- Australia

- /

- Diversified Financial

- /

- ASX:OFX

ASX Penny Stocks Spotlight: OFX Group And Two More Hidden Opportunities

Reviewed by Simply Wall St

The ASX200 is poised to open slightly higher, reflecting a mixed performance on Wall Street amid economic data showing the first quarterly contraction in the US economy in three years. In such a market landscape, identifying stocks with solid fundamentals becomes crucial for investors seeking growth opportunities. Penny stocks, despite their somewhat outdated label, often represent smaller or newer companies that can offer significant potential when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.695 | A$136.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.855 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.415 | A$66.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.64 | A$407.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.38 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.875 | A$630.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.75 | A$857.64M | ✅ 5 ⚠️ 3 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$1.10 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.71 | A$1.24B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 989 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited offers international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$263.32 million.

Operations: The company's revenue is primarily derived from the Asia Pacific region with A$91.22 million, followed by North America at A$88.75 million and Europe contributing A$36.80 million.

Market Cap: A$263.32M

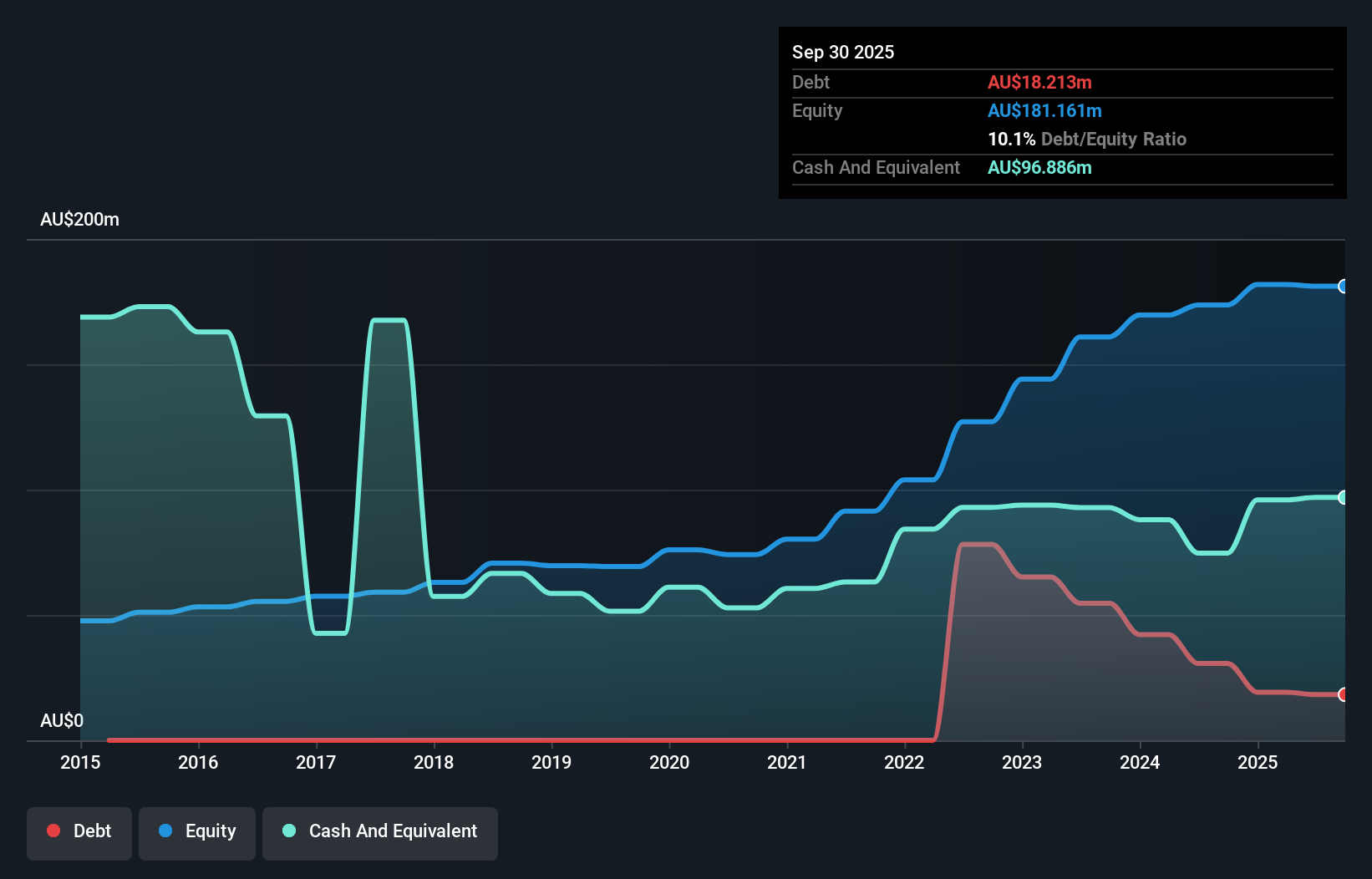

OFX Group Limited, recently added to the S&P/ASX Emerging Companies Index, demonstrates a robust financial position with more cash than total debt and operating cash flow covering debt well. Despite negative earnings growth in the past year, OFX has shown consistent profit growth over five years at 15.7% annually. The company's short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. While trading at good value compared to peers with analysts predicting a price rise of 83.7%, its return on equity is considered low at 15.1%. The management team and board are experienced, providing stability amid volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of OFX Group.

- Review our growth performance report to gain insights into OFX Group's future.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited offers sports, racing, and iGaming betting products and services via its cloud-based technology platform in Australia, with a market cap of A$363.24 million.

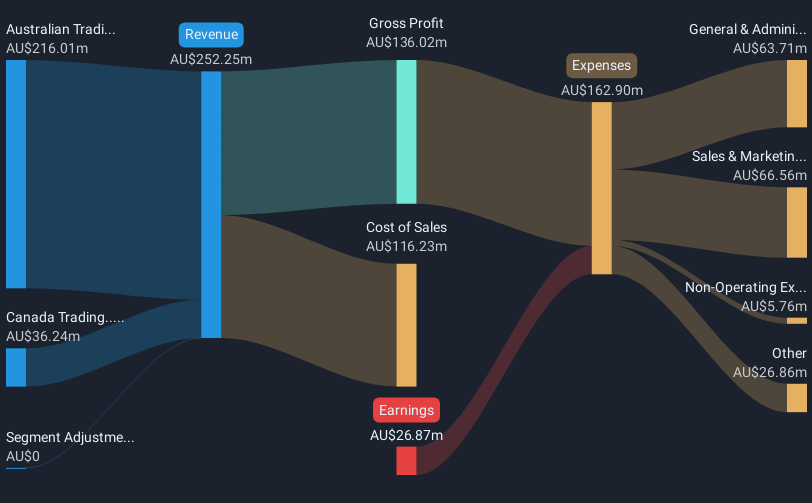

Operations: The company's revenue is derived from its Canadian trading segment, which generated A$36.24 million, and its Australian trading segment, which brought in A$216.01 million.

Market Cap: A$363.24M

PointsBet Holdings Limited, with a market cap of A$363.24 million, is currently under acquisition consideration by MIXI Australia Pty Ltd for approximately A$370 million. Despite being unprofitable and having a negative return on equity of -559.41%, the company has managed to reduce its losses over the past five years at a rate of 27.1% annually. Its short-term assets do not cover short-term liabilities, but it remains debt-free with sufficient cash runway for more than three years based on current free cash flow. The management team and board are experienced, providing some stability amid financial challenges.

- Get an in-depth perspective on PointsBet Holdings' performance by reading our balance sheet health report here.

- Examine PointsBet Holdings' earnings growth report to understand how analysts expect it to perform.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited operates as an infrastructure services provider in Australia and New Zealand, with a market cap of A$3.61 billion.

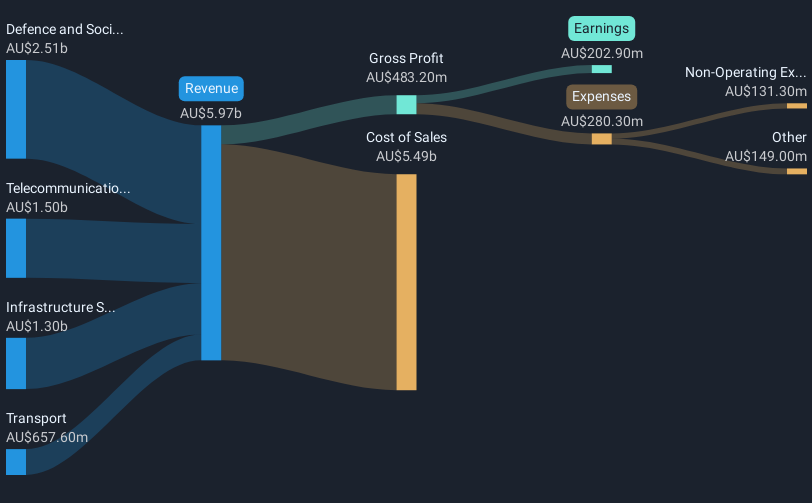

Operations: The company's revenue is derived from four main segments: Transport (A$632.4 million), Telecommunications (A$1.58 billion), Infrastructure Services (A$1.32 billion), and Defence and Social Infrastructure (A$2.58 billion).

Market Cap: A$3.61B

Ventia Services Group, with a market cap of A$3.61 billion, has shown solid financial performance and strategic growth initiatives. Recent contract wins, including a A$2.1 billion deal with NBN Co and a A$270 million extension with the Department of Defence, bolster its revenue streams across key segments like Telecommunications and Defence. Despite high debt levels, Ventia's interest payments are well-covered by EBIT (9x coverage), and its net debt to equity ratio is 55.8%. Earnings have grown significantly over five years at 39.4% annually, although recent growth has decelerated to 16%. The company also announced a share buyback program worth up to A$100 million, indicating confidence in its valuation and future prospects.

- Dive into the specifics of Ventia Services Group here with our thorough balance sheet health report.

- Explore Ventia Services Group's analyst forecasts in our growth report.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 986 more companies for you to explore.Click here to unveil our expertly curated list of 989 ASX Penny Stocks.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OFX

OFX Group

Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives