- Australia

- /

- Commercial Services

- /

- ASX:IMB

We Think Intelligent Monitoring Group (ASX:IMB) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Intelligent Monitoring Group Limited (ASX:IMB) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Intelligent Monitoring Group's Net Debt?

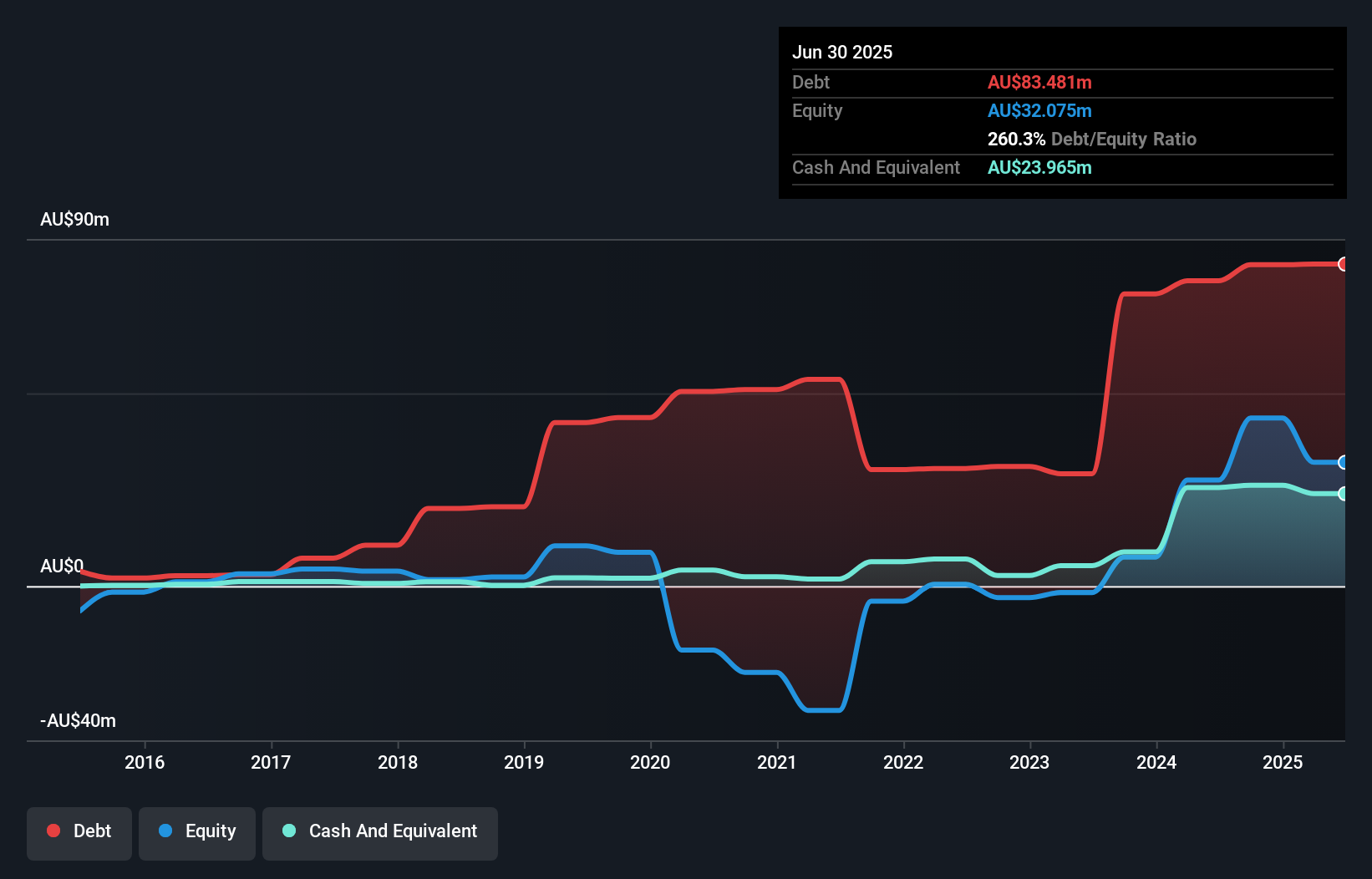

You can click the graphic below for the historical numbers, but it shows that as of June 2025 Intelligent Monitoring Group had AU$83.5m of debt, an increase on AU$79.2m, over one year. However, it also had AU$24.0m in cash, and so its net debt is AU$59.5m.

How Healthy Is Intelligent Monitoring Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Intelligent Monitoring Group had liabilities of AU$52.2m due within 12 months and liabilities of AU$104.2m due beyond that. On the other hand, it had cash of AU$24.0m and AU$27.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$105.4m.

This deficit isn't so bad because Intelligent Monitoring Group is worth AU$255.3m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

Check out our latest analysis for Intelligent Monitoring Group

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Intelligent Monitoring Group has a quite reasonable net debt to EBITDA multiple of 1.9, its interest cover seems weak, at 0.66. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. Importantly Intelligent Monitoring Group's EBIT was essentially flat over the last twelve months. Ideally it can diminish its debt load by kick-starting earnings growth. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Intelligent Monitoring Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last two years, Intelligent Monitoring Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Intelligent Monitoring Group's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least its net debt to EBITDA is not so bad. Looking at the bigger picture, it seems clear to us that Intelligent Monitoring Group's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Intelligent Monitoring Group .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IMB

Intelligent Monitoring Group

Provides security, monitoring, and risk management services for businesses, homes, and individuals in Australia and New Zealand.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.