- Australia

- /

- Transportation

- /

- ASX:KLS

ASX Growth Companies With High Insider Ownership And A Minimum 14% Earnings Growth

Reviewed by Simply Wall St

As the ASX200 shows signs of recovery, buoyed by positive developments in global and domestic markets, investors are keenly observing trends that could indicate sustainable growth. In this context, growth companies with high insider ownership present a compelling narrative, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Telix Pharmaceuticals (ASX:TLX) | 16.1% | 37.1% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Catalyst Metals (ASX:CYL) | 17.1% | 75.7% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 106.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 49.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited specializes in the development and supply of mining technology, with a market capitalization of approximately A$631.21 million.

Operations: The company generates its revenue primarily from mining services, totaling A$34.24 million.

Insider Ownership: 21.3%

Earnings Growth Forecast: 63.5% p.a.

Chrysos Corporation Limited, poised for significant growth, is forecasted to see its earnings expand by 63.48% annually. Despite recent shareholder dilution, the company's revenue growth at 35.3% per year outpaces the Australian market significantly. Insider activity presents a mixed picture with more substantial buying than selling over the past three months, aligning interests with shareholders. However, its projected Return on Equity remains low at 7.7%. Analysts remain optimistic about stock performance, anticipating a near 50% price increase.

- Delve into the full analysis future growth report here for a deeper understanding of Chrysos.

- The analysis detailed in our Chrysos valuation report hints at an inflated share price compared to its estimated value.

Kelsian Group (ASX:KLS)

Simply Wall St Growth Rating: ★★★★☆☆

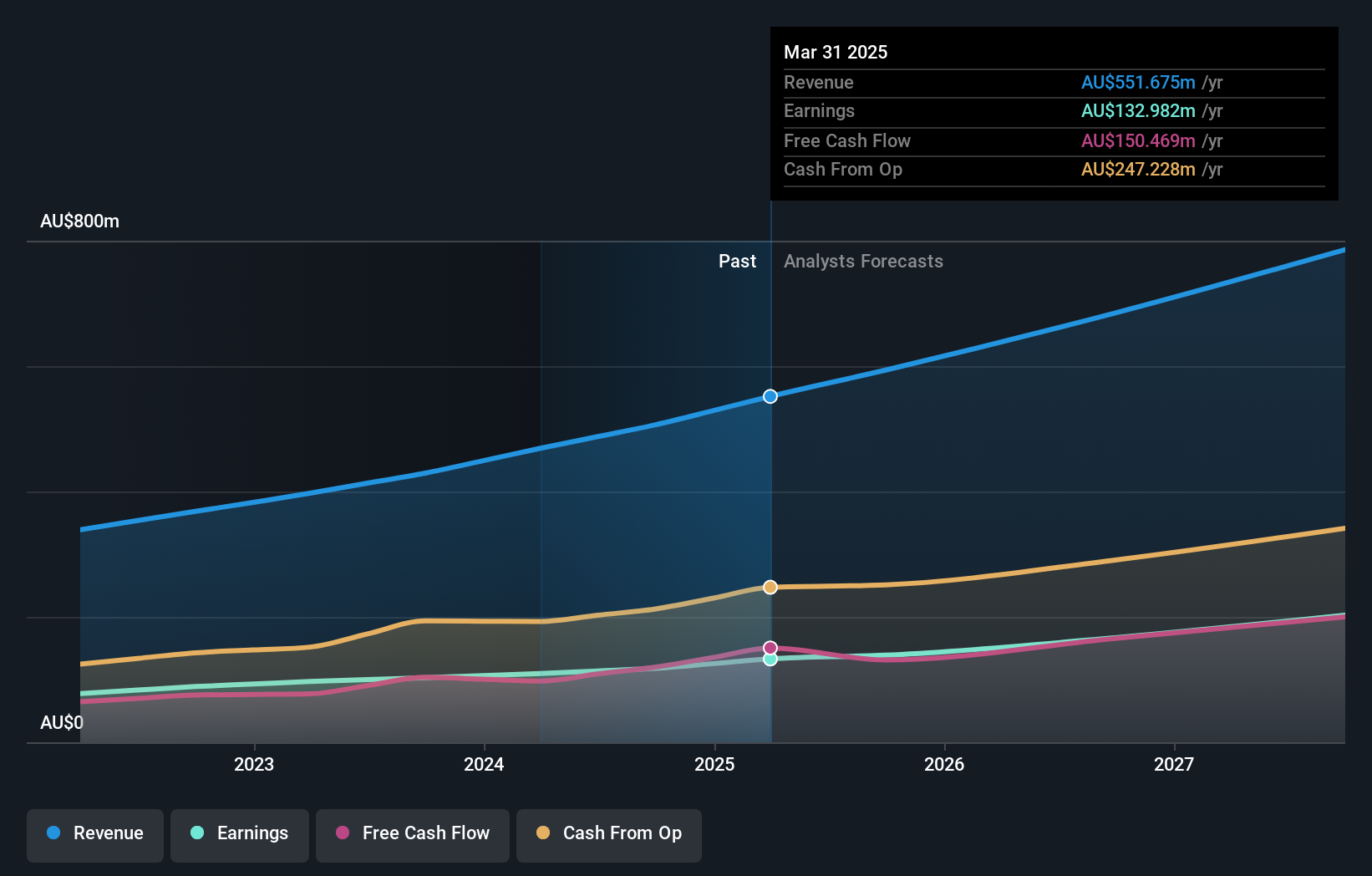

Overview: Kelsian Group Limited operates in providing land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.37 billion.

Operations: The company generates revenue through three primary segments: Australian Bus services contributing A$934.76 million, International Bus services at A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

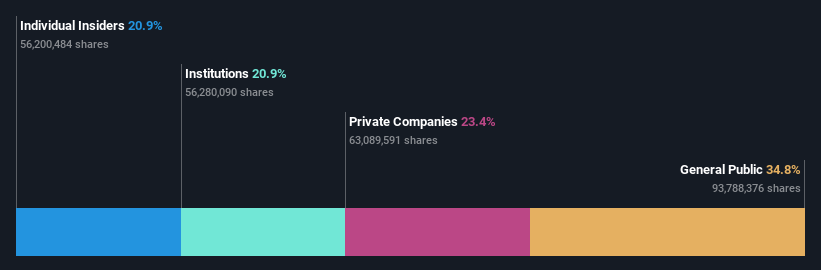

Insider Ownership: 20.9%

Earnings Growth Forecast: 25.5% p.a.

Kelsian Group is set to outperform the Australian market with its earnings growth forecasted at 25.5% annually, compared to the market's 13.3%. Revenue is also expected to slightly exceed market growth at 5.6% per year. Despite this, financial challenges persist as interest payments are poorly covered by earnings and profit margins have declined from last year. Insider buying trends are positive, showing more acquisitions than sales in recent months, though the stock trades below estimated fair value and analyst price targets suggest a potential increase of 39.9%.

- Click here and access our complete growth analysis report to understand the dynamics of Kelsian Group.

- Our valuation report unveils the possibility Kelsian Group's shares may be trading at a discount.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that specializes in developing, marketing, selling, implementing, and supporting integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$6.29 billion.

Operations: The company generates revenue through three primary segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

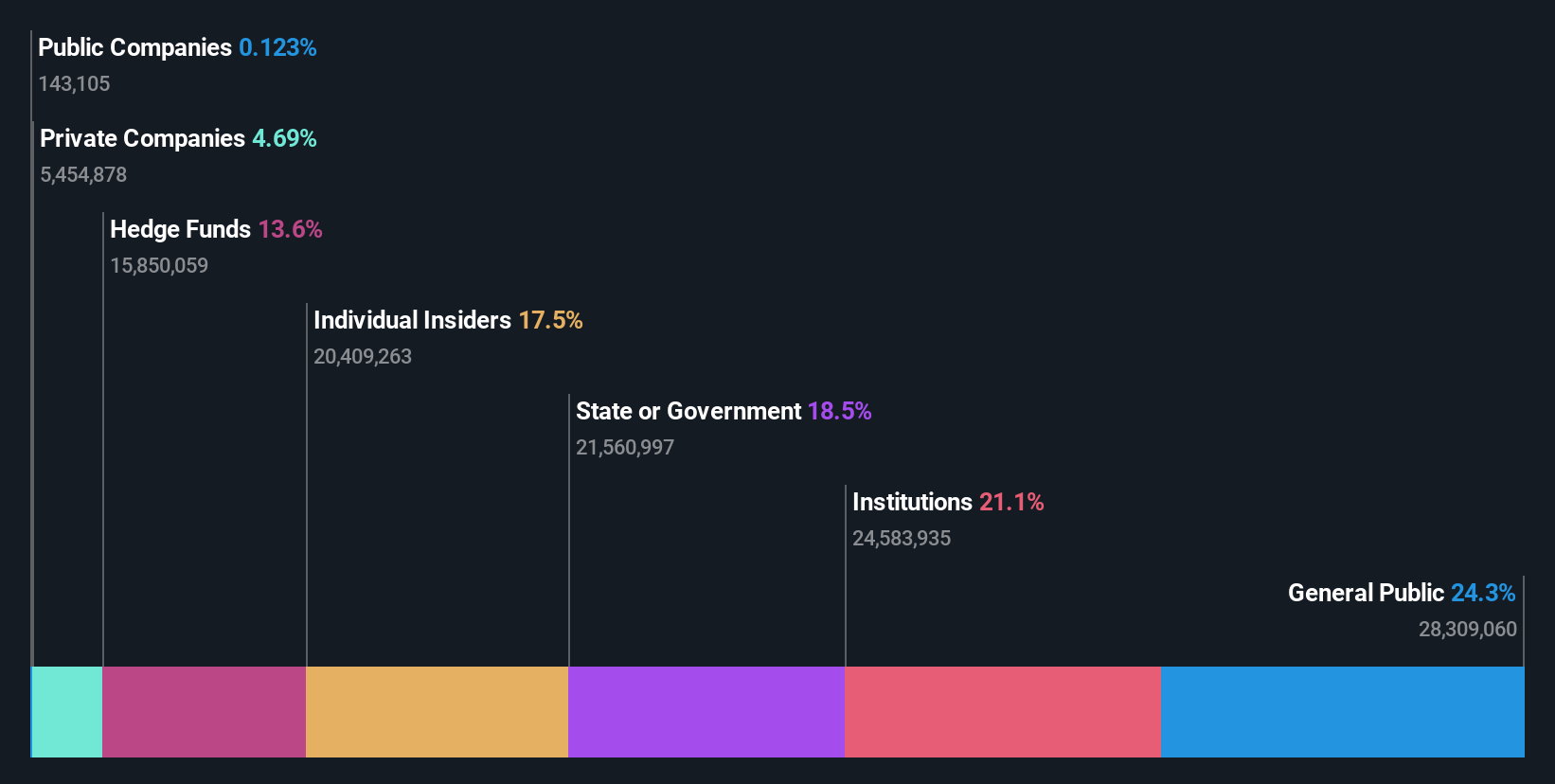

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.3% p.a.

Technology One, a software firm in Australia, is poised for robust growth with earnings expected to increase by 14.3% annually, outpacing the market's 13.3%. Its revenue growth forecast at 11.1% yearly also surpasses the Australian market average of 5.4%. Despite a high Price-To-Earnings ratio of A$57.30, it remains below the industry average. The recent appointment of Paul Robson as Non-Executive Director could further enhance strategic and operational capabilities, aligning with its growth trajectory.

- Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

- Our valuation report here indicates Technology One may be overvalued.

Make It Happen

- Dive into all 88 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Kelsian Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kelsian Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KLS

Kelsian Group

Provides land and marine transport and tourism services in Australia, the United States, Singapore, and the United Kingdom.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives