- Australia

- /

- Metals and Mining

- /

- ASX:SBM

Johns Lyng Group And 2 Other Top Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market remained flat over the last week, but it has seen a 20% rise over the past year, with earnings expected to grow by 12% annually in the coming years. In such a landscape, identifying stocks that combine financial strength with growth potential becomes crucial for investors seeking value. Penny stocks may seem like an outdated term, yet they continue to offer opportunities for growth at lower price points; when these stocks are backed by solid fundamentals and strong balance sheets, they can present compelling investment prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$303.87M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$838.04M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.82B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$114.45M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Johns Lyng Group Limited offers integrated building services across Australia, New Zealand, and the United States with a market capitalization of A$1.10 billion.

Operations: The company generates revenue from Insurance Building and Restoration Services (A$1.08 billion), Commercial Building Services (A$88.17 million), and Commercial Construction (A$23.59 million).

Market Cap: A$1.1B

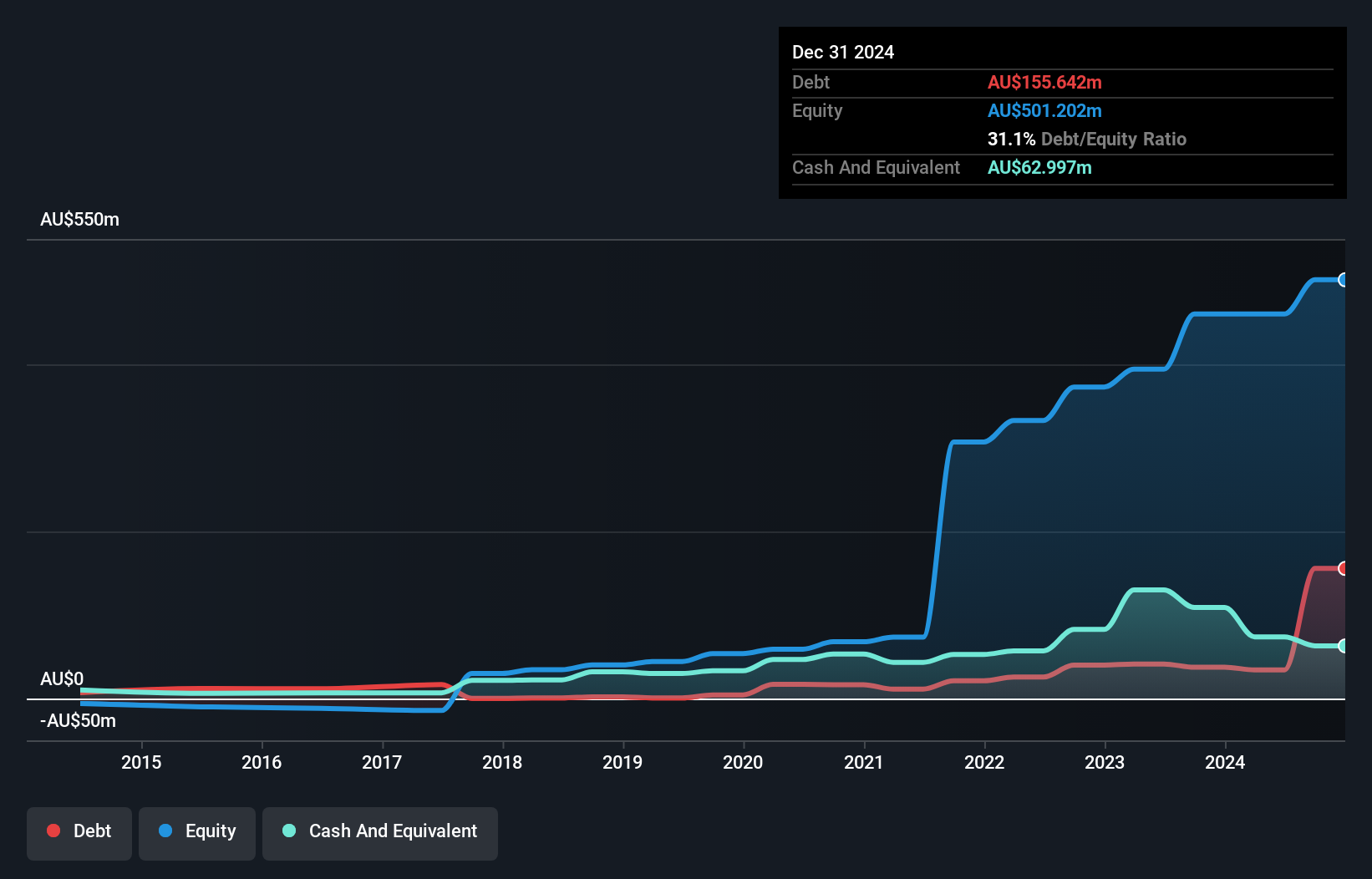

Johns Lyng Group, with a market cap of A$1.10 billion, has demonstrated solid financial health and growth potential. The company reported A$1.16 billion in sales for the year ending June 2024, with net income rising slightly to A$48.01 million from the previous year. Despite a significant one-off loss impacting recent results, Johns Lyng maintains strong cash reserves exceeding its debt and covers liabilities effectively with short-term assets of A$332.4 million surpassing both short-term and long-term obligations. Recent board changes include appointing Alison Terry, enhancing governance expertise particularly in sustainability and corporate affairs.

- Jump into the full analysis health report here for a deeper understanding of Johns Lyng Group.

- Gain insights into Johns Lyng Group's outlook and expected performance with our report on the company's earnings estimates.

St Barbara (ASX:SBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: St Barbara Limited, with a market cap of A$360.07 million, is involved in the exploration, development, mining, and sale of gold through its subsidiaries.

Operations: The company's revenue is derived from its operations at Simberi, generating A$197.72 million, and Atlantic Gold, contributing A$25.88 million.

Market Cap: A$360.07M

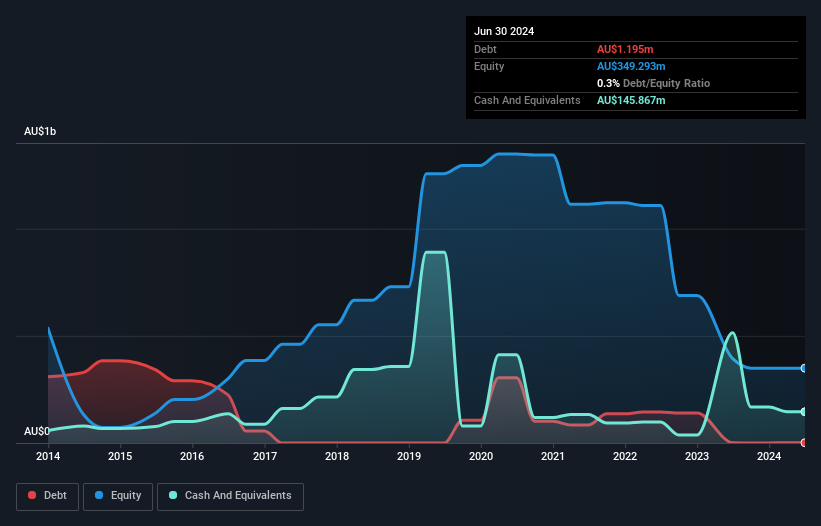

St Barbara Limited, with a market cap of A$360.07 million, faces challenges as it remains unprofitable and reported a net loss of A$53.92 million for the year ending June 2024. Despite this, the company benefits from strong liquidity, with short-term assets of A$281 million exceeding both short-term and long-term liabilities. It also has more cash than total debt and a sufficient cash runway for over two years if free cash flow trends continue. However, its management team is relatively inexperienced with an average tenure of 1.1 years, potentially impacting strategic direction amidst industry volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of St Barbara.

- Review our growth performance report to gain insights into St Barbara's future.

Southern Cross Gold (ASX:SXG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Southern Cross Gold Ltd is involved in the exploration of natural resources in Australia and has a market cap of A$698.53 million.

Operations: No revenue segments have been reported.

Market Cap: A$698.53M

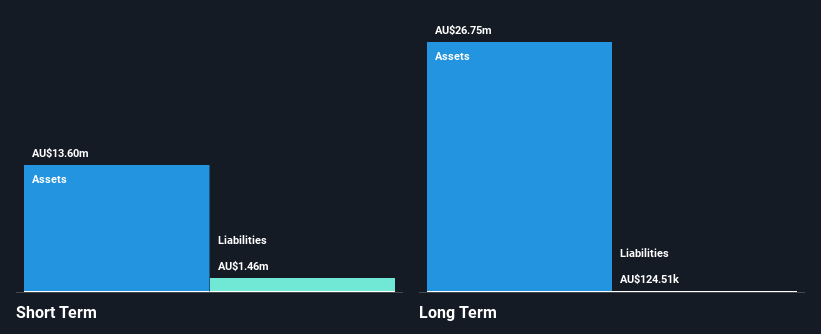

Southern Cross Gold Ltd, with a market cap of A$698.53 million, is pre-revenue and focuses on exploration at its Sunday Creek Gold-Antimony Project in Victoria. Recent drilling results have expanded mineralization at the Golden Dyke prospect, revealing high-grade gold and antimony veins that enhance the project's potential. Despite being unprofitable and having a cash runway of less than a year if current spending continues, the company remains debt-free with short-term assets exceeding liabilities. Shareholders experienced dilution over the past year, while management's limited tenure could affect strategic decisions as exploration progresses.

- Click to explore a detailed breakdown of our findings in Southern Cross Gold's financial health report.

- Evaluate Southern Cross Gold's prospects by accessing our earnings growth report.

Summing It All Up

- Embark on your investment journey to our 1,026 ASX Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SBM

St Barbara

Engages in the exploration, development, mining, and sale of gold.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives