- Australia

- /

- Metals and Mining

- /

- ASX:GWR

ASX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The Australian market has recently experienced a rollercoaster of activity, with the ASX200 showing volatility in response to weaker-than-expected GDP data, reflecting divided investor sentiment. In such fluctuating conditions, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth. Penny stocks, despite their outdated connotation, continue to represent smaller or emerging companies that can offer significant value when backed by robust financial health and clear growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.62 | A$76.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.34 | A$246.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Steadfast Group (ASX:SDF) | A$4.94 | A$5.48B | ✅ 5 ⚠️ 3 View Analysis > |

| West African Resources (ASX:WAF) | A$2.82 | A$3.22B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.30 | A$1.41B | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.48 | A$650.45M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GWR Group (ASX:GWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GWR Group Limited is involved in the exploration, evaluation, and development of mining projects in Australia with a market cap of A$46.92 million.

Operations: The company's revenue is derived entirely from its operations in Australia, amounting to A$2.35 million.

Market Cap: A$46.92M

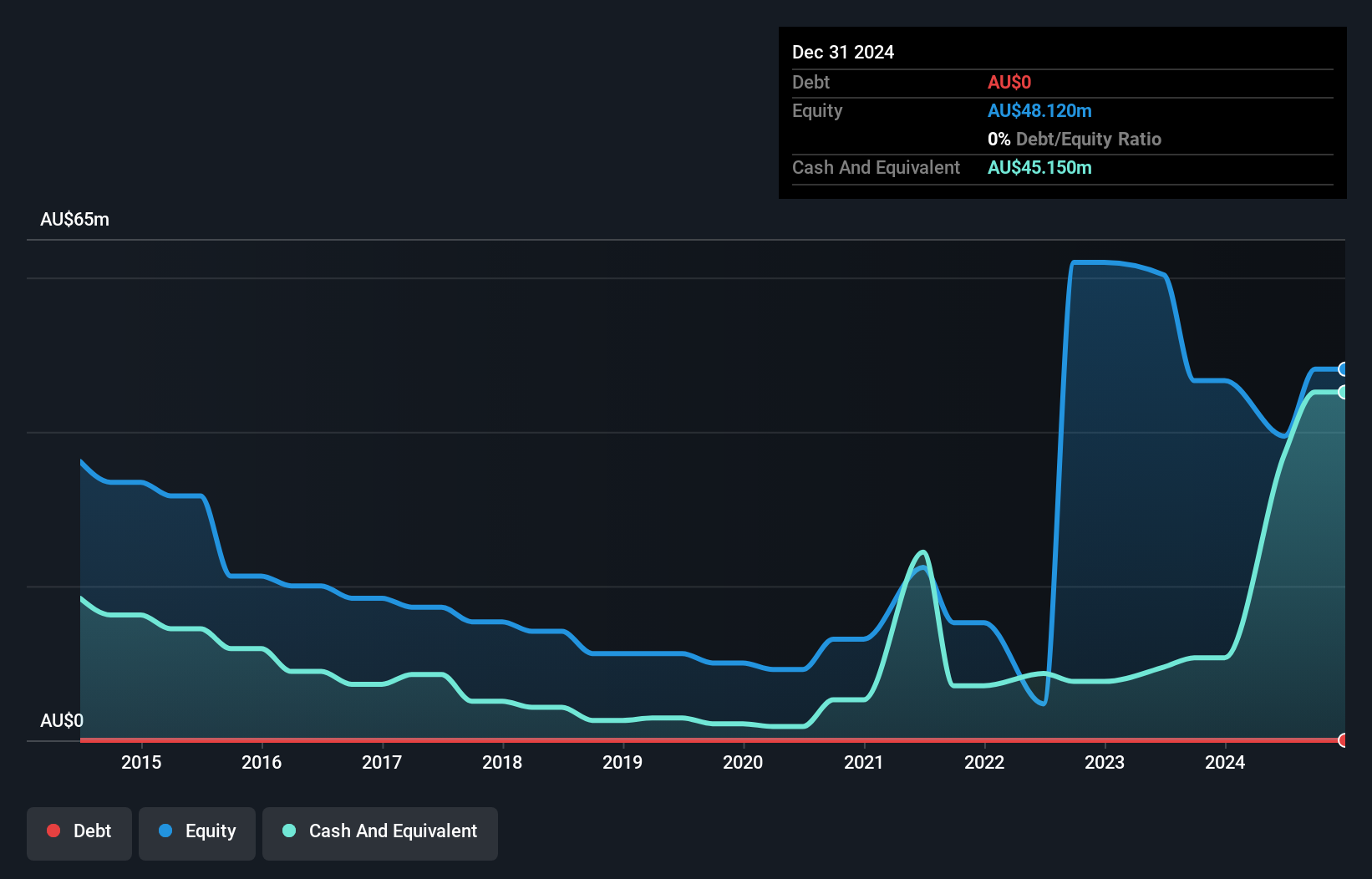

GWR Group has recently transitioned to profitability, reporting A$12.29 million in revenue for the year ended June 2025, a significant increase from A$1.69 million the previous year. The company is debt-free and its short-term assets of A$46.3 million comfortably cover its short-term liabilities of A$7.4 million, providing financial stability. Despite trading at a substantial discount to estimated fair value, GWR's earnings quality is impacted by high non-cash earnings and a low return on equity of 17.4%. The board's average tenure is under three years, indicating an inexperienced governance structure.

- Unlock comprehensive insights into our analysis of GWR Group stock in this financial health report.

- Review our historical performance report to gain insights into GWR Group's track record.

Intelligent Monitoring Group (ASX:IMB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Monitoring Group Limited offers security, monitoring, and risk management services for businesses, homes, and individuals in Australia and New Zealand with a market cap of A$216.96 million.

Operations: The company's revenue is derived from four main segments: Services (A$11.77 million), Monitoring (A$85.32 million), Maintenance (A$18.10 million), and Installations (A$59.70 million).

Market Cap: A$216.96M

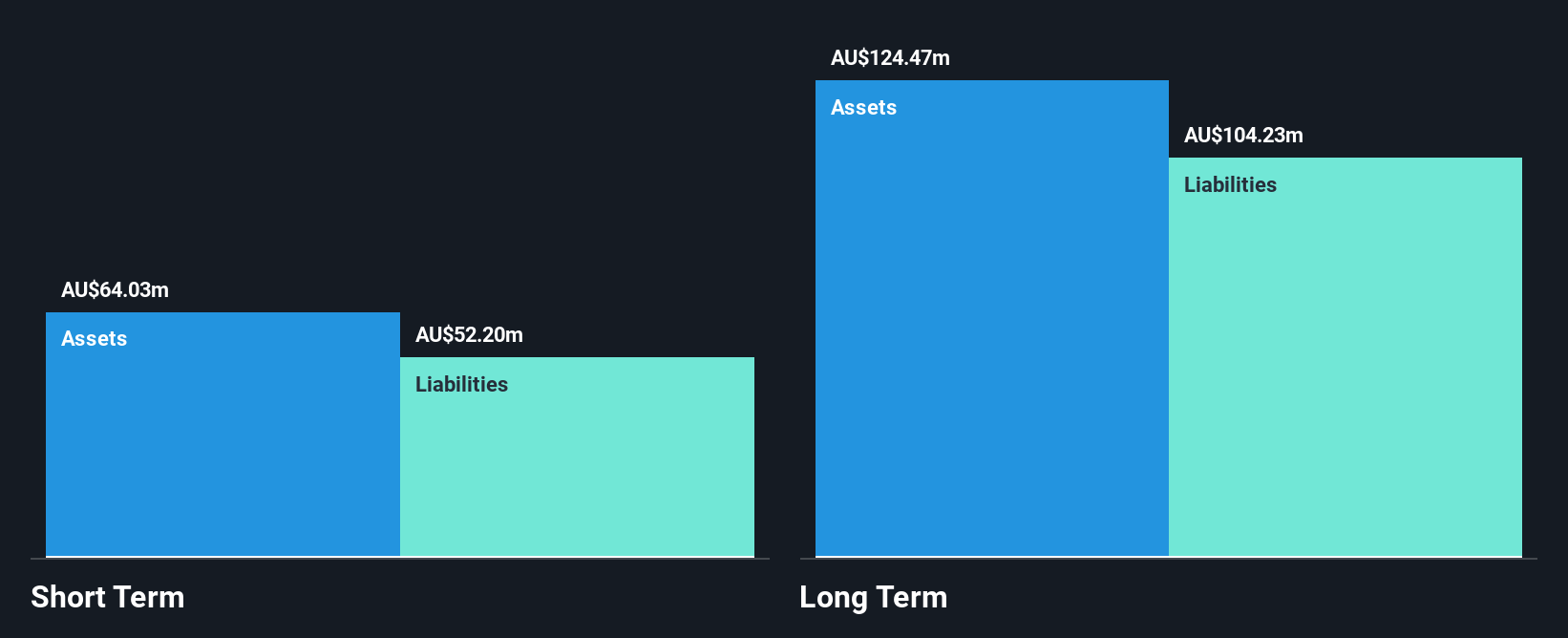

Intelligent Monitoring Group Limited, despite being unprofitable, has made strides in reducing losses by 25.4% annually over the past five years and maintains a cash runway exceeding three years. The company's short-term assets of A$64 million surpass its short-term liabilities of A$52.2 million, though they fall short against long-term liabilities of A$104.2 million. Trading at 75.6% below estimated fair value, it faces challenges with a high net debt to equity ratio of 185.6%. Analysts forecast an 83.77% annual earnings growth and agree on a potential stock price increase by 60%.

- Click to explore a detailed breakdown of our findings in Intelligent Monitoring Group's financial health report.

- Explore Intelligent Monitoring Group's analyst forecasts in our growth report.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the mining, smelting, trading, and marketing of manganese ores and ferroalloys globally, with a market cap of A$206.37 million.

Operations: The company's revenue is primarily derived from its smelting operations, which generated $498.11 million, and its marketing and trading activities, contributing $680.80 million.

Market Cap: A$206.37M

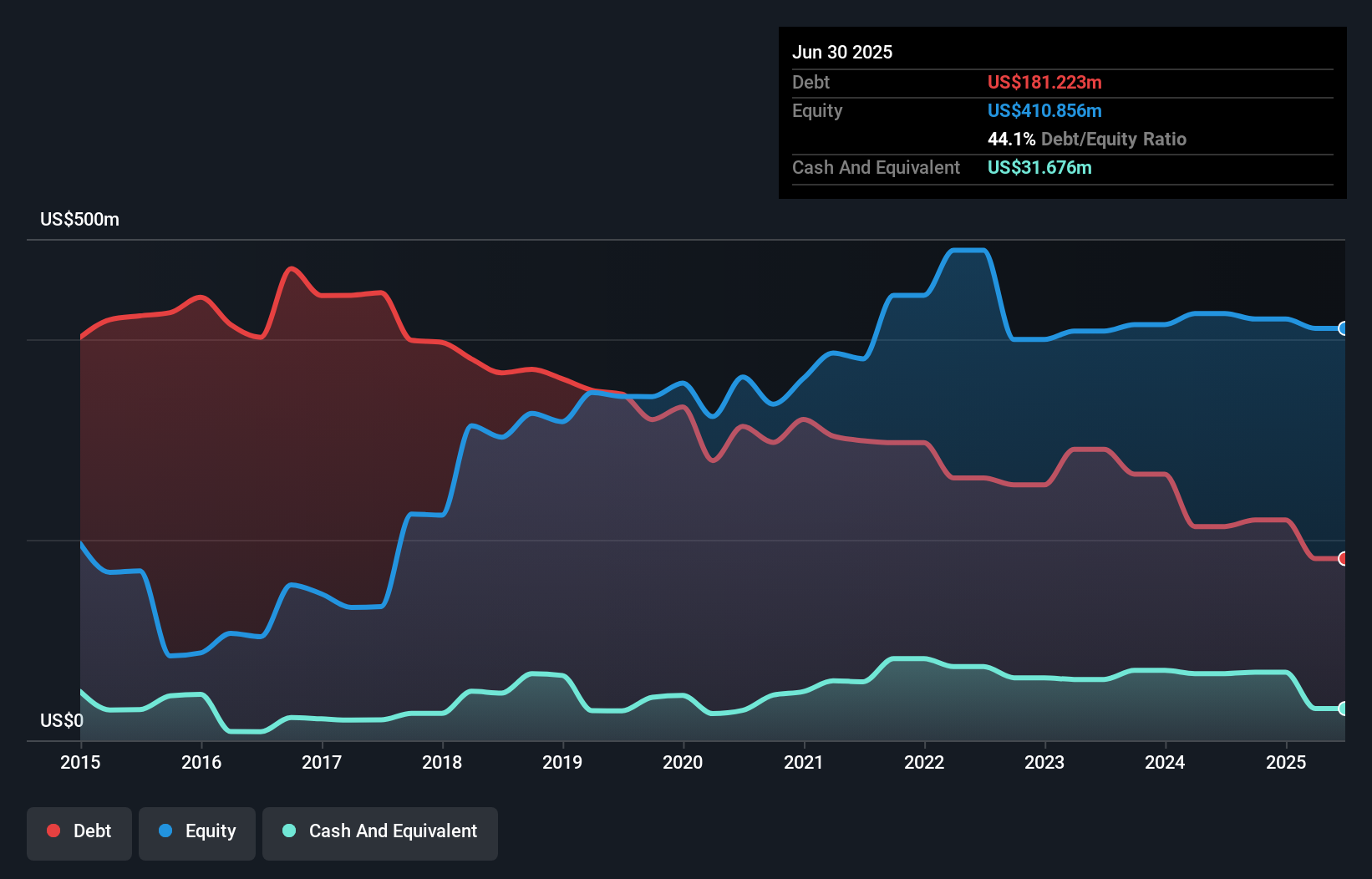

OM Holdings Limited, with a market cap of A$206.37 million, is currently unprofitable but demonstrates financial resilience through reduced debt levels over five years and satisfactory net debt to equity ratio of 36.4%. The company's short-term assets of $392 million comfortably cover both its short-term and long-term liabilities. Despite negative return on equity at -3.11%, OMH's operating cash flow adequately covers its debt obligations, though interest payments are not well covered by EBIT. Analysts anticipate significant earnings growth at 101% annually, while the seasoned board offers stability amidst volatility in weekly returns remaining stable over the past year.

- Click here to discover the nuances of OM Holdings with our detailed analytical financial health report.

- Examine OM Holdings' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Navigate through the entire inventory of 413 ASX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GWR

GWR Group

Explores for, evaluates, and develops mining projects in Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026