- Australia

- /

- Construction

- /

- ASX:JLG

ASX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX edging back towards 8,000 points following recent geopolitical developments and sector gains. Amidst these broader market movements, penny stocks continue to capture investor interest due to their potential for growth at lower price points. Though often overlooked, these smaller or newer companies can offer significant opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.60 | A$128.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.09 | A$154.26M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.565 | A$73.83M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.45 | A$377.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$117.3M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.30 | A$2.62B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$161.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.825 | A$613.5M | ✅ 4 ⚠️ 3 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$244.91M | ✅ 3 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.55 | A$1.17B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 987 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Johns Lyng Group Limited offers integrated building services across Australia, New Zealand, and the United States, with a market capitalization of approximately A$605.86 million.

Operations: The company generates revenue primarily from Insurance Building and Restoration Services (A$1.05 billion), followed by Commercial Building Services (A$85.12 million) and Commercial Construction (A$11.90 million).

Market Cap: A$605.86M

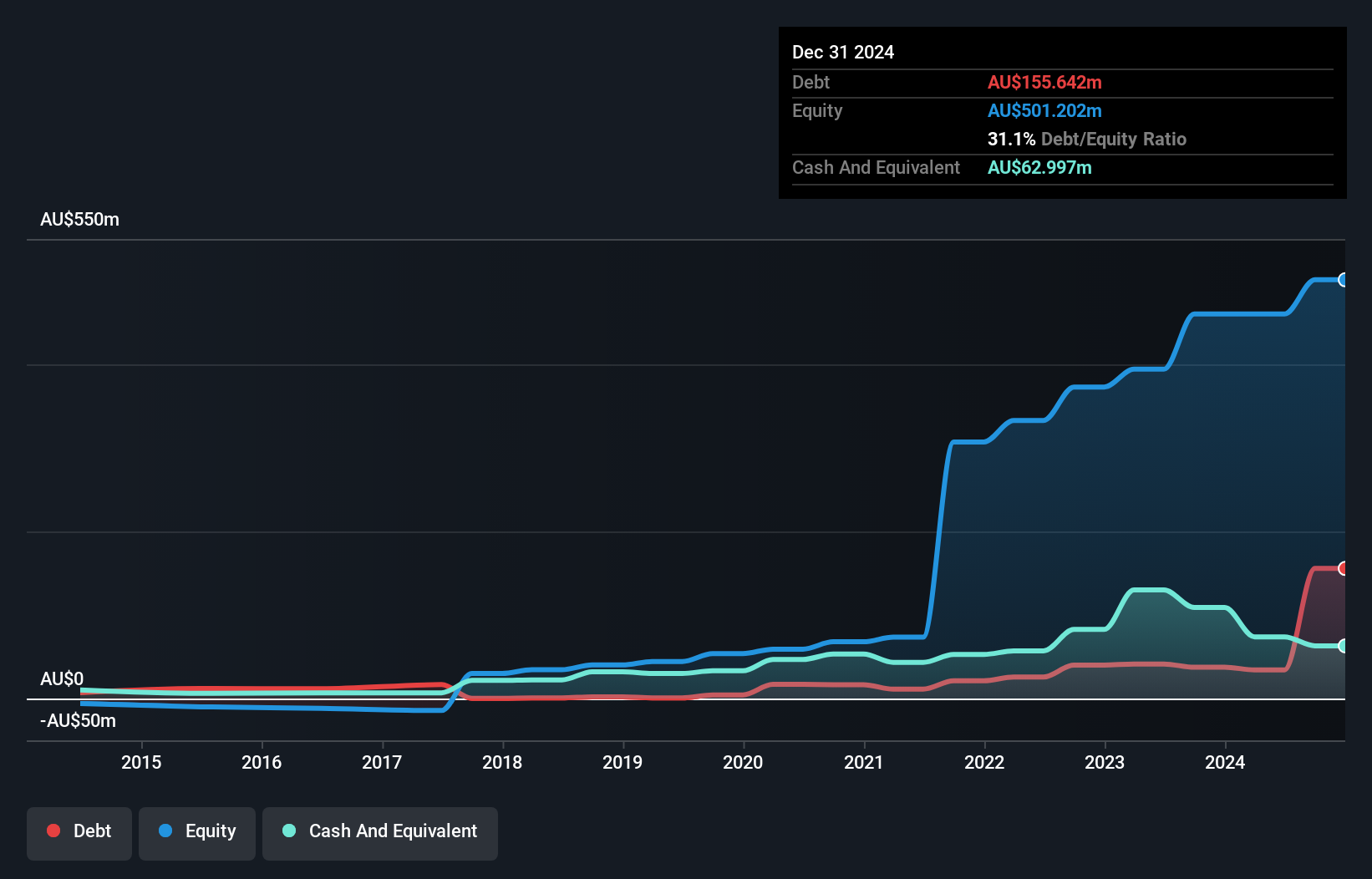

Johns Lyng Group Limited, with a market cap of A$605.86 million, primarily generates revenue from Insurance Building and Restoration Services. Despite having high-quality earnings and satisfactory debt levels, the company faces challenges such as negative earnings growth over the past year and a dividend not well covered by free cash flows. Recent events include its removal from the S&P/ASX 200 Index and lowered earnings guidance for 2025, reflecting potential volatility concerns. The board has seen changes with Curt Mudd's retirement, impacting leadership dynamics further as Alison Terry assumes a key committee role.

- Take a closer look at Johns Lyng Group's potential here in our financial health report.

- Evaluate Johns Lyng Group's prospects by accessing our earnings growth report.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market cap of A$469.79 million.

Operations: The company's revenue is primarily derived from its 50% interest in the Renison Tin Operation, generating A$218.82 million.

Market Cap: A$469.79M

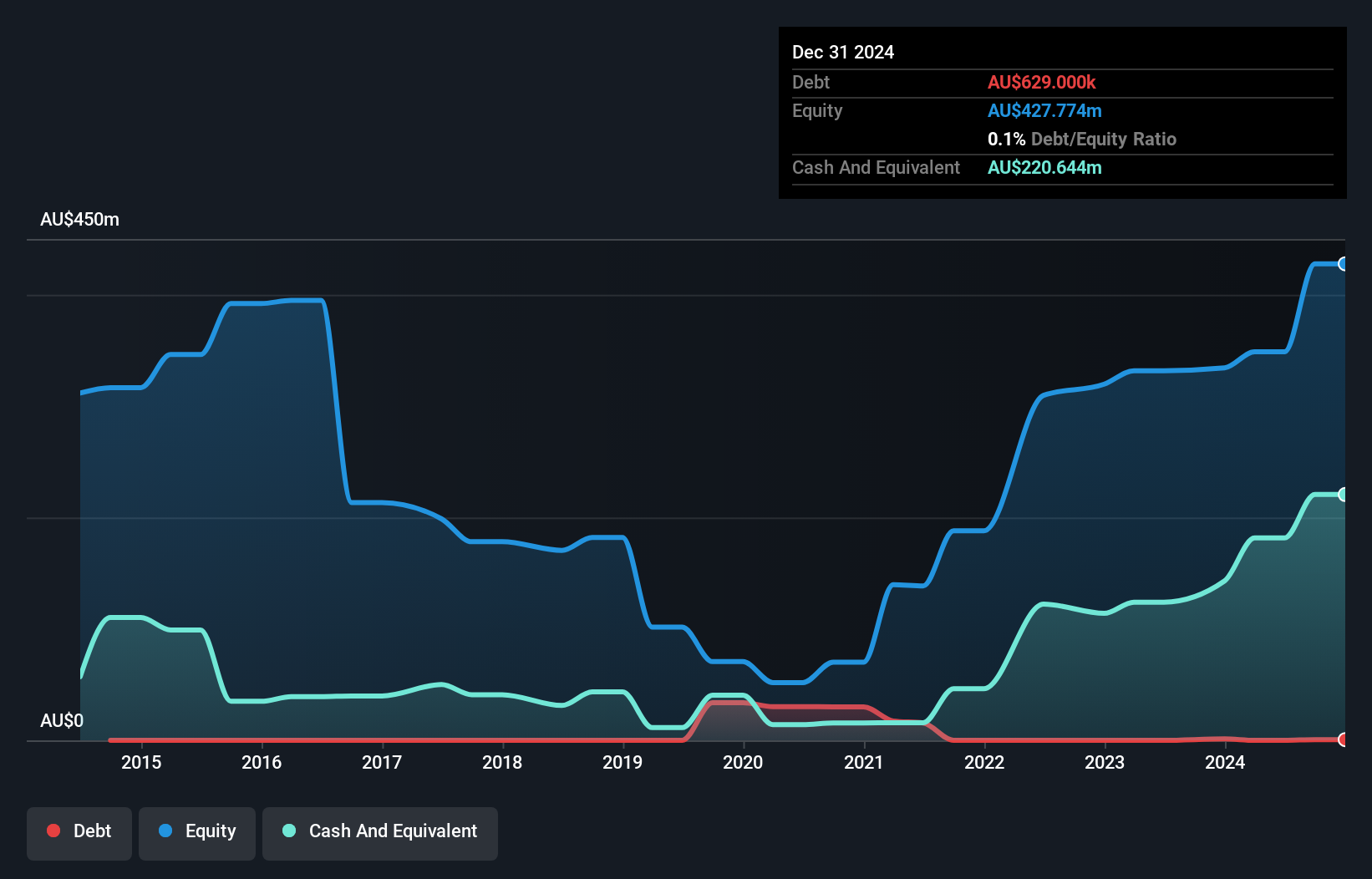

Metals X Limited, with a market cap of A$469.79 million, has shown significant financial improvement, reporting A$218.82 million in sales and a net income of A$102.35 million for 2024. The company’s debt levels are well managed, with more cash than total debt and strong operating cash flow coverage. Earnings growth has been substantial at 601.7% over the past year, supported by improved profit margins and reduced debt-to-equity ratio from 47.7% to 0.1% over five years. However, recent updates indicate a slight decrease in reserve ore tonnes and tin grade at Renison Tin Operations over the previous year.

- Unlock comprehensive insights into our analysis of Metals X stock in this financial health report.

- Explore historical data to track Metals X's performance over time in our past results report.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$349.09 million, offers advisors and wealth management solutions through a seamless digital platform both in Australia and internationally.

Operations: The company's revenue is primarily derived from its operations in Australia, generating A$95.58 million.

Market Cap: A$349.09M

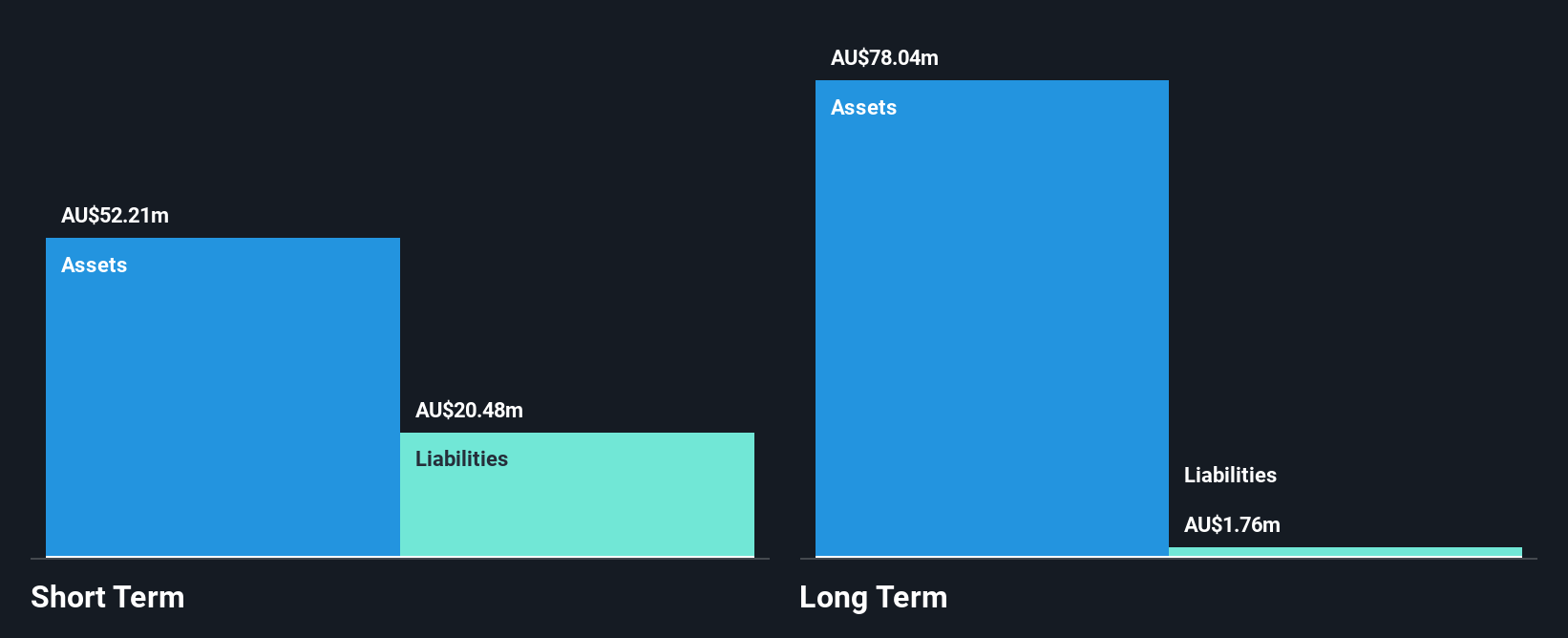

Praemium Limited, with a market cap of A$349.09 million, has demonstrated robust financial health, with short-term assets significantly exceeding both short- and long-term liabilities. The company is debt-free, eliminating concerns over interest coverage or cash flow sufficiency for debt repayment. Despite a low return on equity of 9.8%, Praemium's earnings have grown consistently at 19.8% annually over the past five years and are forecasted to continue growing at 23.63% per year. However, recent results were impacted by a large one-off loss of A$5.5 million, affecting overall profit margins which declined from 13% to 11.1%.

- Navigate through the intricacies of Praemium with our comprehensive balance sheet health report here.

- Understand Praemium's earnings outlook by examining our growth report.

Key Takeaways

- Reveal the 987 hidden gems among our ASX Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JLG

Johns Lyng Group

Provides integrated building services in Australia, New Zealand, and the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives