- Australia

- /

- Metals and Mining

- /

- ASX:IGO

Top ASX Dividend Stocks To Watch In October 2024

Reviewed by Simply Wall St

As the ASX200 experiences a slight dip of 0.32% to 8,154 points, with Consumer Staples leading the decline and IT emerging as the top performer, investors are closely monitoring market trends. In this fluctuating environment, dividend stocks remain attractive for their potential to provide steady income streams; selecting robust companies with consistent payout histories can be key in navigating these conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.84% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.69% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.24% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.36% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.55% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.23% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.40% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.21% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.45% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.00% | ★★★★☆☆ |

Click here to see the full list of 38 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

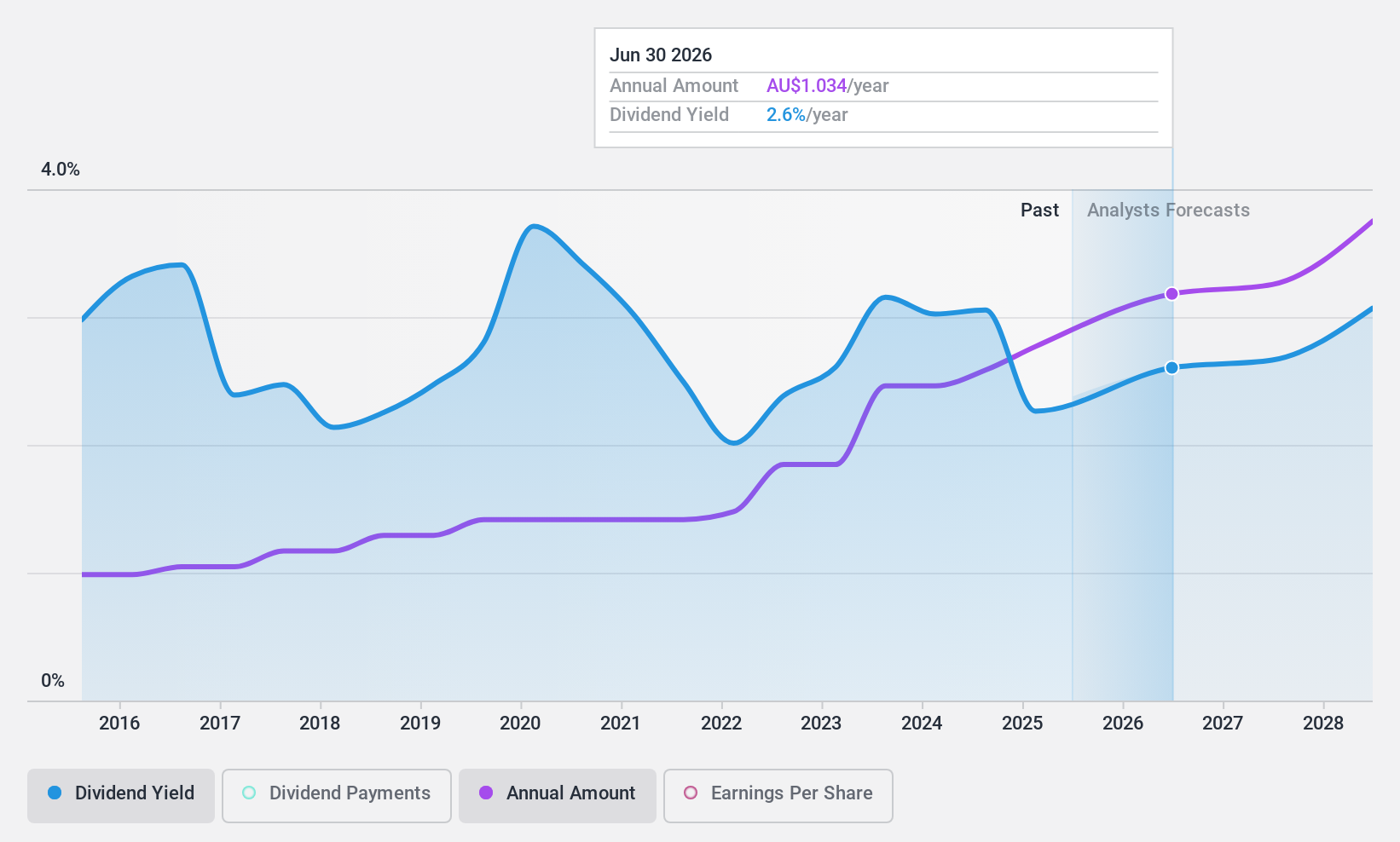

Computershare (ASX:CPU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computershare Limited offers a range of services including issuer services, employee share plans, communication and utilities solutions, technology support, and mortgage and property rental services with a market cap of A$15.49 billion.

Operations: Computershare Limited's revenue segments include Issuer Services ($1.21 billion), Global Corporate Trust ($936.33 million), Technology Services & Operations ($18.73 million), Communication Services & Utilities ($340.20 million), Employee Share Plans & Voucher Services ($458.48 million), and Mortgage Services & Property Rental Services ($499.68 million).

Dividend Yield: 3.2%

Computershare's dividend of A$0.42 per share, announced for the six months ending June 2024, is covered by both earnings and cash flows with payout ratios of 66.5% and 52.9%, respectively. Despite a history of volatile dividends over the past decade, recent increases suggest potential stability. The company maintains a strong balance sheet with strategic acquisitions planned to enhance market position, though insider selling and high debt levels are notable concerns for investors focused on dividends.

- Unlock comprehensive insights into our analysis of Computershare stock in this dividend report.

- The valuation report we've compiled suggests that Computershare's current price could be quite moderate.

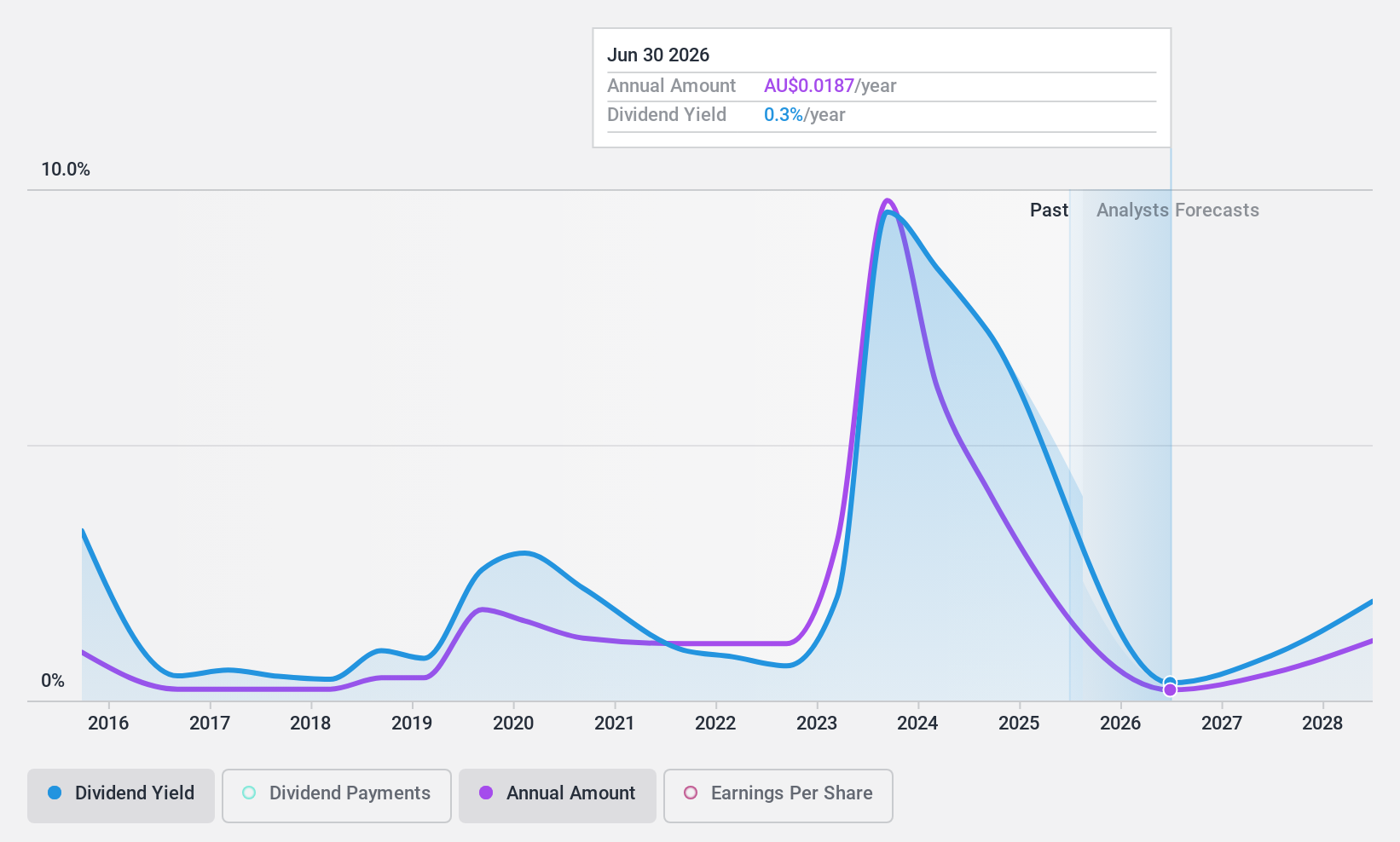

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company focused on discovering, developing, and operating assets for clean energy metals, with a market cap of A$3.99 billion.

Operations: The company's revenue segments include the Nova Operation generating A$539.10 million, Forrestania Operation contributing A$234.80 million, Cosmos Project at A$48.80 million, and Interest Revenue amounting to A$18.10 million.

Dividend Yield: 7.0%

IGO Limited's dividend payments, despite being among the top 25% of Australian dividend payers with a yield of 7.02%, are not well covered by earnings due to a high payout ratio of 10008.1%. The dividends have been volatile over the past decade, indicating unreliability. Recent financial challenges include decreased net income and profit margins, though cash flows sufficiently cover dividends with a low cash payout ratio. M&A activities may impact future dividend stability.

- Get an in-depth perspective on IGO's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of IGO shares in the market.

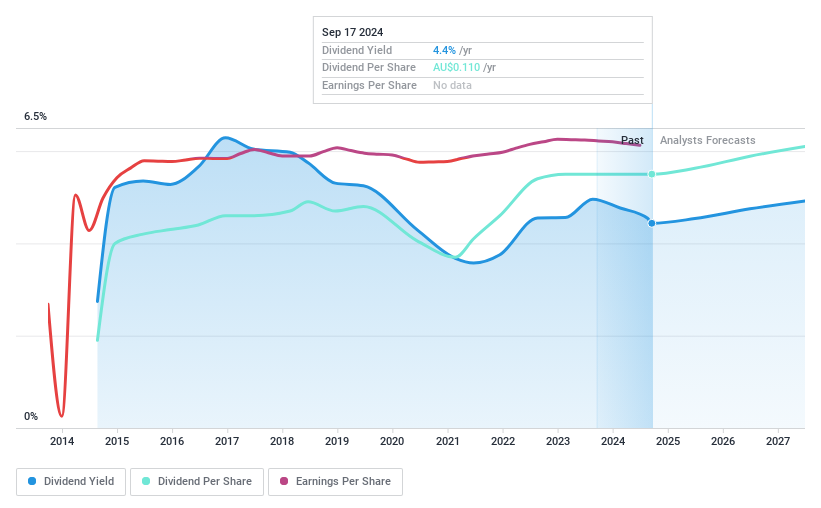

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centres to serve more than 90,000 residential and commercial customers, with a market cap of A$3.45 billion.

Operations: National Storage REIT generates its revenue primarily from the operation and management of storage centres, amounting to A$354.69 million.

Dividend Yield: 4.4%

National Storage REIT offers a stable dividend yield of 4.4%, though it falls short compared to the top Australian dividend payers. The dividends are well-covered by earnings with a payout ratio of 55.5% and cash flows at an 83% cash payout ratio, suggesting sustainability. Recent financials show increased revenue but decreased net income, highlighting potential challenges. The appointment of Simone Haslinger as a non-executive director may bring strategic insights beneficial for future growth and stability.

- Click here to discover the nuances of National Storage REIT with our detailed analytical dividend report.

- The analysis detailed in our National Storage REIT valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Delve into our full catalog of 38 Top ASX Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

Operates as an exploration and mining company that engages in discovering, developing, and operating assets focused on metals to enable clean energy in Australia.

Flawless balance sheet, good value and pays a dividend.