When a single insider purchases stock, it is typically not a major deal. However, when multiple insiders purchase stock, like in Symal Group Limited's (ASX:SYL) instance, it's good news for shareholders.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Symal Group Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by Chief People & Culture Officer Olivia Bartolo for AU$100k worth of shares, at about AU$2.00 per share. That implies that an insider found the current price of AU$2.07 per share to be enticing. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. The good news for Symal Group share holders is that insiders were buying at near the current price.

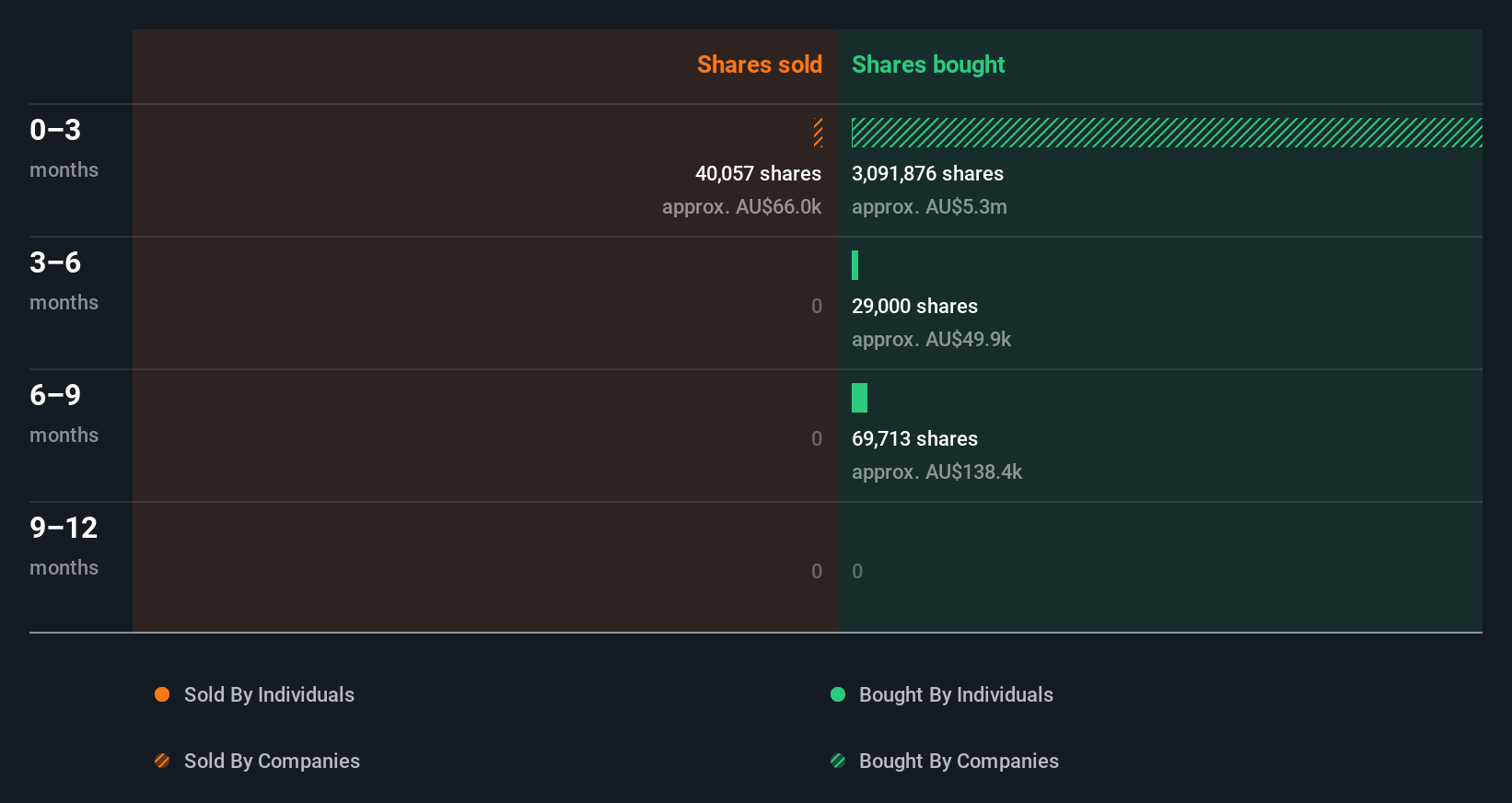

While Symal Group insiders bought shares during the last year, they didn't sell. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Symal Group

Symal Group is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Have Symal Group Insiders Traded Recently?

There was only a small bit of insider buying, worth AU$7.5k, in the last three months. So it is hard to draw any conclusion about how insiders are feeling about the stock, from these recent trades.

Insider Ownership Of Symal Group

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It's great to see that Symal Group insiders own 93% of the company, worth about AU$453m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Symal Group Insider Transactions Indicate?

Our data shows a little insider buying, but no selling, in the last three months. Overall the buying isn't worth writing home about. But insiders have shown more of an appetite for the stock, over the last year. With high insider ownership and encouraging transactions, it seems like Symal Group insiders think the business has merit. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SYL

Symal Group

Provides construction contracting, equipment hires, material sales, recycling, and remediation services to the civil construction industry in Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.