- Australia

- /

- Commercial Services

- /

- ASX:CWY

I Ran A Stock Scan For Earnings Growth And Cleanaway Waste Management (ASX:CWY) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Cleanaway Waste Management (ASX:CWY), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Cleanaway Waste Management

How Quickly Is Cleanaway Waste Management Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Cleanaway Waste Management managed to grow EPS by 7.9% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

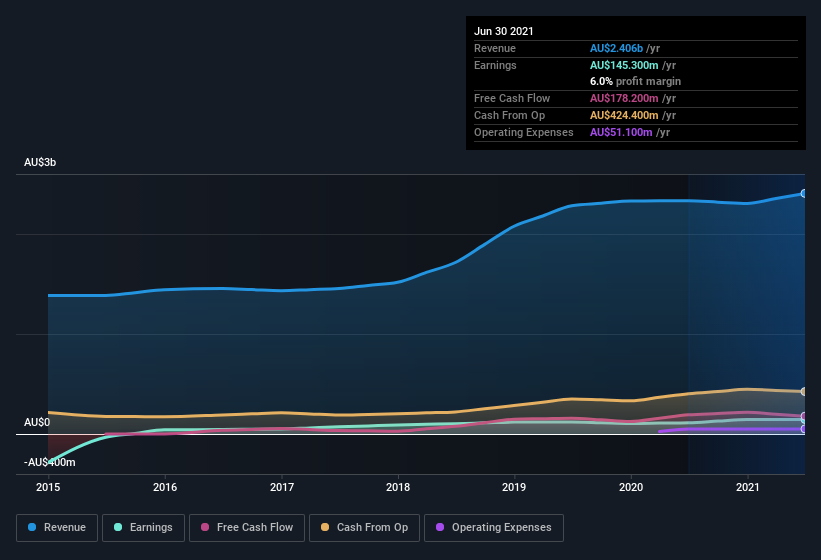

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Cleanaway Waste Management shareholders can take confidence from the fact that EBIT margins are up from 8.3% to 10%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Cleanaway Waste Management.

Are Cleanaway Waste Management Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Cleanaway Waste Management shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Ingrid Player, the Independent Non-Executive Director of the company, paid AU$52k for shares at around AU$2.62 each.

Is Cleanaway Waste Management Worth Keeping An Eye On?

One important encouraging feature of Cleanaway Waste Management is that it is growing profits. Not every business can grow its EPS, but Cleanaway Waste Management certainly can. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Cleanaway Waste Management. You might benefit from giving it a glance today.

The good news is that Cleanaway Waste Management is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CWY

Cleanaway Waste Management

Provides waste management, industrial, and environmental services in Australia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026