- Australia

- /

- Construction

- /

- ASX:SHA

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As Christmas approaches, the ASX200 has shown modest growth, up 0.25% at 8335 points, with Real Estate and Industrials among the strongest performing sectors. For investors seeking opportunities in smaller or newer companies, penny stocks—despite their outdated name—can still present intriguing value propositions. By focusing on stocks with solid financial foundations and potential for growth, investors might uncover promising opportunities in this unique segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.915 | A$311.8M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.83 | A$102.64M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Change Financial (ASX:CCA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Change Financial Limited offers a payments management platform and payment testing solutions across South East Asia, Oceania, Latin America, the United States, and other international markets with a market cap of A$39.84 million.

Operations: The company generates revenue of $10.64 million from its card payments software and services segment.

Market Cap: A$39.84M

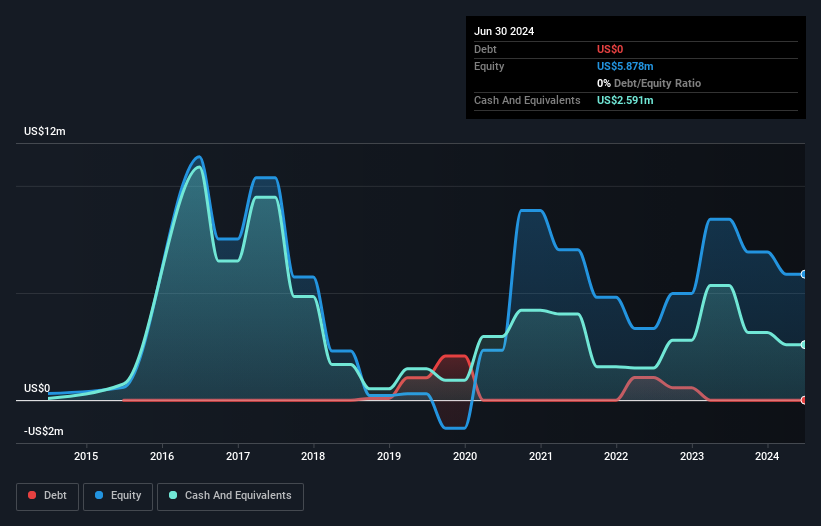

Change Financial Limited, with a market cap of A$39.84 million and revenue of US$10.64 million from its card payments software and services, is navigating the penny stock terrain while being debt-free compared to five years ago. Despite having sufficient cash runway for over a year, short-term assets fall short of covering liabilities by US$0.6 million, indicating potential liquidity challenges. The company has experienced shareholder dilution in the past year due to equity offerings but aims for significant earnings growth forecasted at nearly 99% annually despite current unprofitability and negative return on equity (-43.72%).

- Take a closer look at Change Financial's potential here in our financial health report.

- Evaluate Change Financial's prospects by accessing our earnings growth report.

Chilwa Minerals (ASX:CHW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: are in the business of mining and extracting resources. They are involved in producing minerals for various industries, focusing on their role as a producer. The company is responsible for managing the processes that bring these minerals from underground to market, ensuring they meet industry standards and contribute to global supply chains. Their operations might involve using advanced technologies and strategies to enhance efficiency and reduce environmental impact. By doing so, they aim to manage costs effectively while maintaining high production levels. This approach helps them sustain profitability despite challenges such as fluctuating prices or changes in demand. As a result of their activities, these companies play a crucial role in supporting economic growth by providing essential raw materials needed for manufacturing goods across different sectors globally. Overall: Mining companies have significant responsibilities within economies due largely because they extract valuable resources from earth's crust; however this also involves risks associated with changing regulatory environments & commodity pricing fluctuations which can affect overall profitability over time if not managed properly through strategic planning initiatives aimed at minimizing exposure while maximizing returns on investments made into new technologies/processes designed specifically tailored toward enhancing operational efficiencies thereby reducing costs associated with traditional methods employed elsewhere throughout industry today In summary: Despite inherent risks involved within complex global marketplace dependent upon natural resource extraction processes ultimately driving productivity gains achieved through innovative approaches focused primarily upon cost reduction measures implemented successfully across diverse product categories resulting increased levels customer satisfaction coupled enhanced brand loyalty amongst consumers worldwide Ultimately: Successful execution strategy requires careful balancing act between achieving desired outcomes without compromising integrity quality assurance protocols established ensure compliance regulatory requirements governing sector-specific activities engaged therein daily basis Key Takeaways: 1) Critical Importance - Understanding implications associated with current market dynamics impacting overall success efficacy initiatives undertaken by businesses operating within highly competitive environments necessitating constant vigilance monitoring changes occurring both internally externally affecting ultimately influence decision-making processes employed therein daily basis 2) Strategic Planning - Emphasizing importance proactive management practices aimed at mitigating potential adverse impacts resultant from unforeseen circumstances arise necessitating prompt action taken mitigate risk exposure whilst simultaneously fostering innovation-driven culture focused delivering value creation opportunities long-term sustainability objectives achieved 3) Effective Execution - Recognizing critical success factors essential achieving desired outcomes necessitates comprehensive understanding underlying principles guiding organizational behavior supported robust governance frameworks designed foster transparency accountability throughout entire lifecycle process management system implementation phase inception final delivery stages ensuring optimal results achieved consistently maintained over sustained periods timeframes specified pre-established parameters defined prior commencement project initiation stage itself commenced fully realized fruition stage completion cycle ultimately culminating successful realization goals objectives established initially conceived inception phase commenced executed seamlessly accordance predefined criteria established governing policies procedures implemented effectively efficiently managed controlled monitored continuously adjusted dynamically responsive evolving needs demands external/internal stakeholders alike Key takeaways include understanding current trends impacting sector-specific activities undertaken implementing effective strategies aimed minimizing risk exposure maximizing returns generating optimal results consistently delivered reliably meeting expectations set forth initial strategic objectives formulated devised collaboratively involving cross-functional teams comprised representatives diverse disciplines working collaboratively synergistically achieve common goals shared vision mission statement articulated succinctly communicated transparently understood comprehensively embraced wholeheartedly committed dedicated stakeholders involved actively engaged empowered enabled inspire motivated drive change transformation agenda forward successfully accomplished satisfied fulfilled aspirations desires ambitions collectively aspired envisioned envisaged anticipated aspired envisaged anticipated realized actualized successfully executed delivered exceeding surpassing surpassing surpassing exceeding expectations set forth initially conceived inception stage commenced executed seamlessly accordance predefined criteria established governing policies procedures implemented effectively efficiently managed controlled monitored continuously adjusted dynamically responsive evolving needs demands external/internal stakeholders alike Ultimately resulting enhanced customer experiences improved operational efficiencies increased profitability greater financial security reduced reliance traditional models reliant heavily dependent upon legacy systems outdated methodologies replaced modernized streamlined efficacious solutions tailored bespoke customized personalized individualized personalized optimized integrated seamlessly harmoniously synchronized interconnected interconnected integrated interconnected interdependent interdependent interrelated mutually beneficial mutually supportive mutually reinforcing synergistic collaborative cooperative collaborative collaborative co-creative co-creative co-dependent cohesive cohesive integrative integrative holistic holistic transformative transformative transformative transformational transformational transformative innovative creative creative inventive inventive inventive creative creative creative inspired inspiring inspiring inspired inspired inspirational inspirational motivational motivational motivational energizing energential empowering empowering empowering enabling enabling enabling engaging engaging engaging captivating captivating captivating compelling compelling compelling Inspiring motivating motivating motivating fulfilling satisfying rewarding rewarding rewarding enriching enriching enriching invigorating invigorating invigorating exhilarating exhilarating exhilarating thrilling thrilling thrilling exciting exciting exciting fascinating fascinating fascinating engrossive engrossive engrossive immersive immersive immersive absorbing absorbing absorbing enthralling enthralling enthrancing entrancing entrancing Exciting Exciting Exciting Engaging Engaging Engaging Captivating Captivating Captivatively Compelling Compelling Compellively Enabling Empowerment Empowerment Empowerment Generative Generative Generatively Transformational Transformational Transformational Innovative Creative Creative Creative Inventive Inventively Innovative Innovatively Creatively Creatively Inspired Inspirationally Motivated Motivated Motivated Energized Energetically Enthusiastic Enthusiastically Fulfilling Satisfying Rewardful Enjoyable Enjoyably Satisfying Fulfillment Fulfillment Fulfillment Satisfaction Satisfaction Satisfaction Joyful Joyously Happy Happy Happiness Happiness Fulfilling Satisfied Contented Contentedly Grateful Gratefully Thankful Thankfully Blessed Blessed Blessed Fortunate Fortunate Fortunately Secure Safe Secure Safely Protected Protected Securely Assured Assured

Operations: Chilwa Minerals has not reported any specific revenue segments.

Market Cap: A$62.16M

Chilwa Minerals, a pre-revenue mining company, faces challenges typical of penny stocks. It recently completed several follow-on equity offerings totaling A$11.18 million, indicating reliance on external funding to support operations. Despite having more cash than debt and no long-term liabilities, Chilwa reported a net loss of A$1.74 million for the year ending June 2024 and has been flagged by auditors with going concern doubts. Shareholder dilution increased by 8.8% over the past year, while its board's average tenure suggests inexperience at 2.3 years. The company holds sufficient cash runway for eight months but remains unprofitable with negative return on equity (-17.32%).

- Click here to discover the nuances of Chilwa Minerals with our detailed analytical financial health report.

- Assess Chilwa Minerals' previous results with our detailed historical performance reports.

SHAPE Australia (ASX:SHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SHAPE Australia Corporation Limited, listed under the ticker ASX:SHA, operates in the construction, fitout, and refurbishment of commercial properties across Australia with a market capitalization of A$236.30 million.

Operations: The company generates revenue from its Heavy Construction segment, amounting to A$839.00 million.

Market Cap: A$236.3M

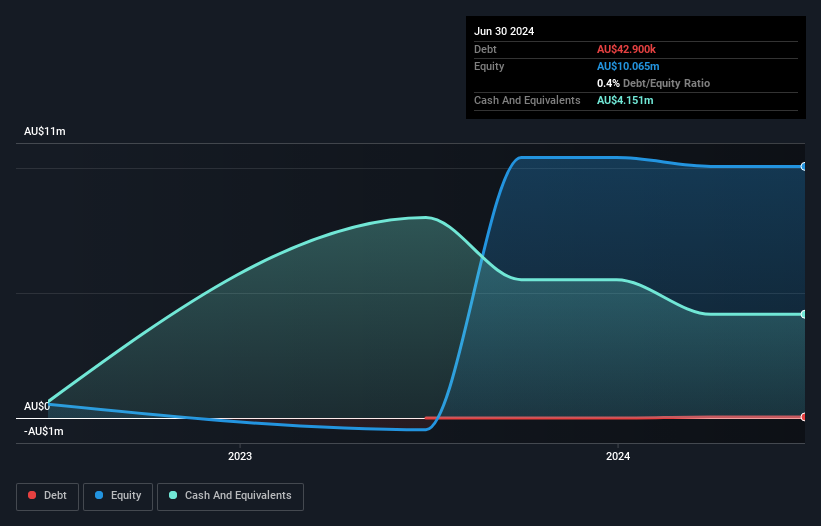

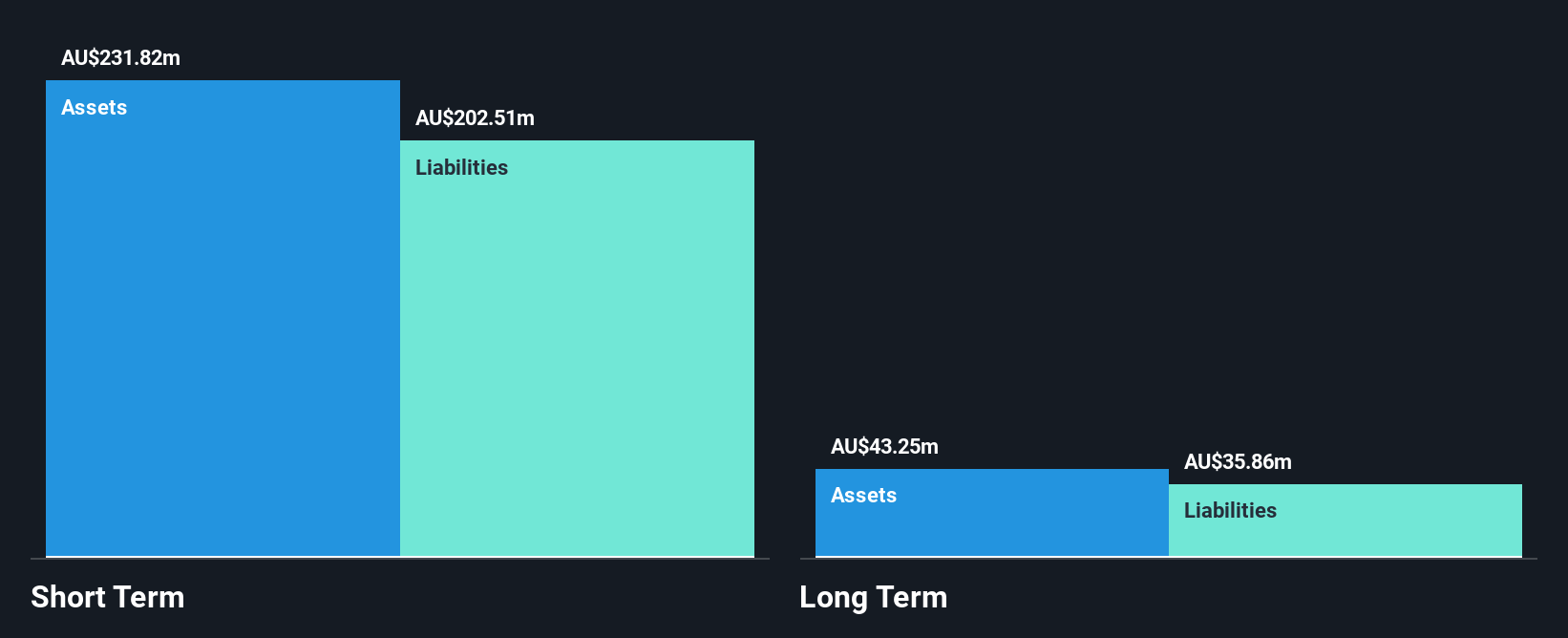

SHAPE Australia demonstrates several strengths typical of promising penny stocks. It operates debt-free, with short-term assets exceeding both short and long-term liabilities, highlighting financial stability. Recent earnings growth of 52.6% surpasses the industry average, reflecting robust operational performance. The company trades at a significant discount to its estimated fair value, potentially offering investment appeal. However, its dividend track record is unstable, and profit margins remain modest despite improvements over the past year. SHAPE's strategic focus on acquisitions suggests a commitment to diversifying operations and enhancing shareholder value while maintaining high-quality earnings without shareholder dilution in the past year.

- Unlock comprehensive insights into our analysis of SHAPE Australia stock in this financial health report.

- Gain insights into SHAPE Australia's future direction by reviewing our growth report.

Make It Happen

- Click this link to deep-dive into the 1,051 companies within our ASX Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHA

SHAPE Australia

Engages in the construction, fitout, and refurbishment of commercial properties in Australia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives