Should You Be Adding Korvest (ASX:KOV) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Korvest (ASX:KOV), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Korvest

Korvest's Improving Profits

In the last three years Korvest's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Korvest's EPS soared from AU$0.36 to AU$0.53, over the last year. That's a commendable gain of 47%.

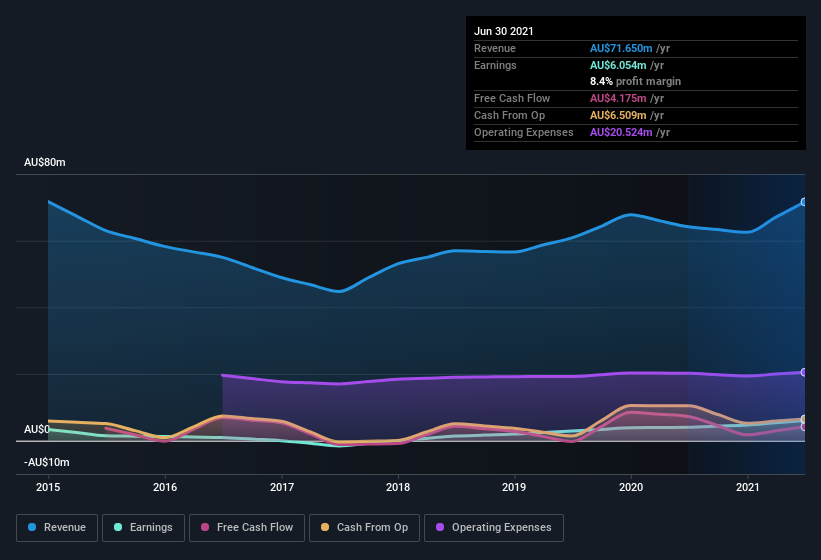

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Korvest is growing revenues, and EBIT margins improved by 3.5 percentage points to 13%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Korvest is no giant, with a market capitalization of AU$78m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Korvest Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Korvest insiders spent AU$63k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. We also note that it was the Independent Non-Executive Chairman, Andrew Stobart, who made the biggest single acquisition, paying AU$32k for shares at about AU$6.44 each.

Does Korvest Deserve A Spot On Your Watchlist?

For growth investors like me, Korvest's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe Korvest is probably worth spending some time on. It is worth noting though that we have found 2 warning signs for Korvest that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Korvest, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Korvest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KOV

Korvest

Manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives