Silex Systems (ASX:SLX) Is Up 24.6% After Achieving Key Laser Uranium Enrichment Milestone - What's Changed

Reviewed by Sasha Jovanovic

- Silex Systems recently announced that its laser uranium enrichment technology reached the TRL-6 milestone, a crucial step toward commercial deployment, while its US-based partner Global Laser Enrichment submitted a bid for substantial Department of Energy funding to help rebuild the country's nuclear fuel infrastructure.

- This progress highlights both the growing focus on nuclear energy independence and Silex Systems' increased relevance in the global shift toward secure energy supply chains.

- We’ll explore how achieving a key technical milestone in uranium enrichment could reshape Silex Systems’ investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Silex Systems' Investment Narrative?

For anyone considering Silex Systems, the investment story hinges on belief in the expanding demand for secure, independent nuclear fuel technology and the company's ability to move from technical milestones to profitable, large-scale deployment. The TRL-6 achievement confirmed by an independent review is a substantial step forward and could shift key short-term catalysts: the potential for U.S. Department of Energy funding and demonstrable progress toward commercial operations. With a share price that has more than doubled recently, market attention is clearly intensifying, but the business remains unprofitable and has issued new shares, diluting existing holders. The latest milestone could accelerate timeframes and reduce perceived commercialization risks but doesn't eliminate the challenge of scaling up or the uncertainty around when significant, recurring revenue will arrive. Big gains have fueled optimism, but the substantial net losses still dominate the risk profile here.

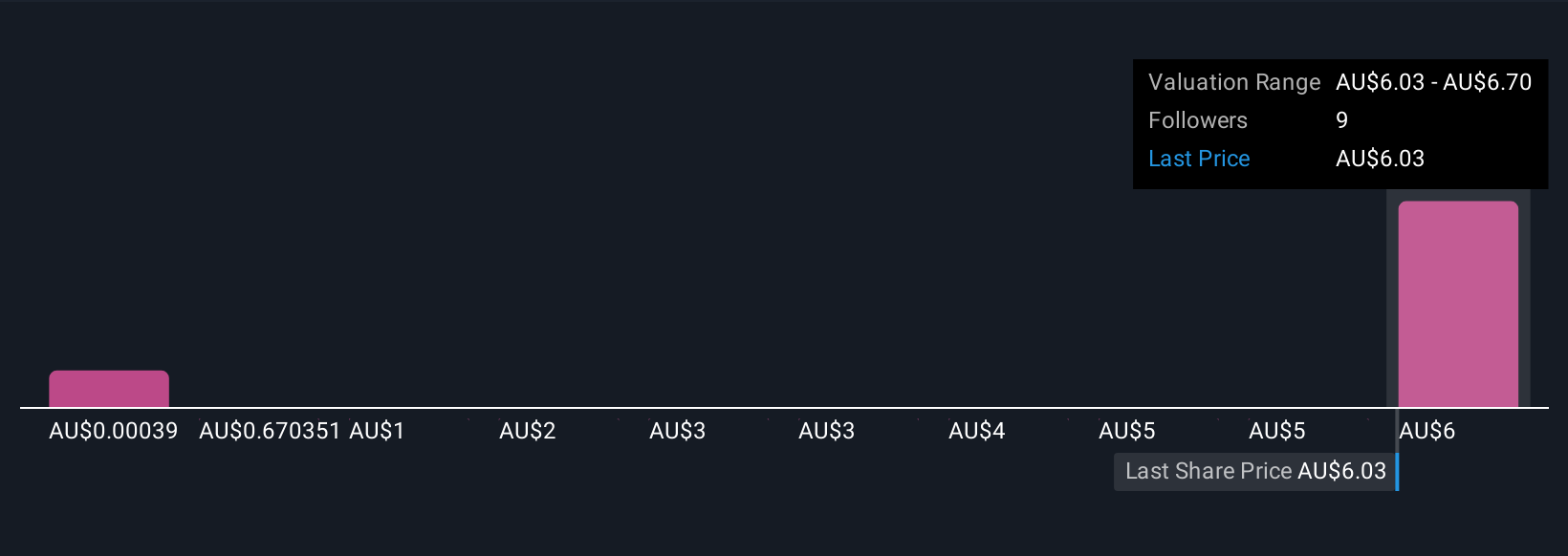

But behind the recent hype, share dilution and uncertain profitability remain issues investors should be aware of. Silex Systems' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Silex Systems - why the stock might be worth less than half the current price!

Build Your Own Silex Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silex Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Silex Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silex Systems' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion