Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Quickstep Holdings (ASX:QHL) looks quite promising in regards to its trends of return on capital.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Quickstep Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = AU$4.6m ÷ (AU$67m - AU$23m) (Based on the trailing twelve months to June 2020).

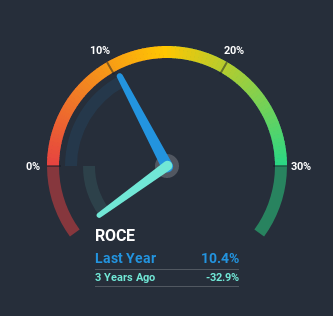

Therefore, Quickstep Holdings has an ROCE of 10%. On its own, that's a standard return, however it's much better than the 7.3% generated by the Aerospace & Defense industry.

See our latest analysis for Quickstep Holdings

In the above chart we have measured Quickstep Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What The Trend Of ROCE Can Tell Us

The fact that Quickstep Holdings is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 10% on its capital. And unsurprisingly, like most companies trying to break into the black, Quickstep Holdings is utilizing 261% more capital than it was five years ago. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

One more thing to note, Quickstep Holdings has decreased current liabilities to 34% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.In Conclusion...

In summary, it's great to see that Quickstep Holdings has managed to break into profitability and is continuing to reinvest in its business. Given the stock has declined 44% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

Quickstep Holdings does have some risks, we noticed 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

While Quickstep Holdings isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Quickstep Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quickstep Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:QHL

Quickstep Holdings

Manufactures and sells advanced composites for the defense and commercial aerospace, automotive, and other industry sectors in Australia, the United Kingdom, and the United States.

Good value with mediocre balance sheet.

Market Insights

Community Narratives