- Australia

- /

- Professional Services

- /

- ASX:CPU

Top ASX Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

The Australian market has recently seen notable movements, with the ASX200 closing up 0.1% at 8,212 points. The Materials sector led gains driven by a higher iron ore price following China's latest stimulus announcement, while Financials and Health Care lagged behind. In this dynamic environment, identifying robust dividend stocks can provide stability and consistent income for investors amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.44% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.45% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.62% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.98% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.22% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.75% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.60% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.33% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 5.99% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

Click here to see the full list of 39 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Computershare (ASX:CPU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computershare Limited (ASX:CPU) offers issuer services, employee share plans, communication solutions, technology services, and mortgage and property rental management with a market cap of A$14.72 billion.

Operations: Computershare Limited's revenue segments include Issuer Services ($1.21 billion), Global Corporate Trust ($936.33 million), Technology Services & Operations ($18.73 million), Communication Services & Utilities ($340.20 million), Employee Share Plans & Voucher Services ($458.48 million), and Mortgage Services & Property Rental Services ($499.68 million).

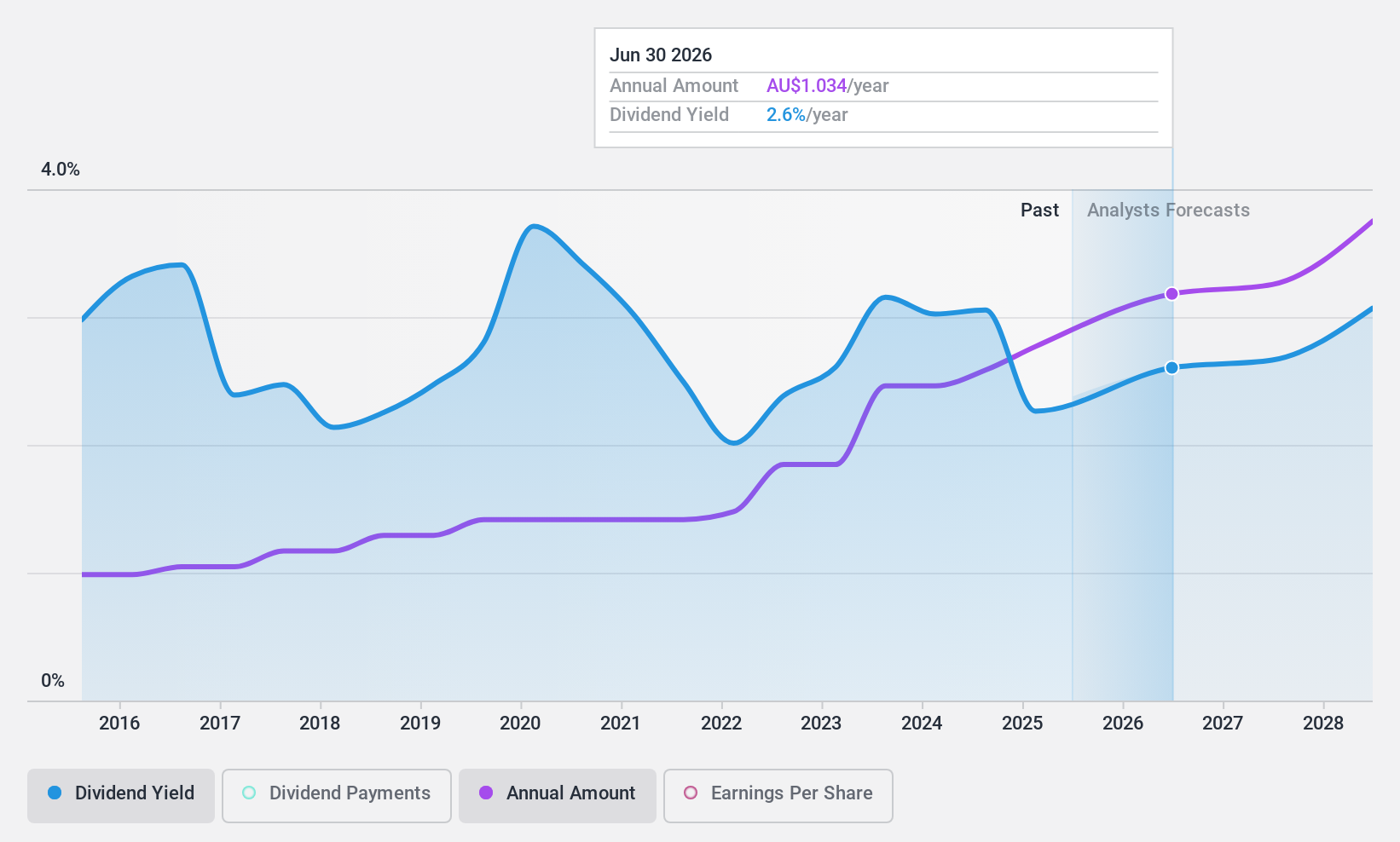

Dividend Yield: 3.3%

Computershare's dividend payments have been volatile and unreliable over the past decade, despite a reasonable payout ratio of 66.5% and cash flow coverage of 55.3%. Recent earnings growth was modest at 2%, with future earnings expected to increase by 7.5%. The company announced a dividend increase to A$0.42 per share for June 2024 and continues share buybacks, repurchasing shares worth A$321 million in the first half of 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Computershare.

- Our comprehensive valuation report raises the possibility that Computershare is priced lower than what may be justified by its financials.

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited (ASX:RIC) provides animal nutrition solutions in Australia and has a market cap of A$815.18 million.

Operations: Ridley Corporation Limited generates revenue from two main segments: Bulk Stockfeeds, which contributes A$886.59 million, and Packaged/Ingredients, accounting for A$376.31 million.

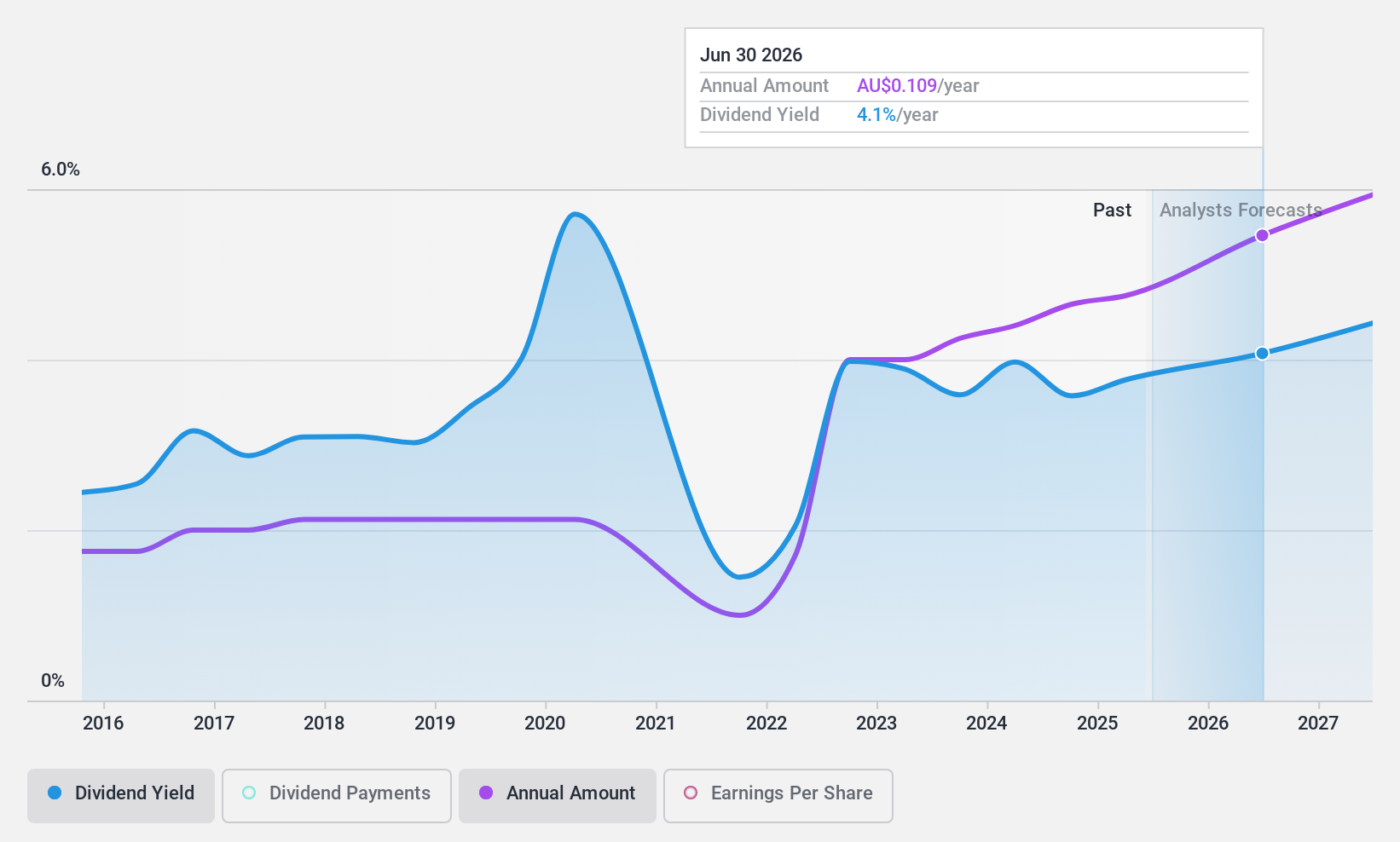

Dividend Yield: 3.6%

Ridley Corporation's dividend yield of 3.63% is below the top quartile in Australia, and its dividend history has been volatile over the past decade. However, recent financials show stable earnings with A$1.26 billion in sales and net income of A$39.85 million for FY2024. The company announced a share buyback program worth A$20 million and increased its semi-annual dividend to A$0.0465 per share, covered by both earnings (71.7%) and cash flows (41.2%).

- Click here and access our complete dividend analysis report to understand the dynamics of Ridley.

- Our valuation report unveils the possibility Ridley's shares may be trading at a discount.

Waterco (ASX:WAT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Waterco Limited (ASX:WAT) manufactures, wholesales, and exports equipment and accessories for swimming pools, spa pools, spa baths, rural pumps, and water treatment across Australia, New Zealand, Asia, North America, and Europe with a market cap of A$186.73 million.

Operations: Waterco Limited generates revenue primarily from its Building Products segment, amounting to A$244.85 million.

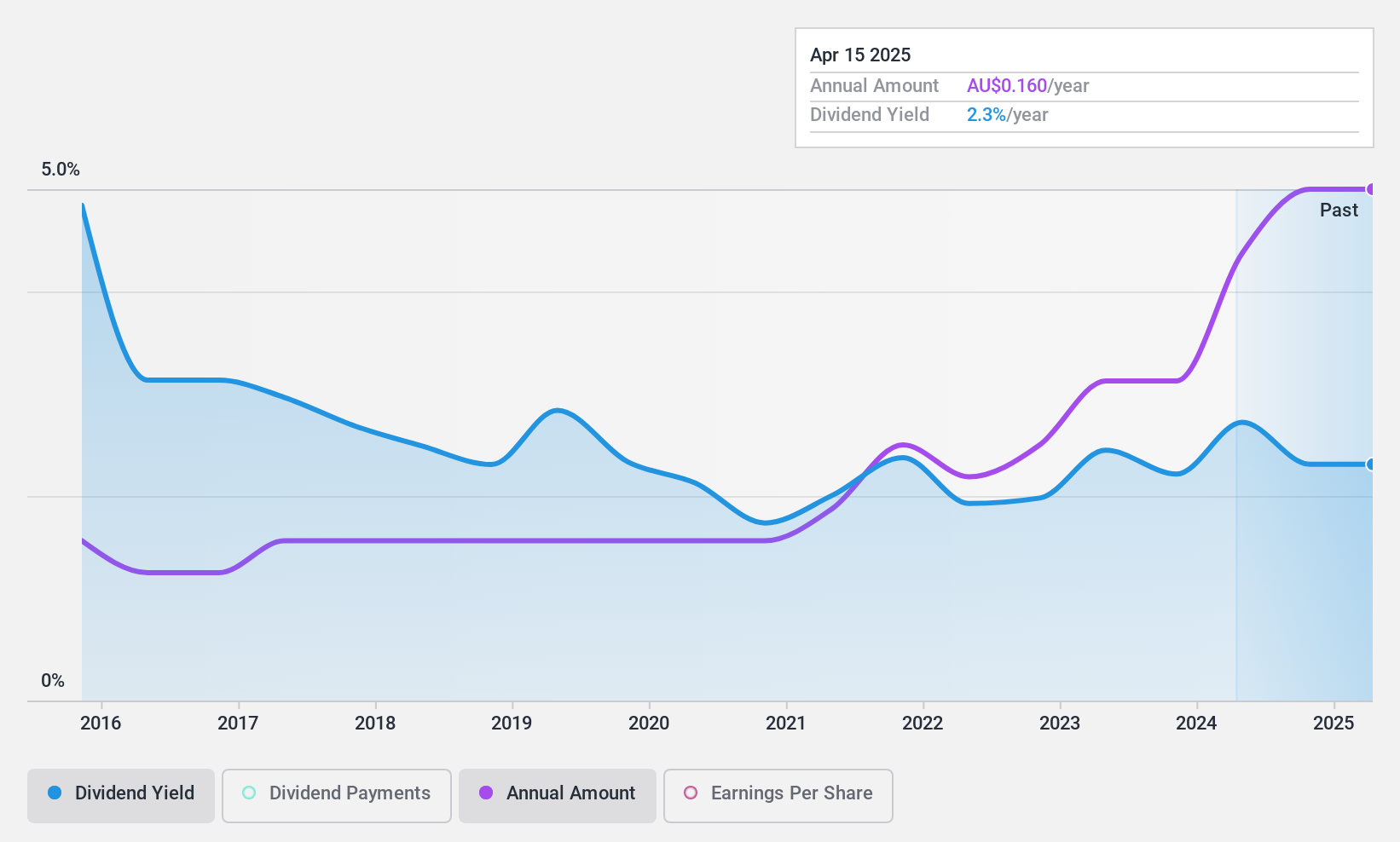

Dividend Yield: 3%

Waterco's dividend yield of 3.01% is lower than the top quartile in Australia, and its dividend history has been volatile over the past decade. Despite this, recent financials show strong earnings growth with A$244.85 million in sales and net income of A$13.85 million for FY2024. The company announced a final dividend of A$0.08 per share, well-covered by earnings (38.1%) and cash flows (25.4%). Additionally, Waterco initiated a share buyback program valid until June 2025.

- Navigate through the intricacies of Waterco with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Waterco shares in the market.

Turning Ideas Into Actions

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 36 more companies for you to explore.Click here to unveil our expertly curated list of 39 Top ASX Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CPU

Computershare

Provides issuer, employee share plans and voucher, communication and utilities, technology, and mortgage and property rental services.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives