The Australian stock market has shown resilience, with the ASX200 closing up 0.92% at 8,070 points, driven by strong performances in the Energy and Utilities sectors. In this context, penny stocks—often seen as an entry point for investors seeking affordable growth opportunities—remain relevant despite their somewhat outdated label. These smaller or newer companies can offer a blend of value and potential when they possess robust financial health; we'll explore several that stand out in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.66 | A$133.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.84 | A$1.04B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.38 | A$65.1M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.38 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.895 | A$637.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.725 | A$845.39M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.68 | A$1.23B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 988 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ridley (ASX:RIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ridley Corporation Limited, with a market cap of A$760.35 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

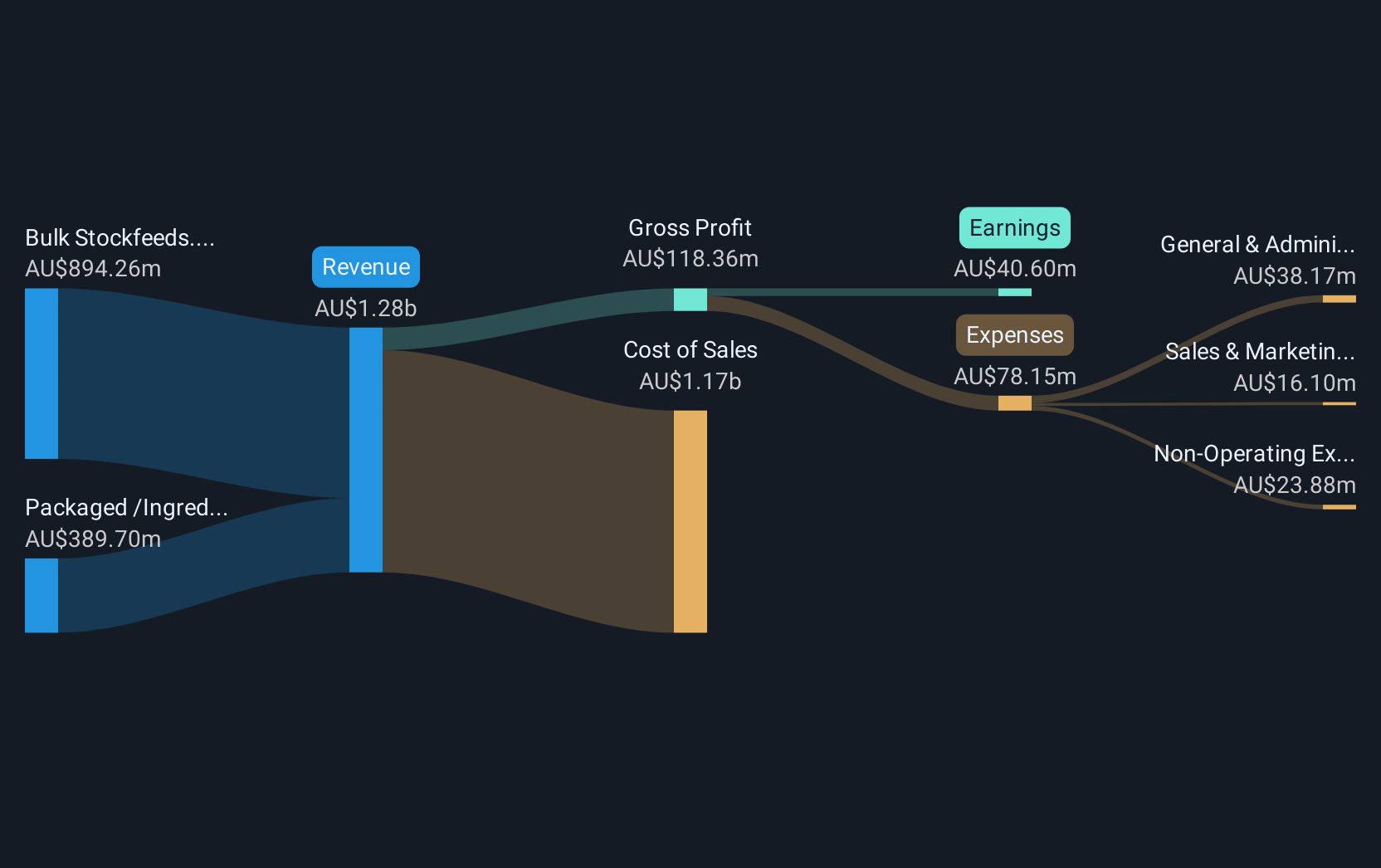

Operations: The company's revenue is derived from two main segments: Bulk Stockfeeds, contributing A$894.26 million, and Packaged/Ingredients, which accounts for A$389.70 million.

Market Cap: A$760.35M

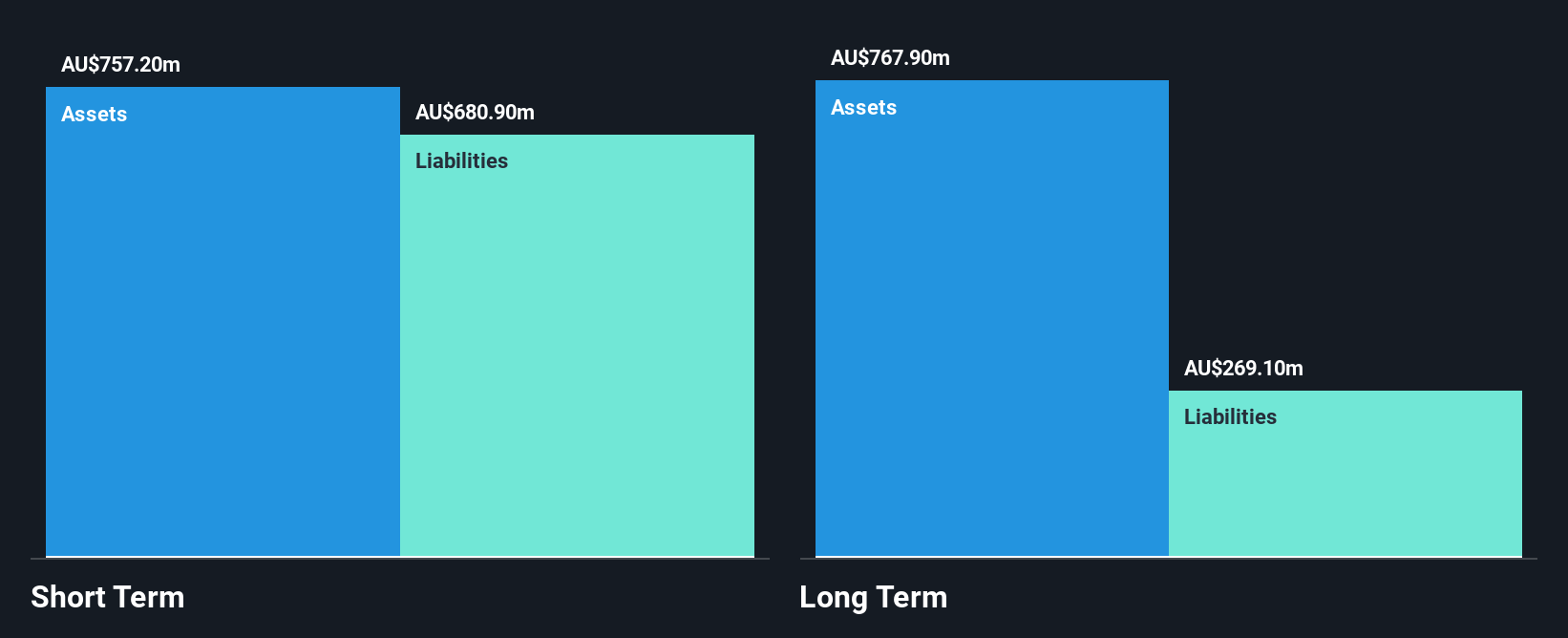

Ridley Corporation Limited, with a market cap of A$760.35 million, is trading at 57.9% below its estimated fair value and shows satisfactory debt levels with a net debt to equity ratio of 21%. Despite negative earnings growth over the past year, Ridley's earnings are forecasted to grow by 10.64% annually. The company has experienced management and board teams, each averaging over three years in tenure. Recent financial results indicate stable revenue growth and consistent profitability, with sales reaching A$658.85 million for the half-year ending December 31, 2024. However, its dividend history remains unstable despite recent increases.

- Take a closer look at Ridley's potential here in our financial health report.

- Assess Ridley's future earnings estimates with our detailed growth reports.

Silex Systems (ASX:SLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silex Systems Limited is a technology commercialization company focused on the research, development, and licensing of SILEX laser enrichment technology across Australia, the United States, and the United Kingdom, with a market cap of A$714.31 million.

Operations: The company's revenue is derived from two segments: Translucent, contributing A$2.40 million, and Silex Systems, generating A$7.61 million.

Market Cap: A$714.31M

Silex Systems Limited, with a market cap of A$714.31 million, is unprofitable but has demonstrated revenue growth in its recent earnings report, increasing sales to A$4 million for the half-year ending December 31, 2024. Despite rising net losses of A$18.06 million compared to the previous year, Silex maintains a robust financial position with short-term assets significantly exceeding both short-term and long-term liabilities. The company benefits from an experienced management team and board of directors while remaining debt-free and possessing a cash runway extending over three years due to positive free cash flow growth.

- Click here to discover the nuances of Silex Systems with our detailed analytical financial health report.

- Learn about Silex Systems' future growth trajectory here.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited offers online travel booking services across Australia, New Zealand, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.55 billion.

Operations: The company generates revenue primarily through its Business to Business Travel (B2B) segment, which accounts for A$323.2 million.

Market Cap: A$1.55B

Web Travel Group, with a market cap of A$1.55 billion, has demonstrated robust financial health and growth potential. The company has achieved significant earnings growth of 63% over the past year, surpassing both its five-year average and industry benchmarks. Its strong financial position is underscored by more cash than total debt, high interest coverage (93.3x), and ample short-term assets to cover liabilities. Recent share buybacks totaling A$150 million suggest confidence in its valuation, which trades slightly below estimated fair value. However, a low return on equity (10.5%) highlights room for improvement in capital efficiency despite stable profitability margins improving to 16%.

- Jump into the full analysis health report here for a deeper understanding of Web Travel Group.

- Evaluate Web Travel Group's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Gain an insight into the universe of 988 ASX Penny Stocks by clicking here.

- Seeking Other Investments? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet minimal.

Market Insights

Community Narratives