- Australia

- /

- Oil and Gas

- /

- ASX:ECH

3 ASX Penny Stocks With Market Caps Over A$80M To Consider

Reviewed by Simply Wall St

The Australian market has been buoyant, with the ASX200 rising 1.35% to 8,325 points amid positive economic indicators such as a slowdown in U.S. consumer prices and robust domestic employment growth. In this context of overall market optimism, penny stocks remain an intriguing investment area despite being considered a somewhat outdated term. These smaller or newer companies can offer unique opportunities for growth and value when backed by strong financials, making them worth considering for investors seeking potential long-term success in under-the-radar sectors.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.99 | A$111.58M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.965 | A$319.94M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$104.27M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$109.71M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Echelon Resources (ASX:ECH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Echelon Resources Limited is involved in the exploration and production of oil and gas properties across New Zealand, Australia, and Indonesia, with a market cap of A$80.65 million.

Operations: The company's revenue is derived from its operations in the Kupe Oil & Gas segment (NZ$8.86 million), Cue Energy Resources Ltd (NZ$53.69 million), and the Amadeus Basin Oil & Gas Fields (NZ$30.32 million).

Market Cap: A$80.65M

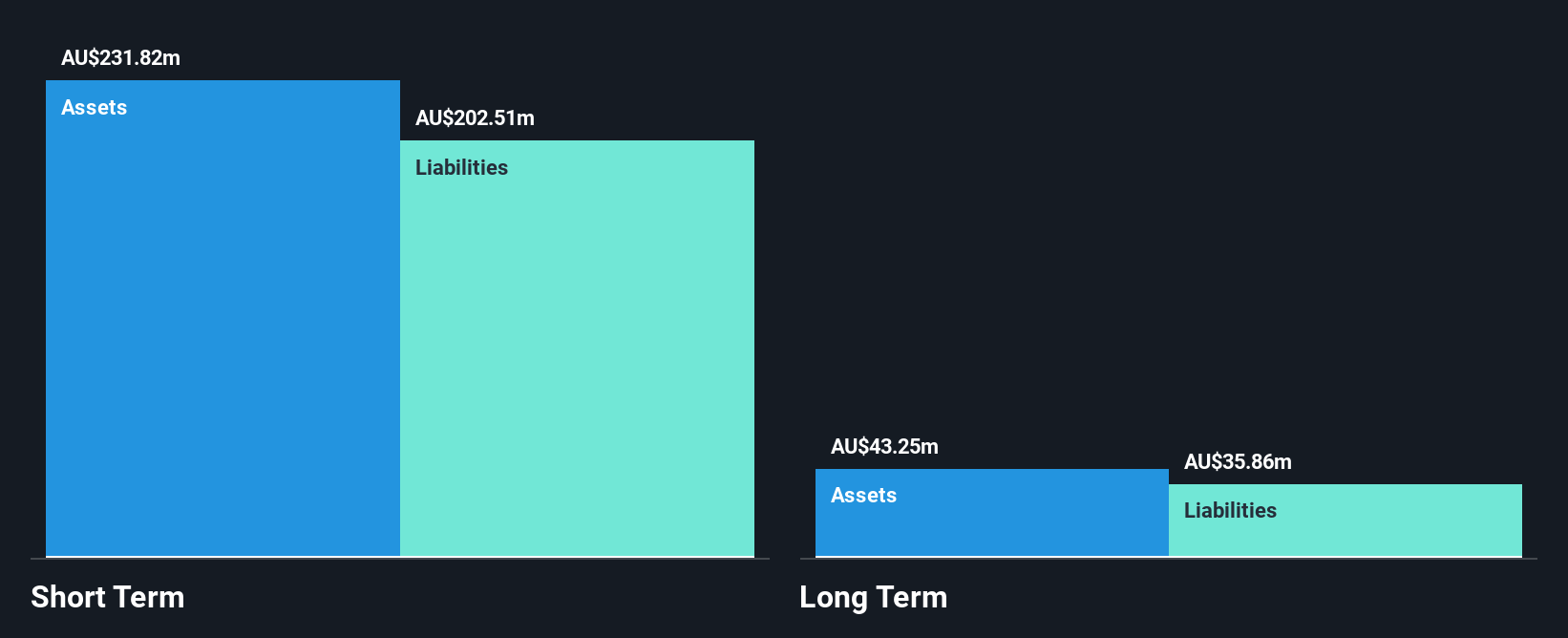

Echelon Resources Limited, with a market cap of A$80.65 million, is involved in oil and gas exploration across New Zealand, Australia, and Indonesia. The company has faced a large one-off loss of NZ$11.5M impacting its recent financial results. Despite this setback, Echelon's debt level remains satisfactory with a net debt to equity ratio of 6.1%, and its operating cash flow covers its debt well at 68.1%. However, profit margins have declined from 10.9% to 4.2%, and earnings growth was negative last year at -63.5%. Short-term assets exceed short-term liabilities but do not cover long-term liabilities fully.

- Get an in-depth perspective on Echelon Resources' performance by reading our balance sheet health report here.

- Understand Echelon Resources' track record by examining our performance history report.

SHAPE Australia (ASX:SHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia, with a market cap of A$242.10 million.

Operations: The company's revenue primarily comes from its heavy construction segment, which generated A$839.00 million.

Market Cap: A$242.1M

SHAPE Australia Corporation Limited, with a market cap of A$242.10 million, has demonstrated robust financial health and growth potential in the construction sector. The company is debt-free, with short-term assets (A$206.9M) comfortably exceeding both its short-term liabilities (A$186.9M) and long-term liabilities (A$33.0M). Its earnings grew by 52.6% over the past year, surpassing industry averages, while maintaining stable weekly volatility at 3%. SHAPE's Return on Equity is outstanding at 51.2%, indicating efficient use of equity to generate profits. Recent strategic initiatives include seeking acquisitions to diversify and enhance shareholder value further.

- Take a closer look at SHAPE Australia's potential here in our financial health report.

- Understand SHAPE Australia's earnings outlook by examining our growth report.

Silver Mines (ASX:SVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver Mines Limited, along with its subsidiaries, focuses on acquiring, exploring, and developing silver projects in Australia with a market cap of A$110.09 million.

Operations: The company's revenue segment includes Agricultural Operations, generating A$0.26 million.

Market Cap: A$110.09M

Silver Mines Limited, with a market cap of A$110.09 million, is pre-revenue and currently unprofitable. The company has no debt and sufficient cash runway for over a year based on current free cash flow, although shareholders have faced dilution with a recent follow-on equity offering raising A$25 million. Its short-term assets (A$11.7M) exceed liabilities (A$1.1M), indicating solid liquidity management despite high volatility in its share price compared to 75% of Australian stocks. The board's experience averages 5.2 years, which may provide stability as the company navigates its development phase in the silver mining sector.

- Navigate through the intricacies of Silver Mines with our comprehensive balance sheet health report here.

- Gain insights into Silver Mines' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,024 more companies for you to explore.Click here to unveil our expertly curated list of 1,027 ASX Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Echelon Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ECH

Echelon Resources

Engages in the exploration and production of oil and gas properties in New Zealand, Australia, and Indonesia.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives