Zicom Group Limited (ASX:ZGL) Held Back By Insufficient Growth Even After Shares Climb 51%

The Zicom Group Limited (ASX:ZGL) share price has done very well over the last month, posting an excellent gain of 51%. The last 30 days bring the annual gain to a very sharp 70%.

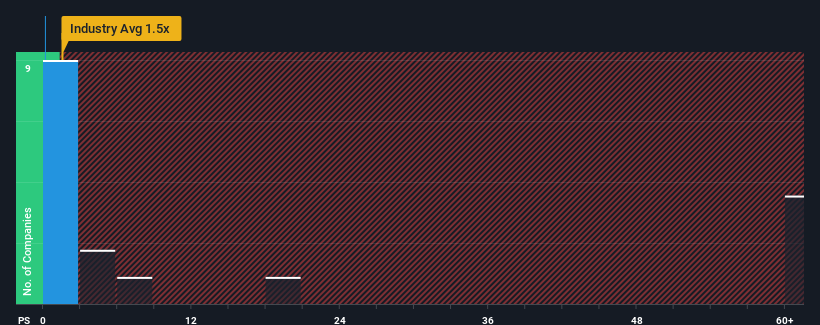

In spite of the firm bounce in price, Zicom Group may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Machinery industry in Australia have P/S ratios greater than 2.6x and even P/S higher than 54x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Zicom Group

How Has Zicom Group Performed Recently?

For instance, Zicom Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zicom Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Zicom Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 21% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 94% shows it's an unpleasant look.

In light of this, it's understandable that Zicom Group's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Zicom Group's P/S Mean For Investors?

Even after such a strong price move, Zicom Group's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Zicom Group maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It is also worth noting that we have found 3 warning signs for Zicom Group that you need to take into consideration.

If you're unsure about the strength of Zicom Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zicom Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZGL

Zicom Group

Manufactures and sells marine deck machinery, fluid regulating and metering stations, transit concrete mixers, foundation and geotechnical equipment, and precision engineered and automation equipment in Australia, the Philippines, Singapore, China, Bangladesh, and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives