- Australia

- /

- Construction

- /

- ASX:SXE

Will Heyday’s WestConnex Arbitration Loss Reframe Southern Cross Electrical Engineering’s (ASX:SXE) Risk Management Narrative?

Reviewed by Sasha Jovanovic

- Southern Cross Electrical Engineering’s subsidiary Heyday recently lost an arbitration case against the CPB Dragados Samsung Joint Venture over additional cost claims on Sydney’s WestConnex M5 tunnel project.

- This setback has raised questions about the group’s project risk management, even as analysts continue to highlight its robust order pipeline and sector tailwinds.

- We’ll now explore how this arbitration loss and its risk-management lessons may influence Southern Cross Electrical Engineering’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Southern Cross Electrical Engineering Investment Narrative Recap

To own Southern Cross Electrical Engineering, you need to believe that its exposure to renewables, data centers and critical infrastructure can offset lumpier construction risks and tight margins. The Heyday arbitration loss is a negative headline but appears contained against the backdrop of a strong order book, so the main near term swing factor remains execution quality on large projects, while the biggest risk is how the group controls commercial and contract risk on complex, fixed price work.

The recent appointment of Michael McNulty as independent Non Executive Director and Chair of the Audit and Risk Committee ties directly into this episode, as it places more board level focus on risk oversight just as investors are weighing the implications of the arbitration outcome for future contract selection, pricing discipline and the sustainability of SCEE’s project driven growth.

But investors should also be aware of how concentrated exposure to large, competitive infrastructure contracts can...

Read the full narrative on Southern Cross Electrical Engineering (it's free!)

Southern Cross Electrical Engineering's narrative projects A$977.8 million revenue and A$43.7 million earnings by 2028. This requires 6.9% yearly revenue growth and about A$12 million earnings increase from A$31.7 million today.

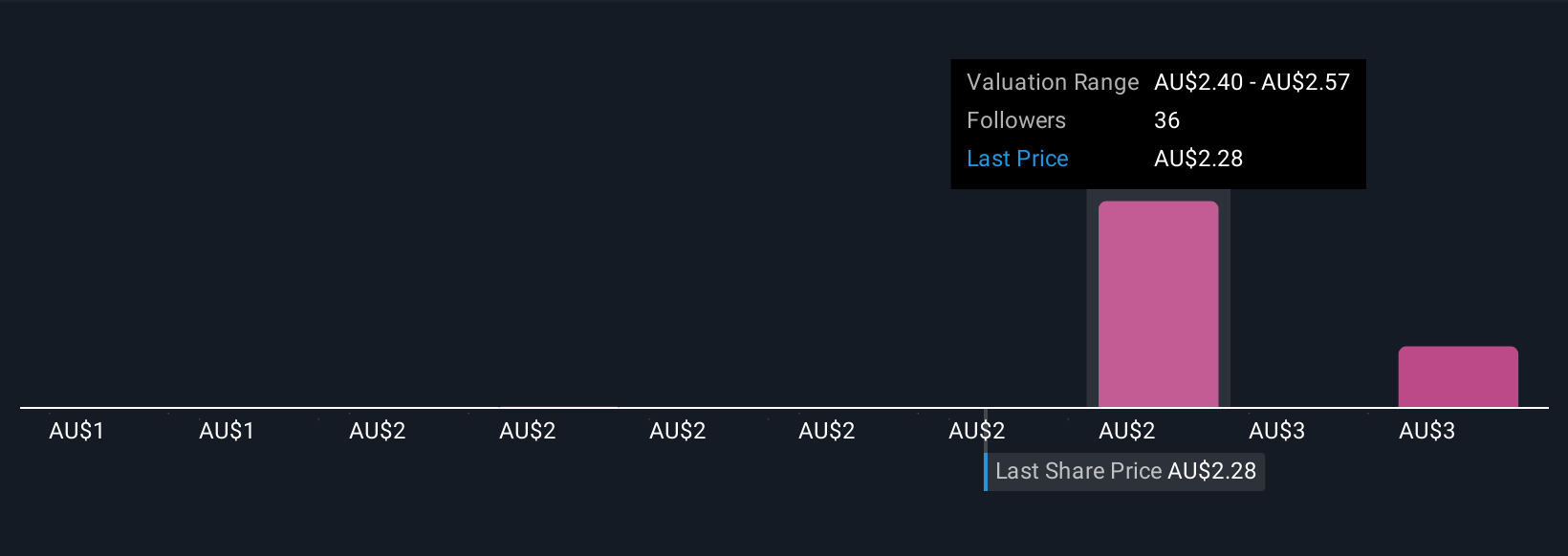

Uncover how Southern Cross Electrical Engineering's forecasts yield a A$2.44 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published 9 fair value estimates for SCEE, ranging from A$1.20 to about A$2.88 per share, highlighting very different expectations. When you set those views against the current focus on contract and arbitration risk, it becomes even more important to compare multiple perspectives on how SCEE’s project mix might influence future performance.

Explore 9 other fair value estimates on Southern Cross Electrical Engineering - why the stock might be worth as much as 25% more than the current price!

Build Your Own Southern Cross Electrical Engineering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Cross Electrical Engineering research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Southern Cross Electrical Engineering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Cross Electrical Engineering's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026