- Australia

- /

- Construction

- /

- ASX:GNP

GenusPlus Group Alongside 2 Other Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

The Australian market has recently experienced a slight downturn, with the ASX200 down 0.79% amid disappointing results from major banks and anticipation of the Reserve Bank's upcoming decision. While sectors such as Consumer Staples and Real Estate have shown resilience, Financials have struggled, highlighting the importance of identifying stocks with strong fundamentals and growth potential in challenging economic conditions. In this context, exploring lesser-known companies like GenusPlus Group can uncover promising opportunities that may not yet be reflected in broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia, with a market capitalization of A$515.33 million.

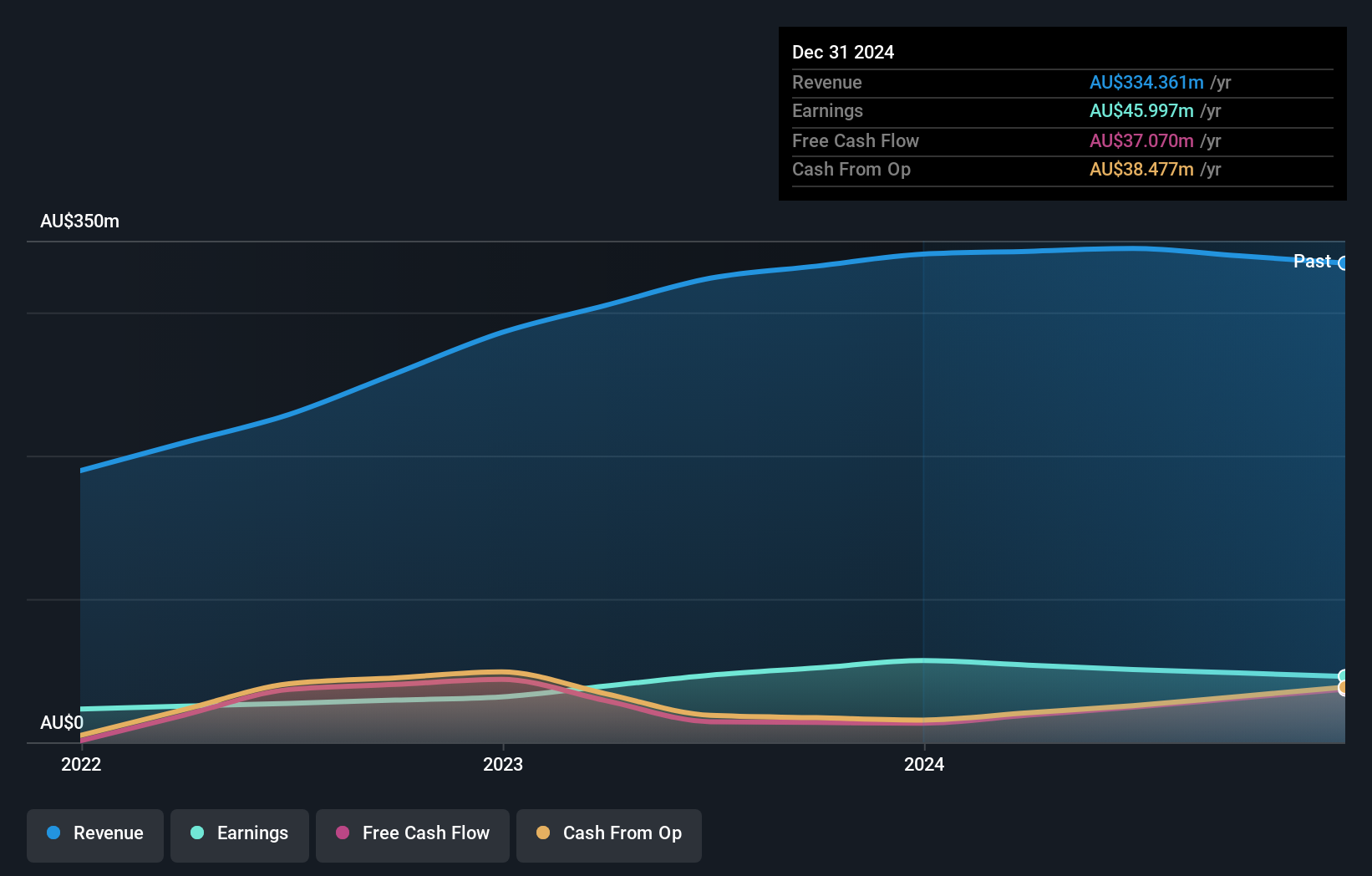

Operations: GenusPlus Group generates revenue primarily from its Infrastructure segment, which contributes A$336.04 million, followed by Industrial at A$152.62 million and Communication at A$71.59 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

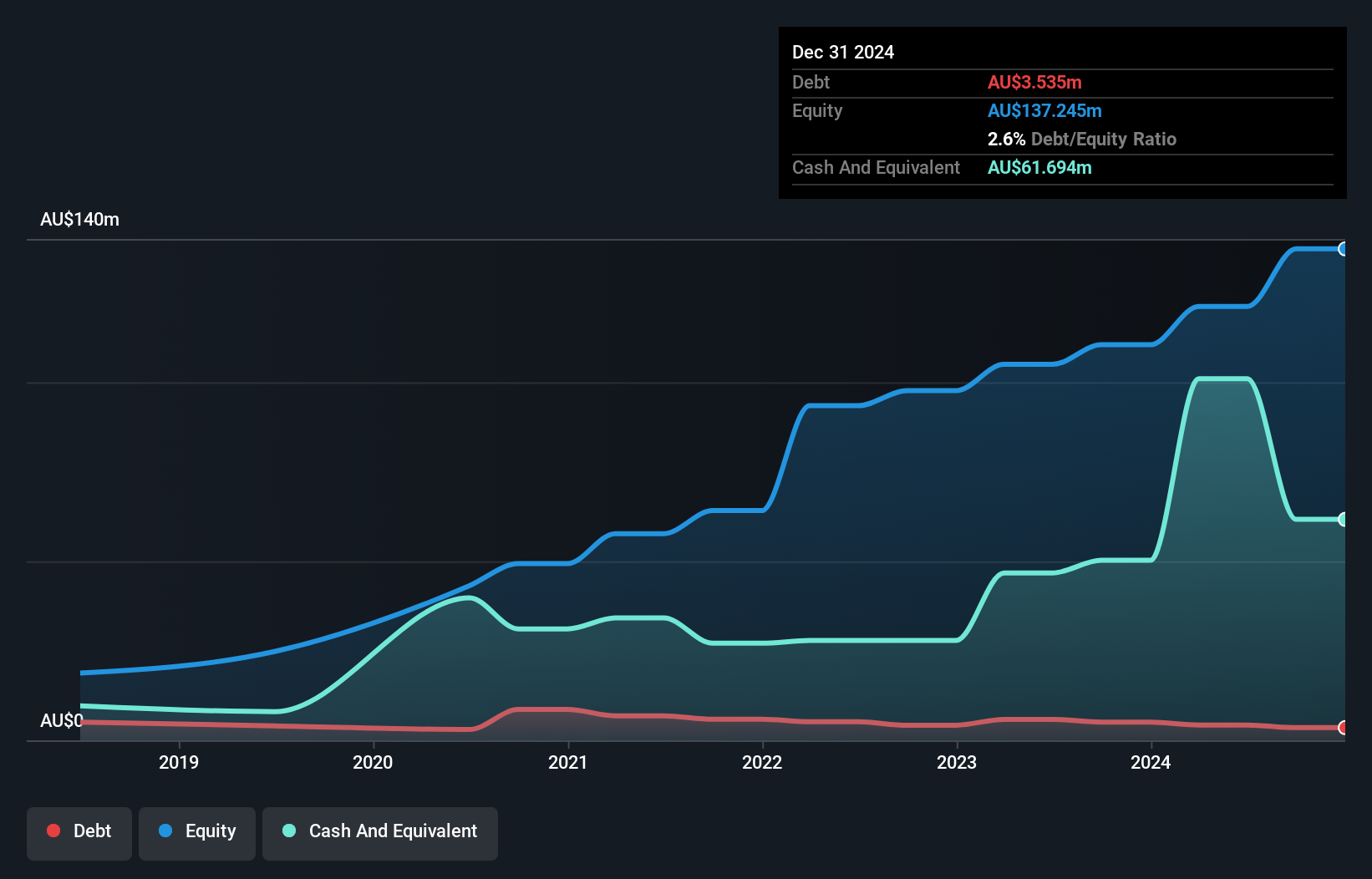

GenusPlus Group, a notable player in the construction sector, showcases impressive financial health with earnings growth of 43.7% over the past year, surpassing the industry average of 24.3%. The company's debt to equity ratio has significantly improved from 16.3% to 3.5% over five years, indicating prudent financial management. Trading at a valuation that's nearly 39% below its estimated fair value suggests potential for appreciation. With interest payments well-covered by EBIT at a robust multiple of 40x and positive free cash flow reported consistently, GenusPlus seems poised for continued stability and growth in its market niche.

- Delve into the full analysis health report here for a deeper understanding of GenusPlus Group.

Understand GenusPlus Group's track record by examining our Past report.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★★

Overview: Lycopodium Limited is an Australian company that offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors, with a market capitalization of A$448.71 million.

Operations: Lycopodium's primary revenue stream comes from the resources sector, generating A$366.49 million. The process industries and rail infrastructure sectors contribute A$11.45 million and A$10.21 million, respectively.

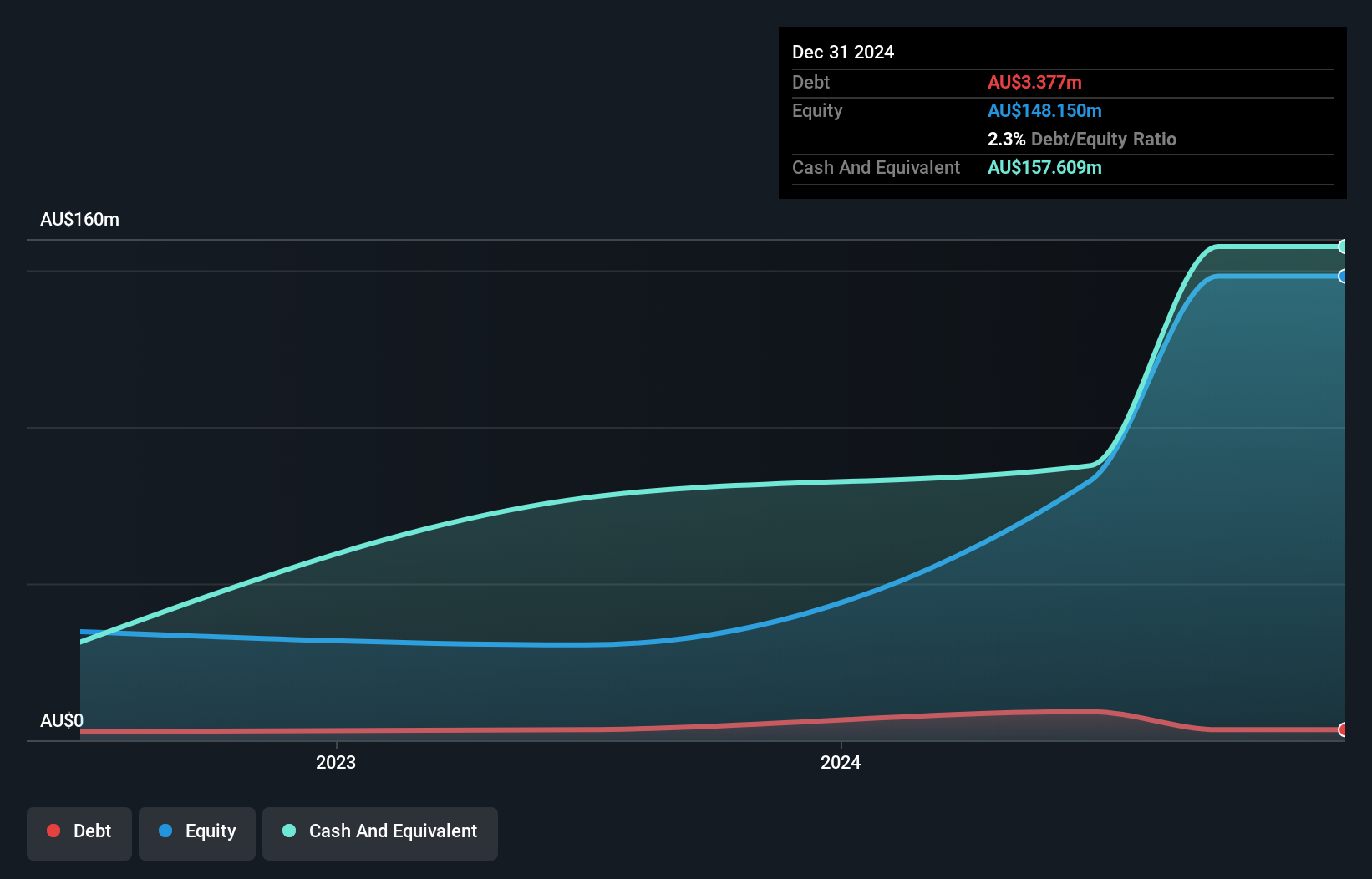

Lycopodium, with its roots in the engineering and construction sector, is a standout among Australia's smaller companies. The firm showcases impressive financial health, boasting a debt-free status for the past five years. Its earnings have surged by an annual rate of 33.8% over this period, although recent growth at 8.4% lagged behind the broader construction industry’s 24.3%. With a price-to-earnings ratio of 8.8x compared to the Australian market's average of 19.7x, it seems undervalued. Despite significant insider selling recently, Lycopodium remains profitable with strong non-cash earnings and positive free cash flow (A$24 million).

- Navigate through the intricacies of Lycopodium with our comprehensive health report here.

Gain insights into Lycopodium's past trends and performance with our Past report.

Symal Group (ASX:SYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering services such as construction contracting, equipment hires, material sales, recycling, and remediation, with a market capitalization of A$471.14 million.

Operations: Symal Group generates revenue primarily from Major Infrastructure (A$485.98 million), Construction Services (A$171.86 million), and Asset Management (A$88.32 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability within the civil construction industry in Australia.

Symal Group, a recent entrant to the public market with an IPO raising A$136 million, showcases impressive growth potential. Over the past year, earnings skyrocketed by 133803%, significantly outpacing the construction industry's 24% growth. The company trades at a substantial discount of 45% below its estimated fair value, suggesting attractive valuation prospects. Additionally, Symal maintains more cash than total debt and boasts positive free cash flow of A$53.16 million as of June 2024. Recent board appointments signal strategic leadership changes that could further enhance its trajectory in the competitive landscape.

Turning Ideas Into Actions

- Reveal the 48 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNP

GenusPlus Group

Engages in the installation, construction, and maintenance of power and communication systems in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives