- Australia

- /

- Metals and Mining

- /

- ASX:S32

3 ASX Stocks Estimated Up To 49.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 closing up 0.51% at 8,416 points, buoyed by a positive response to China’s measured reaction to tariffs and strong performances in sectors like Materials and IT. In this environment of fluctuating global trade dynamics, identifying undervalued stocks becomes crucial for investors seeking opportunities; these are stocks that may be trading below their intrinsic value despite broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$2.10 | A$3.83 | 45.2% |

| Pureprofile (ASX:PPL) | A$0.048 | A$0.092 | 47.7% |

| Mader Group (ASX:MAD) | A$6.23 | A$11.90 | 47.6% |

| Atlas Arteria (ASX:ALX) | A$5.01 | A$9.59 | 47.8% |

| Symal Group (ASX:SYL) | A$1.91 | A$3.79 | 49.6% |

| MLG Oz (ASX:MLG) | A$0.605 | A$1.16 | 47.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.16 | A$6.10 | 48.2% |

| Charter Hall Group (ASX:CHC) | A$15.58 | A$28.74 | 45.8% |

| SciDev (ASX:SDV) | A$0.48 | A$0.87 | 45% |

| South32 (ASX:S32) | A$3.45 | A$6.63 | 47.9% |

Here we highlight a subset of our preferred stocks from the screener.

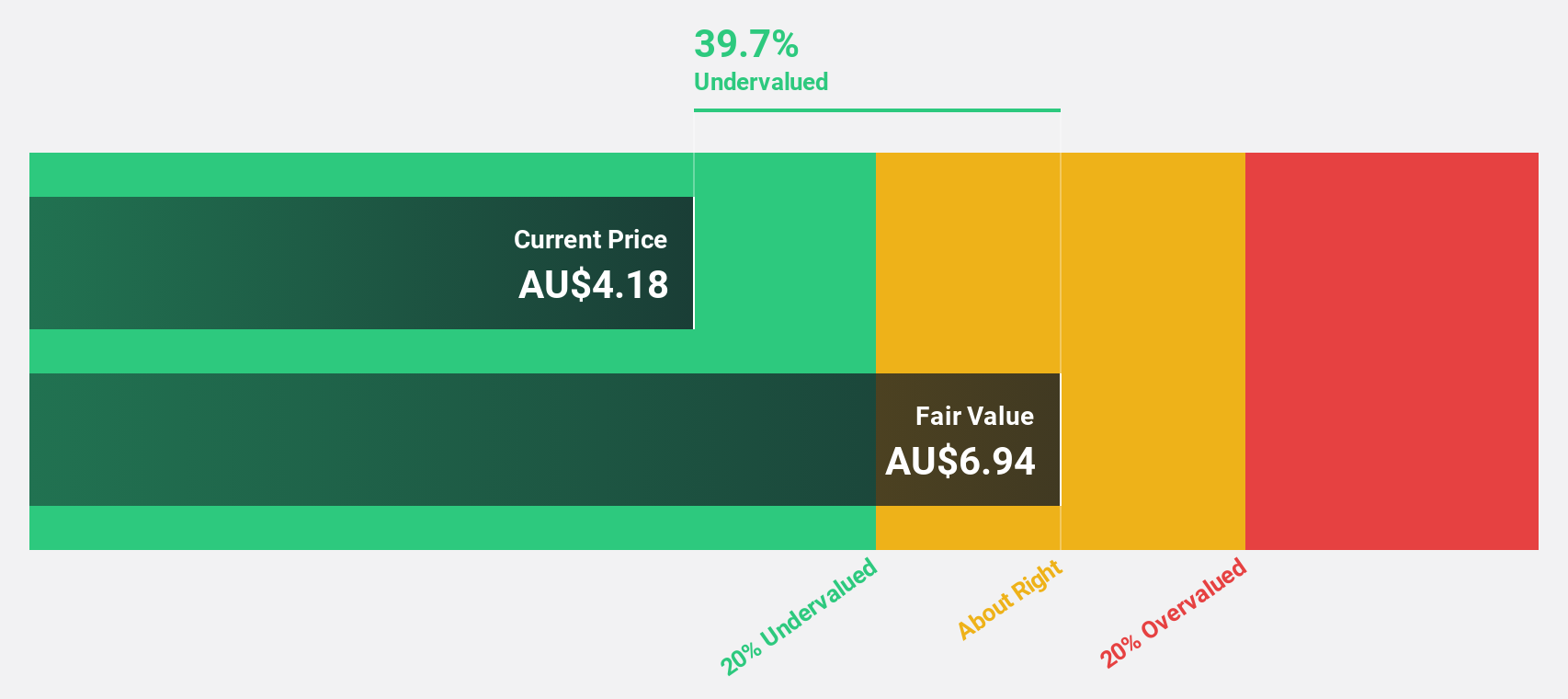

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is an infection prevention company operating globally, with a market cap of A$1.02 billion.

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, amounting to A$170.01 million.

Estimated Discount To Fair Value: 36%

Nanosonics is currently trading at A$3.35, significantly below its estimated fair value of A$5.23, suggesting it is undervalued based on discounted cash flow analysis. With forecasted earnings growth of 24.3% annually and revenue growth above the market average, the company shows promising financial prospects despite a recent decline in profit margins from 12% to 7.6%. The appointment of Gerard Dalbosco as an Independent Non-Executive Director could strengthen governance and strategic oversight moving forward.

- The growth report we've compiled suggests that Nanosonics' future prospects could be on the up.

- Get an in-depth perspective on Nanosonics' balance sheet by reading our health report here.

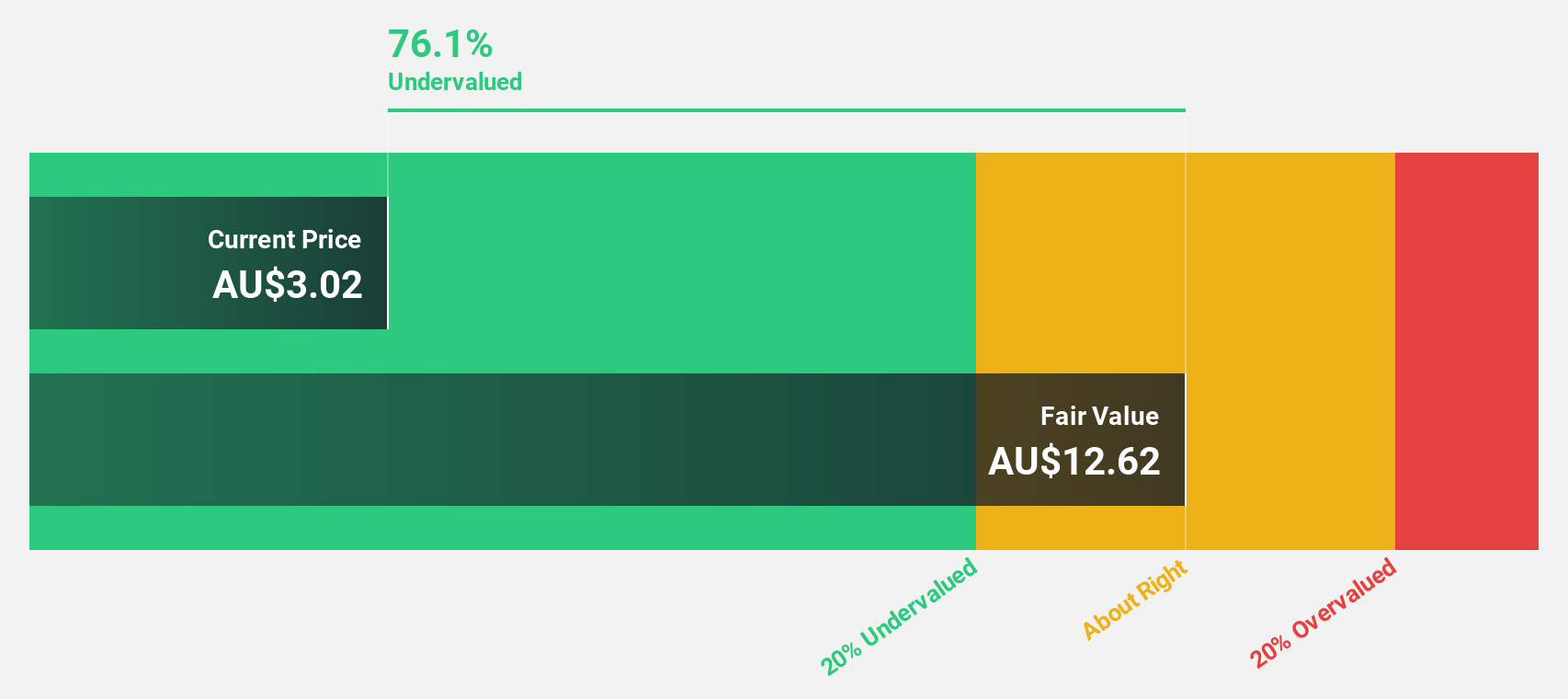

South32 (ASX:S32)

Overview: South32 Limited is a diversified metals and mining company with a market capitalization of approximately A$15.22 billion.

Operations: The company's revenue is derived from various segments including Cannington ($631 million), Cerro Matoso ($556 million), Sierra Gorda ($647 million), Brazil Alumina ($484 million), Mozal Aluminium ($812 million), Worsley Alumina ($1.36 billion), Hillside Aluminium ($1.72 billion), Australia Manganese ($436 million), Brazil Aluminium (BA) ($242 million), and South Africa Manganese ($343 million).

Estimated Discount To Fair Value: 47.9%

South32 is trading at A$3.45, well below its estimated fair value of A$6.63, indicating it is undervalued based on discounted cash flow analysis. The company forecasts earnings growth of 51.98% annually and revenue growth of 9.1%, outpacing the Australian market average. Recent production guidance and regulatory approvals for the Worsley Mine Development Project support its operational stability, while new board appointments may enhance strategic direction and governance effectiveness moving forward.

- Our growth report here indicates South32 may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of South32.

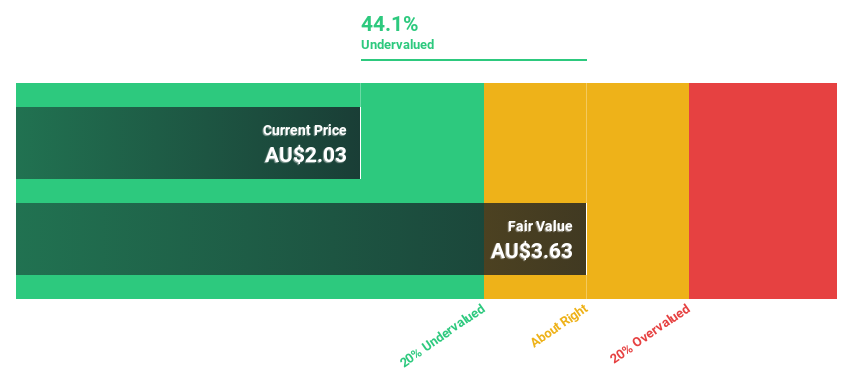

Symal Group (ASX:SYL)

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering services such as construction contracting, equipment hires, material sales, recycling, and remediation, with a market cap of A$455.79 million.

Operations: The company generates revenue through its Asset Management (A$88.32 million), Major Infrastructure (A$485.98 million), Construction Services (A$171.86 million), and Plant, People and Logistics (A$21.95 million) segments in the civil construction industry in Australia.

Estimated Discount To Fair Value: 49.6%

Symal Group, trading at A$1.91, is significantly undervalued with an estimated fair value of A$3.79 based on discounted cash flow analysis. Its earnings are expected to grow annually by 16.8%, surpassing the Australian market's average growth rate of 12.4%. Despite slower revenue growth at 8.9% per year, it remains above market expectations. The recent IPO raised A$136 million, and new board appointments could strengthen governance and strategic oversight.

- In light of our recent growth report, it seems possible that Symal Group's financial performance will exceed current levels.

- Click here to discover the nuances of Symal Group with our detailed financial health report.

Seize The Opportunity

- Navigate through the entire inventory of 47 Undervalued ASX Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion