- Australia

- /

- Metals and Mining

- /

- ASX:GMD

ASX Penny Stocks With Potential For January 2025

Reviewed by Simply Wall St

The Australian market has been on an upward trajectory, with the ASX200 closing up 0.36% at 8,408 points as it continues to adapt to the new Trump administration and favorable tariff outcomes. Amidst these developments, investors are seeking opportunities that align with current market dynamics, particularly in sectors showing resilience and potential for growth. Though the term 'penny stock' might sound like a relic of past trading days, these typically smaller or newer companies can still offer significant growth potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.945 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.985 | A$110.44M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.32 billion.

Operations: The company generates revenue from two main segments: Retail, contributing A$1.27 billion, and Wholesale, accounting for A$463.20 million.

Market Cap: A$1.32B

Accent Group's financial position reveals a mixed outlook. While short-term liabilities are covered by assets, long-term liabilities remain uncovered. The company's debt is manageable with satisfactory net debt to equity and strong interest coverage. However, profit margins have declined from 6.2% to 4.1%, and earnings growth has been negative at -32.7%. Despite trading below fair value, the dividend yield of 5.56% isn't well-supported by earnings, raising sustainability concerns. Recent board changes include the appointment of Dave Forsey as an Independent Non-Executive Director, potentially bringing valuable retail sector expertise to the company amidst these challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Accent Group.

- Examine Accent Group's earnings growth report to understand how analysts expect it to perform.

Genesis Minerals (ASX:GMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia, with a market cap of A$3.45 billion.

Operations: The company generates revenue of A$438.59 million from its mineral production, exploration, and development activities.

Market Cap: A$3.45B

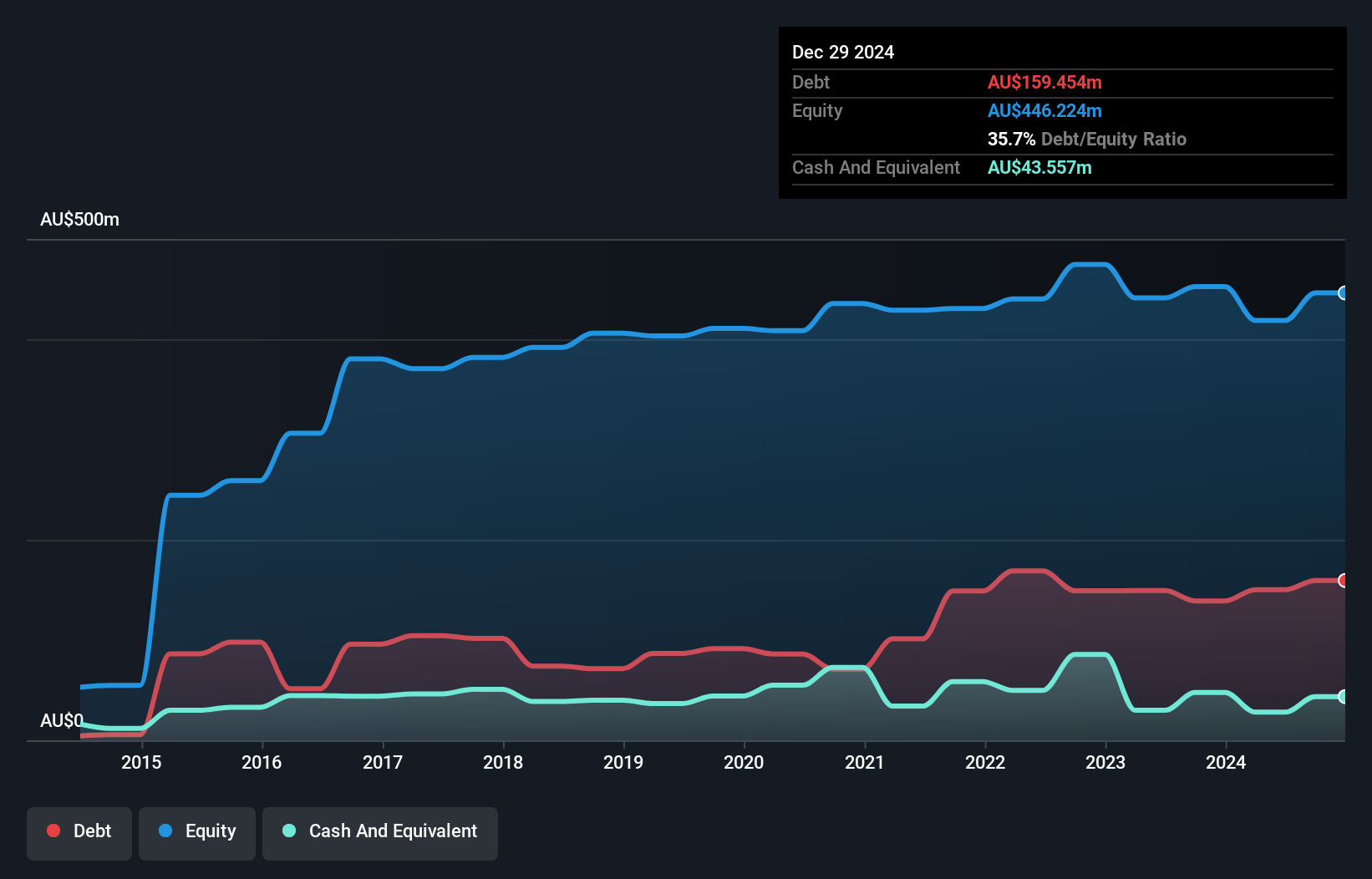

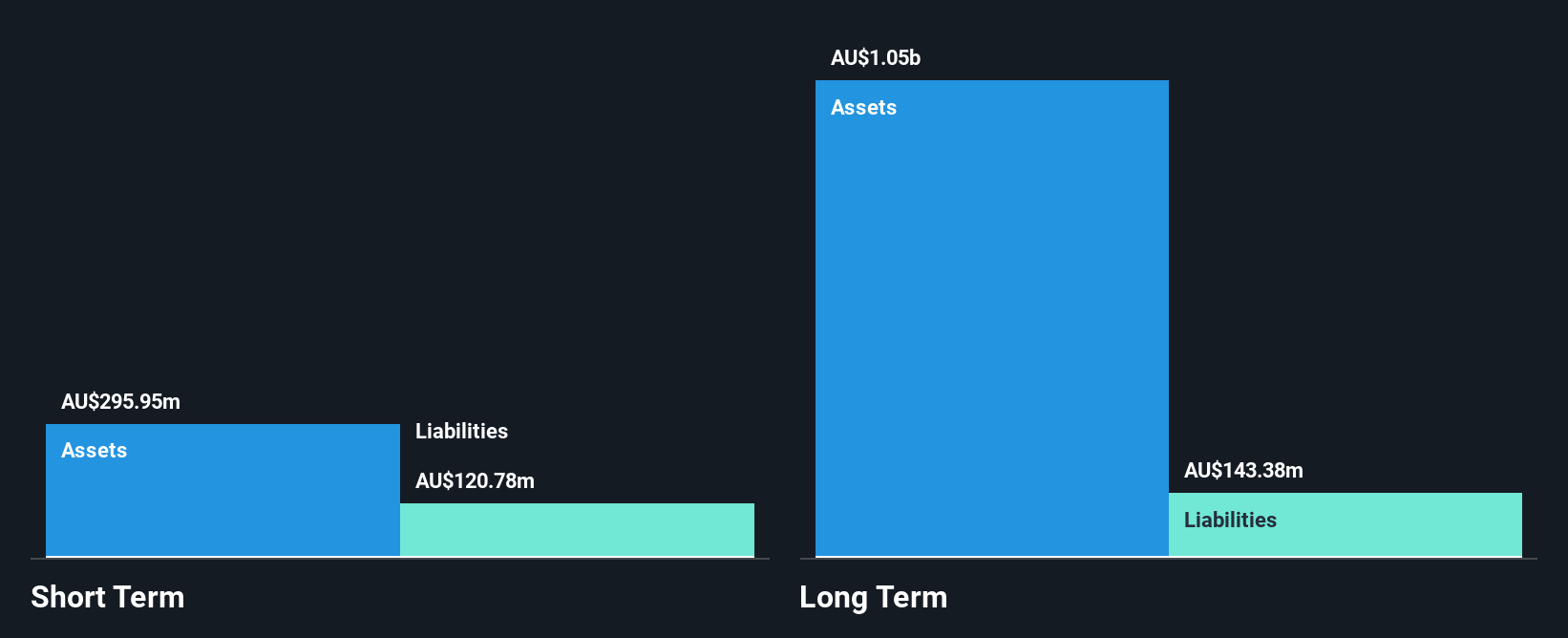

Genesis Minerals Limited has shown progress in its financial health, becoming profitable over the past year with high-quality earnings. Its short-term assets of A$224.8 million comfortably cover both short and long-term liabilities, indicating a strong liquidity position. The company's debt management is prudent, with cash exceeding total debt and operating cash flow well covering its obligations. Despite a low return on equity at 8.4%, Genesis trades significantly below estimated fair value, suggesting potential undervaluation. Recent presentations in Melbourne and Sydney indicate active corporate engagement, though the board's relatively new tenure may affect strategic continuity.

- Take a closer look at Genesis Minerals' potential here in our financial health report.

- Gain insights into Genesis Minerals' outlook and expected performance with our report on the company's earnings estimates.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited offers infrastructure services across Australia and New Zealand, with a market capitalization of A$3.28 billion.

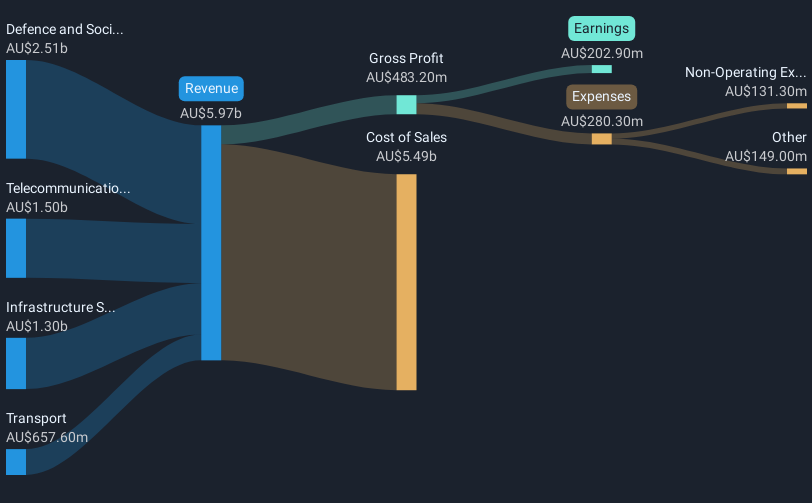

Operations: The company's revenue is derived from four main segments: Transport (A$657.6 million), Telecommunications (A$1.50 billion), Infrastructure Services (A$1.30 billion), and Defence and Social Infrastructure (A$2.51 billion).

Market Cap: A$3.28B

Ventia Services Group's financial position is characterized by a high net debt to equity ratio of 63.8%, although its debt is well covered by operating cash flow at 41.2%. The company's earnings have grown significantly, averaging 45% annually over the past five years, though recent growth has slowed to 16.3%. Trading below estimated fair value and showing good relative value compared to peers, Ventia maintains stable weekly volatility at 8%. However, recent legal proceedings initiated by the ACCC could impact its operations and investor sentiment. Management changes continue with a new Company Secretary appointment in November 2024.

- Navigate through the intricacies of Ventia Services Group with our comprehensive balance sheet health report here.

- Evaluate Ventia Services Group's prospects by accessing our earnings growth report.

Make It Happen

- Explore the 1,026 names from our ASX Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the exploration, production, and development of gold deposits in Western Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives