after accounting for all costs and expenses.

PE: 26.9x

Badger Infrastructure Solutions, a small company with potential, recently reported an increase in first-quarter sales to US$172.63 million and net income of US$3.26 million, doubling its earnings per share from the previous year. Despite high debt levels and reliance on external borrowing, insider confidence is evident through share repurchases totaling CAD 83.45 million by April 2025. The company's dividend affirmation reflects stability amidst growth forecasts of 28% annually, suggesting promising prospects ahead.

- Click here and access our complete valuation analysis report to understand the dynamics of Badger Infrastructure Solutions.

Learn about Badger Infrastructure Solutions' historical performance.

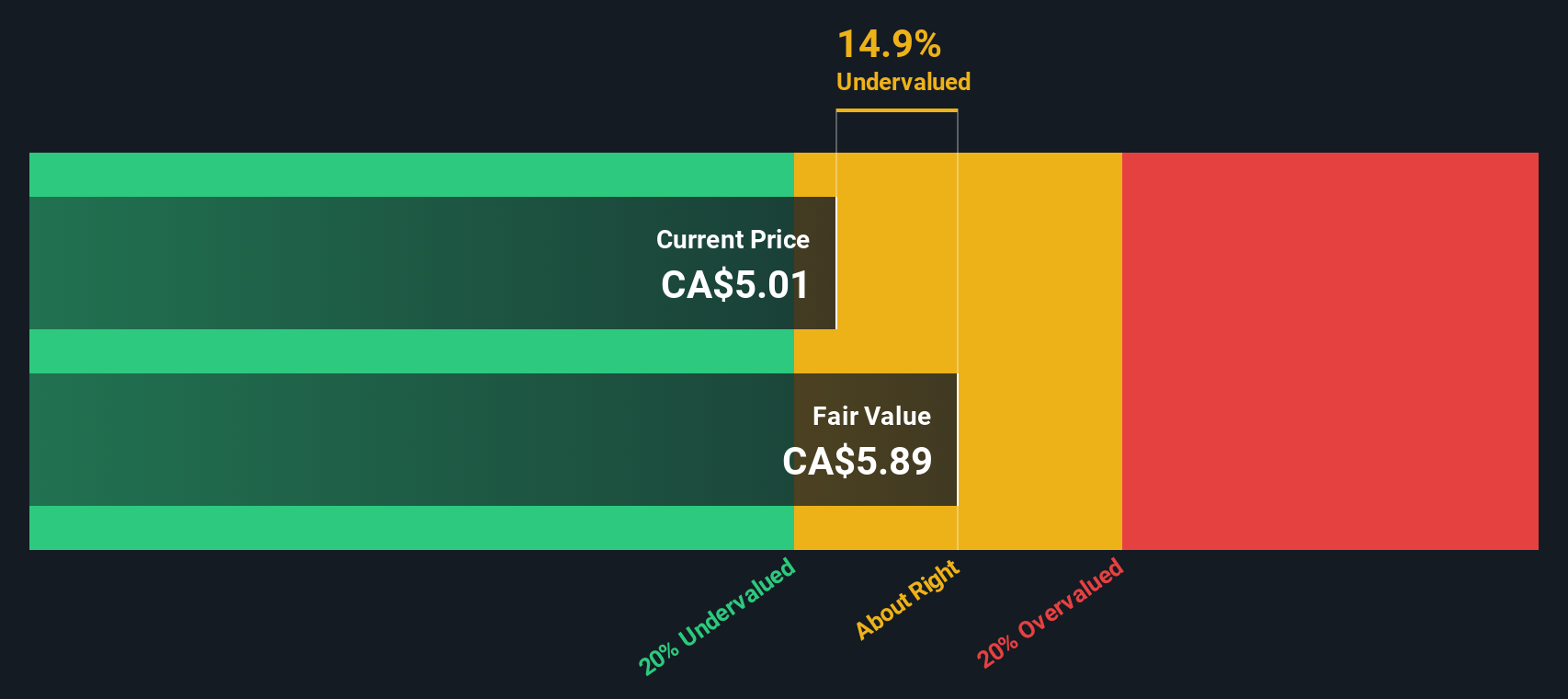

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates as a healthcare real estate company, focusing on owning and managing a portfolio of medical office buildings, clinics, and hospitals with a market capitalization of approximately CA$1.88 billion.

Operations: The company generates revenue primarily from the healthcare real estate sector, with a recent quarterly revenue of CA$434.41 million. Its cost structure includes significant costs of goods sold (COGS) at CA$109.40 million and operating expenses totaling CA$51.43 million, impacting its overall profitability. A notable trend is the gross profit margin, which recently stood at 74.82%.

PE: -4.9x

NorthWest Healthcare Properties REIT, a smaller player in the real estate sector, recently appointed Zachary Vaughan as CEO, bringing extensive international experience that could drive future growth. Despite a first-quarter net loss of C$0.89 million compared to last year's C$47.61 million loss, the company maintains regular monthly dividends of C$0.03 per unit. While funding relies solely on external borrowing, earnings are expected to grow significantly at 136% annually, indicating potential for value appreciation despite current challenges.

Next Steps

- Unlock more gems! Our Undervalued Global Small Caps With Insider Buying screener has unearthed 116 more companies for you to explore.Click here to unveil our expertly curated list of 119 Undervalued Global Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)