Why Silex Systems (ASX:SLX) Is Up 6.6% After Major Advances in US Uranium Market Push

Reviewed by Sasha Jovanovic

- Silex Systems recently announced significant advancements in the commercialization of its SILEX uranium enrichment technology, including successful technology demonstrations and regulatory milestones, alongside news of a completed equity raise securing funding through FY2028.

- These developments position Silex to actively pursue US nuclear fuel supply opportunities as the global nuclear industry undergoes continued expansion.

- We’ll explore how progress in unlocking US nuclear sector opportunities may reshape Silex Systems’ investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Silex Systems' Investment Narrative?

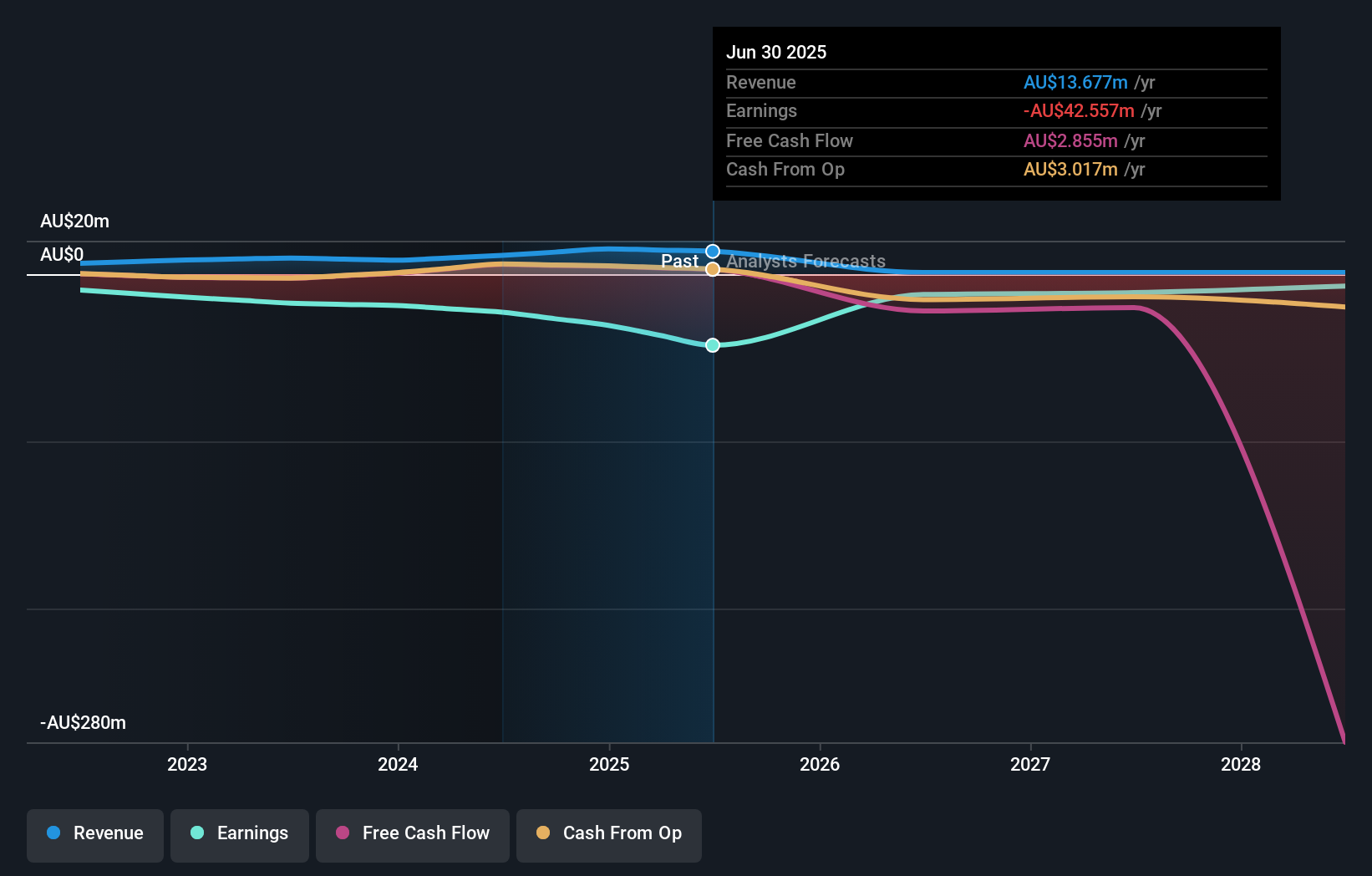

For anyone considering Silex Systems today, the big picture centers on belief in the company’s laser uranium enrichment and quantum silicon projects unlocking significant value from the energy transition. The most recent update materially shifts the risk and catalyst profile. Silex’s completed equity raise now shores up its financial runway through FY2028, which directly addresses concerns about near-term funding gaps. At the same time, recent successful demonstrations and regulatory achievements may pave the way for contracts in the US nuclear fuel market, placing commercial execution front and center as the key short-term catalyst. However, despite a strengthened balance sheet, major risks remain. Silex is still unprofitable, forecasts suggest ongoing negative earnings, and future revenue outlook points to a rapid decline, while shareholders have faced dilution. A premium valuation and uncertain timelines keep execution risk elevated.

But despite this progress, reliance on unproven commercial contracts still poses risk investors should be aware of.

Exploring Other Perspectives

Explore 2 other fair value estimates on Silex Systems - why the stock might be worth as much as A$0.00!

Build Your Own Silex Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silex Systems research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Silex Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silex Systems' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Hemisphere Energy Looks Forward to a Remarkable 38% Profit Margin Surge

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion