Is Now The Time To Put Korvest (ASX:KOV) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Korvest (ASX:KOV), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Korvest with the means to add long-term value to shareholders.

How Fast Is Korvest Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. It's good to see that Korvest's EPS has grown from AU$0.95 to AU$1.11 over twelve months. This amounts to a 18% gain; a figure that shareholders will be pleased to see.

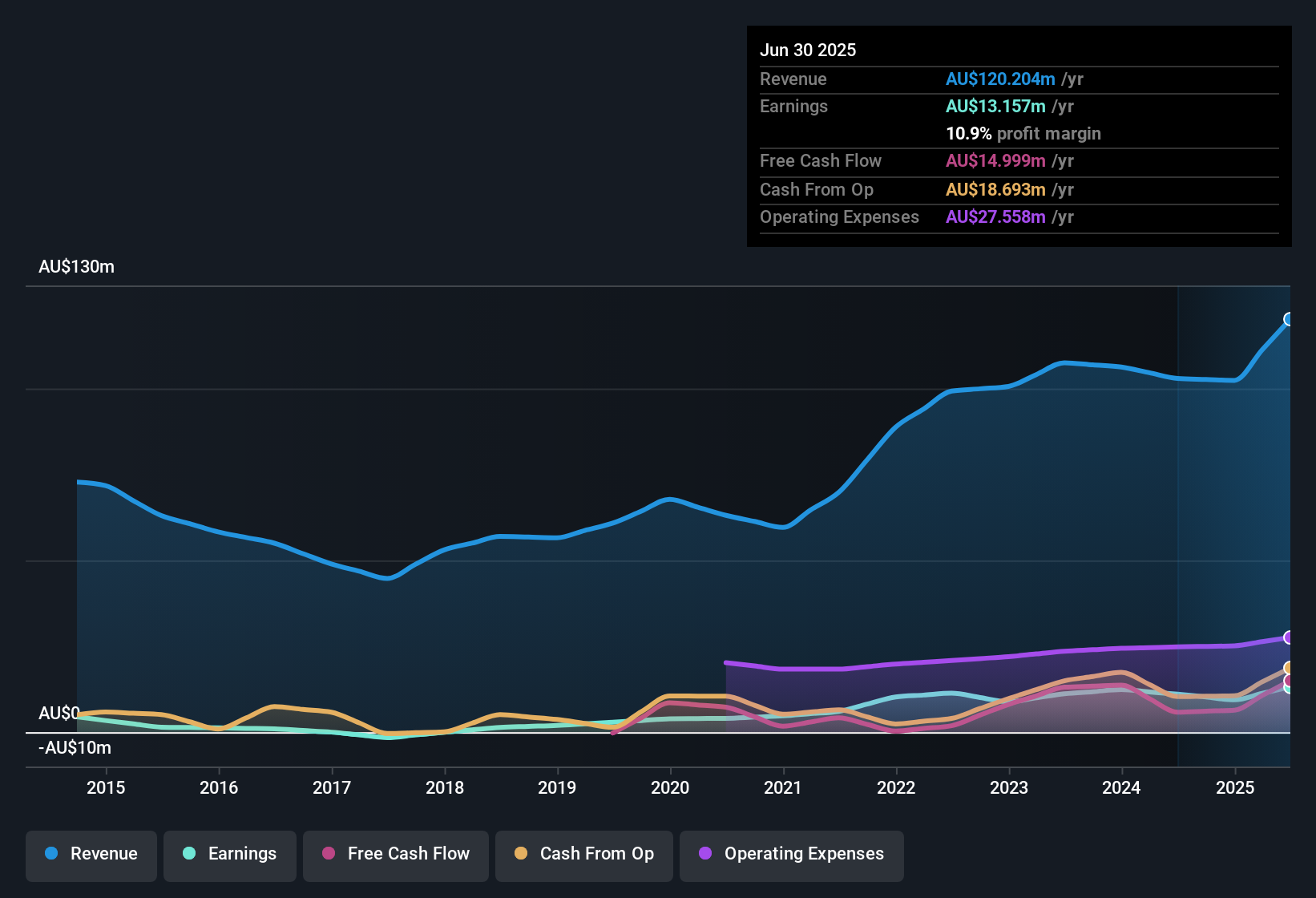

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Korvest maintained stable EBIT margins over the last year, all while growing revenue 17% to AU$120m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for Korvest

Since Korvest is no giant, with a market capitalisation of AU$154m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Korvest Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Korvest shares, in the last year. Add in the fact that Warrick R. Ranson, the Independent Non-Executive Director of the company, paid AU$25k for shares at around AU$9.93 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Does Korvest Deserve A Spot On Your Watchlist?

As previously touched on, Korvest is a growing business, which is encouraging. While some companies are struggling to grow EPS, Korvest seems free from that morose affliction. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. Even so, be aware that Korvest is showing 2 warning signs in our investment analysis , you should know about...

The good news is that Korvest is not the only stock with insider buying. Here's a list of small cap, undervalued companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Korvest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KOV

Korvest

Manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026