- Australia

- /

- Construction

- /

- ASX:SRG

SRG Global (ASX:SRG) Valuation in Focus After Major Blue-Chip Contract Wins and Strong Sector Diversification

Reviewed by Simply Wall St

SRG Global (ASX:SRG) shares have gained attention after the company announced it secured A$650 million in new and repeat contracts with blue-chip clients across multiple sectors in Australia and New Zealand.

See our latest analysis for SRG Global.

SRG Global’s string of contract wins has done more than just make headlines. Substantial deals like these have contributed to its share price, which has doubled with a 114% year-to-date gain and pushed total shareholder return to an impressive 125% over the past year. Momentum is clearly with the company, reflecting renewed market confidence and appetite for its long-term growth story.

If major contract wins like these have you thinking about what else is moving in the market, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With the stock price at all-time highs and a strong run behind it, the key question for investors is whether SRG Global remains undervalued and poised for further upside, or if the market has already priced in its future growth story.

Most Popular Narrative: 4.7% Undervalued

SRG Global’s most widely followed narrative points to a fair value of A$3.02, suggesting modest upside from the recent closing price of A$2.88. The case for this valuation is based on the company’s recurring earnings and diversified project base, providing stability through market cycles.

The company’s asset care and maintenance services now generate approximately 80% annuity-style (recurring) earnings, improving predictability of cash flows and supporting stable, long-term EBITDA and net earnings growth.

Curious what drives analysts to this fair value? There is a bold future profit estimate, sharp margin improvements, and a premium growth target that set this narrative apart. Find out exactly which financial factors need to align for this story to hold up and uncover the formulas behind the headline number.

Result: Fair Value of $3.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in government infrastructure spending or rising input costs could quickly challenge the bullish narrative around SRG Global’s future growth.

Find out about the key risks to this SRG Global narrative.

Another View: What About Market Ratios?

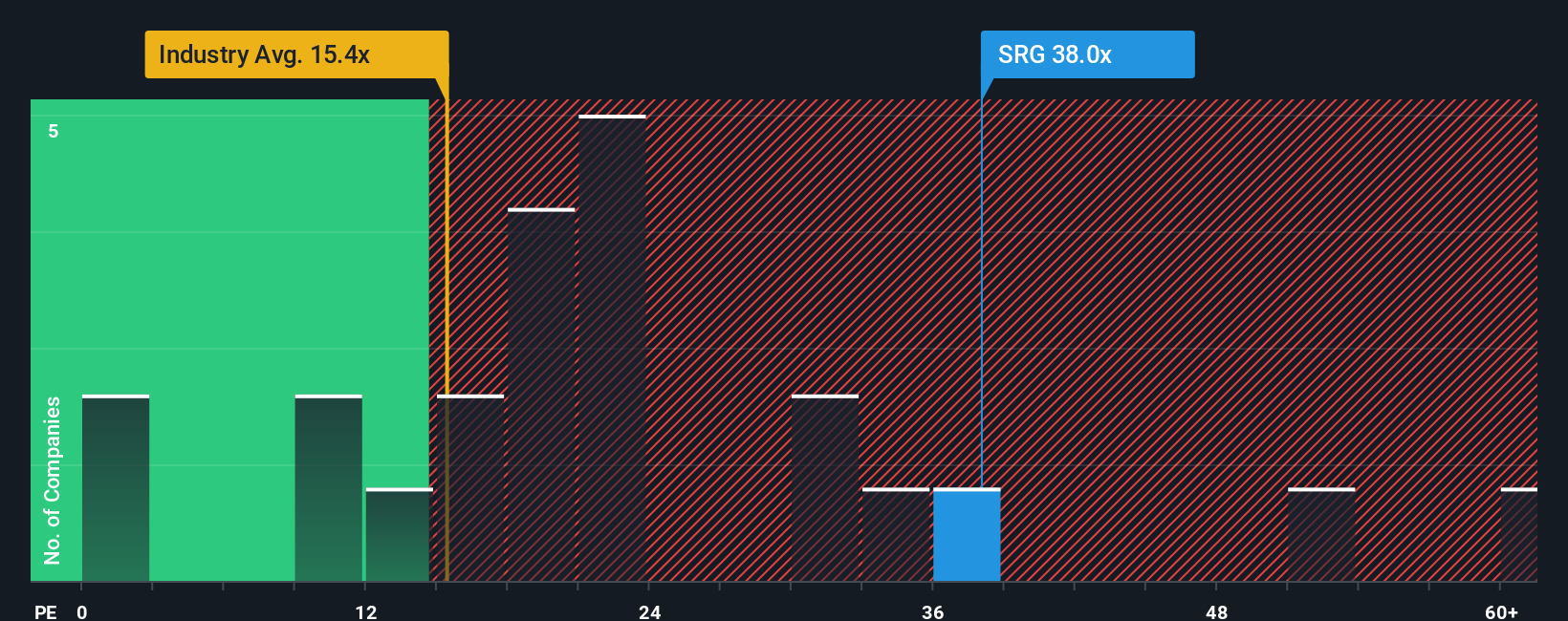

Market-based valuation tells a different story. SRG Global trades on a price-to-earnings ratio of 38x, which is well above the Australian Construction industry average of 15.4x, its peer group at 25.6x, and the fair ratio of 25.2x. This sizable premium suggests that the stock is priced for continued strong growth and leaves less room for disappointment if expectations slip. Could the market be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SRG Global Narrative

If the mainstream story does not fit your outlook, or you would rather dig through the numbers yourself, you can shape your own perspective in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SRG Global.

Looking for more investment ideas?

Step up your investing results and catch trends before the crowd. Make smarter moves by checking stocks that fit your strategy and could set you ahead.

- Accelerate your gains by targeting stocks that look undervalued right now through these 930 undervalued stocks based on cash flows with strong cash flow potential.

- Boost your portfolio’s income by finding proven companies offering yields over 3%. Get started with these 15 dividend stocks with yields > 3% that stand out for dividend strength.

- Ride the growth wave by uncovering leaders in AI, automation and smart tech. Scout your next pick using these 25 AI penny stocks ready for tomorrow’s breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRG

SRG Global

Engages in engineering, mining, maintenance and construction contracting in Australia and New Zealand.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.