- Australia

- /

- Construction

- /

- ASX:JLG

ASX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Australian market is currently experiencing a period of uncertainty, with ASX 200 futures fluctuating and recent economic developments such as the RBA's rate cut creating mixed sentiments among investors. For those interested in exploring investment opportunities beyond the larger, more established companies, penny stocks can offer intriguing possibilities. Despite their somewhat outdated name, these smaller or newer companies can still present valuable opportunities when they are underpinned by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$250.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.22 | A$346.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.81 | A$101.78M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$2.11 | A$226.38M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alcidion Group (ASX:ALC)

Simply Wall St Financial Health Rating: ★★★★☆☆

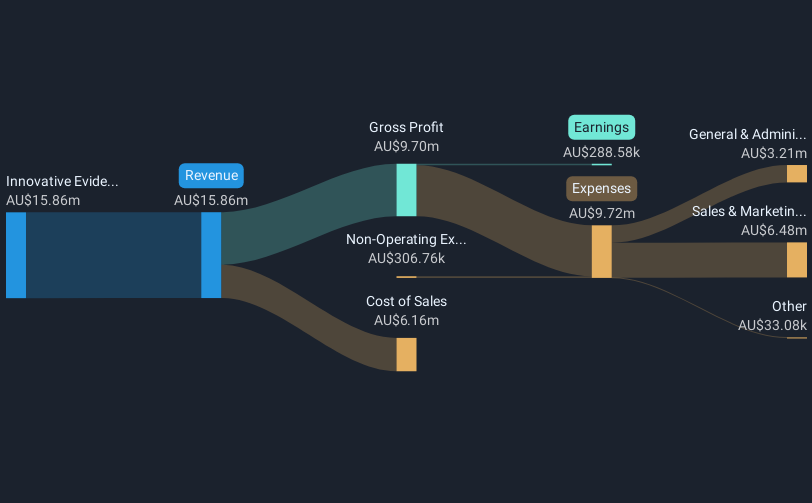

Overview: Alcidion Group Limited, along with its subsidiaries, develops and licenses healthcare software products in Australia, New Zealand, and the United Kingdom, with a market cap of A$119.52 million.

Operations: The company's revenue is primarily generated from the provision of healthcare software solutions, totaling A$37.06 million.

Market Cap: A$119.52M

Alcidion Group Limited, with a market cap of A$119.52 million, is currently unprofitable but has a stable cash runway exceeding one year based on current free cash flow. Despite being debt-free and having an experienced board and management team, its short-term assets (A$18.5M) fall short of covering short-term liabilities (A$19.2M). The company trades at 43.5% below estimated fair value, offering potential upside if profitability improves. Earnings are forecast to grow significantly at 103.74% annually, though past losses have increased by 27.5% per year over five years, highlighting ongoing challenges in achieving profitability.

- Dive into the specifics of Alcidion Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Alcidion Group's future.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited focuses on developing, commercializing, and marketing live biotherapeutics and complementary medicines both in Australia and internationally, with a market cap of A$132.61 million.

Operations: Biome Australia Limited does not report specific revenue segments.

Market Cap: A$132.61M

Biome Australia Limited, with a market cap of A$132.61 million, has transitioned to profitability, reporting a net income of A$0.43 million for the half year ended December 31, 2024. The company's short-term assets (A$9.8M) comfortably exceed both its short-term (A$5.7M) and long-term liabilities (A$181.8K), indicating solid financial health in the near term. Despite low return on equity at 6.4%, Biome's debt management is strong with more cash than total debt and reduced debt-to-equity ratio over five years from 25.5% to 22.1%. The stock trades significantly below estimated fair value, suggesting potential investment appeal amidst stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Biome Australia.

- Examine Biome Australia's earnings growth report to understand how analysts expect it to perform.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★★☆

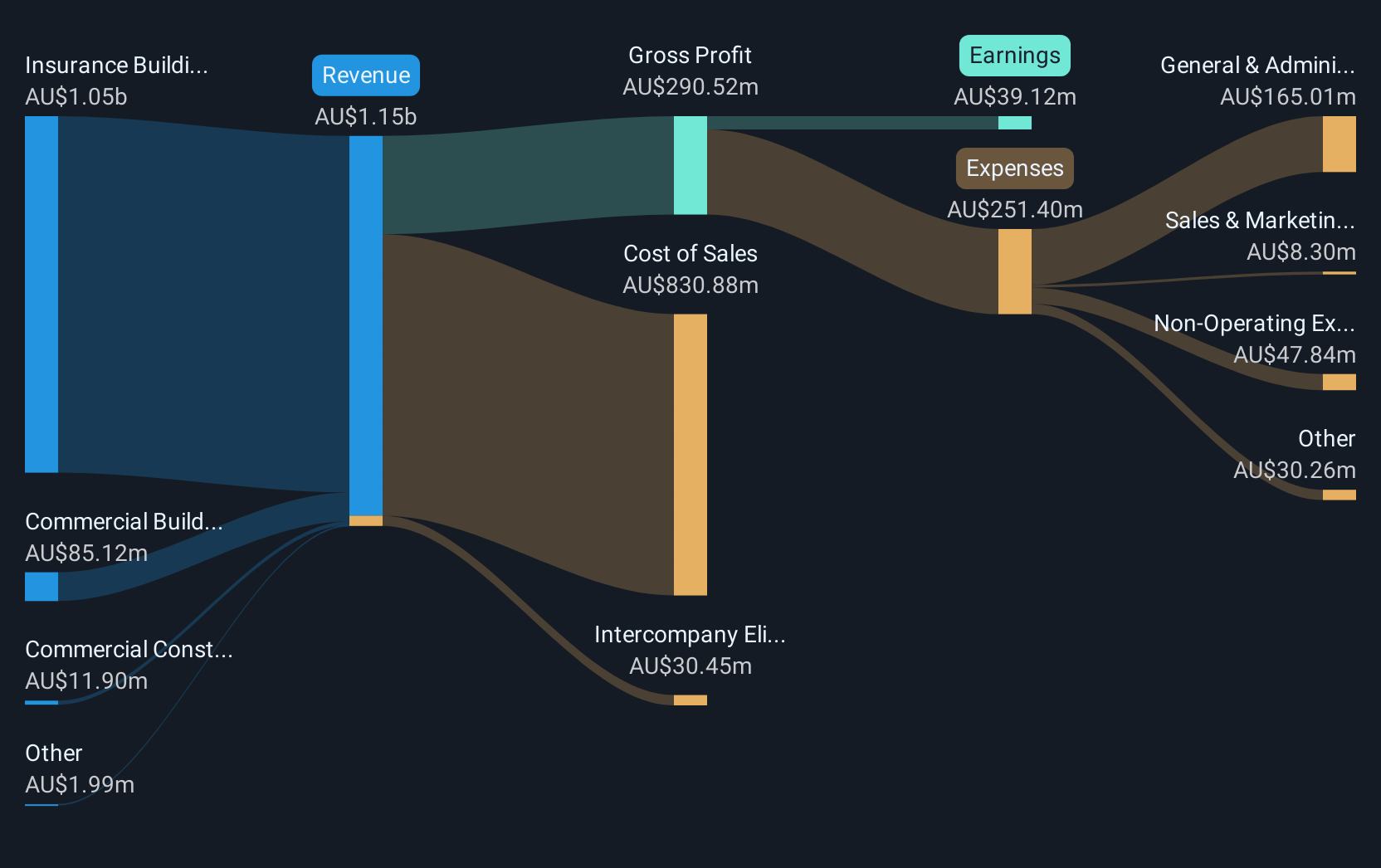

Overview: Johns Lyng Group Limited offers integrated building services across Australia, New Zealand, and the United States, with a market cap of A$1.10 billion.

Operations: The company's revenue is primarily derived from Insurance Building and Restoration Services, which generated A$1.08 billion, and Commercial Building Services, which contributed A$88.17 million.

Market Cap: A$1.1B

Johns Lyng Group, with a market cap of A$1.10 billion, demonstrates robust financial health and growth potential. The company's earnings have grown significantly at 30% annually over the past five years, although recent growth has slowed to 2.5%. Trading at 39% below estimated fair value suggests potential undervaluation. Despite an increase in debt-to-equity ratio from 1.9% to 7.4%, debt is well-covered by operating cash flow (85.5%) and interest payments are covered 51 times by EBIT, indicating sound debt management. Additionally, short-term assets exceed liabilities, further supporting its financial stability amidst stable weekly volatility.

- Get an in-depth perspective on Johns Lyng Group's performance by reading our balance sheet health report here.

- Evaluate Johns Lyng Group's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 1,033 ASX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JLG

Johns Lyng Group

Provides integrated building services in Australia, New Zealand, and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives