- Australia

- /

- Professional Services

- /

- ASX:FLN

Would Shareholders Who Purchased Freelancer's (ASX:FLN) Stock Five Years Be Happy With The Share price Today?

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. To wit, the Freelancer Limited (ASX:FLN) share price managed to fall 62% over five long years. That's an unpleasant experience for long term holders. But it's up 6.0% in the last week. We would posit that the recently released financial results have driven this rise, so you might want to check the latest numbers in our full company report.

Check out our latest analysis for Freelancer

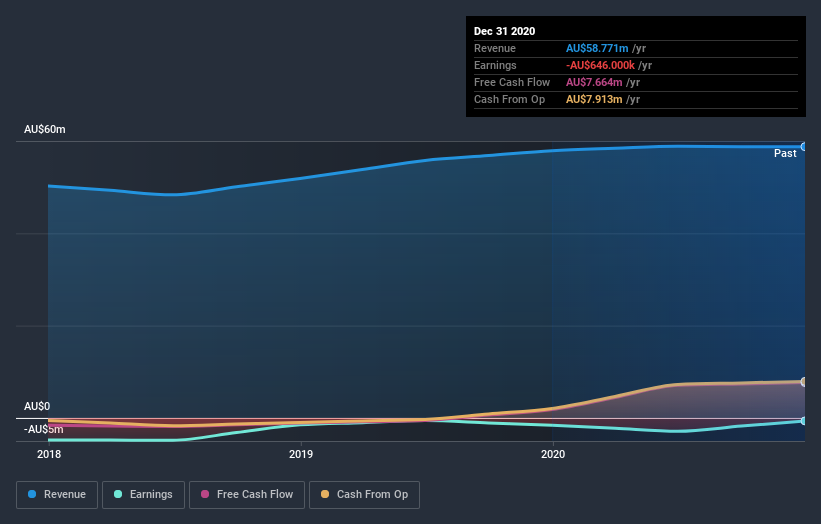

Because Freelancer made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Freelancer saw its revenue increase by 5.5% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Freelancer's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Freelancer shareholders have received a total shareholder return of 34% over the last year. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Freelancer or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:FLN

Freelancer

Operates a freelancing and crowdsourcing marketplace in Australia.

Excellent balance sheet very low.

Market Insights

Community Narratives