- Australia

- /

- Metals and Mining

- /

- ASX:DLI

Delta Lithium And 2 Other Exciting ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market is poised for a cautious start, with the ASX200 set to open slightly higher amid ongoing global economic discussions and upcoming domestic events like the Federal Election and CPI data release. In such a climate, investors often seek opportunities that balance risk with potential growth, turning their attention to smaller or newer companies known as penny stocks. While the term may seem outdated, these stocks can still offer intriguing prospects when backed by solid financials, presenting hidden value in an ever-evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.63 | A$131.29M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.46 | A$379.29M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.33 | A$2.66B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.45 | A$163.7M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.835 | A$616.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.715 | A$840.49M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.61 | A$1.19B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 989 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delta Lithium Limited focuses on exploring and developing lithium and gold properties in Western Australia, with a market cap of A$125.39 million.

Operations: Delta Lithium Limited has not reported any specific revenue segments.

Market Cap: A$125.39M

Delta Lithium Limited, with a market cap of A$125.39 million, is pre-revenue and primarily focused on lithium and gold exploration in Western Australia. Recent updates highlight a significant 140% increase in the Indicated lithium Mineral Resource at its Yinnetharra project, though overall resources have decreased due to refined geological models. The company is advancing its Mt Ida Gold Project with promising drill results and has applied for necessary permits to construct a processing plant. Despite being debt-free and having sufficient cash reserves for two years, Delta remains unprofitable with no immediate forecast for profitability.

- Click here to discover the nuances of Delta Lithium with our detailed analytical financial health report.

- Explore Delta Lithium's analyst forecasts in our growth report.

Helia Group (ASX:HLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Helia Group Limited operates in the loan mortgage insurance sector primarily in Australia and has a market capitalization of approximately A$1.28 billion.

Operations: The company generates revenue of A$504.73 million from its loan mortgage insurance operations.

Market Cap: A$1.28B

Helia Group Limited, with a market cap of A$1.28 billion, operates in the loan mortgage insurance sector and faces potential challenges as it enters exclusive negotiations with an alternative provider for its contract with Commonwealth Bank of Australia. Despite this, Helia maintains strong financial health, having more cash than debt and well-covered liabilities. The company reported A$231.54 million net income for 2024 but anticipates earnings decline over the next three years. Recent moves include increasing its equity buyback plan to A$200 million and declaring both ordinary and special dividends, though dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Dive into the specifics of Helia Group here with our thorough balance sheet health report.

- Understand Helia Group's earnings outlook by examining our growth report.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited distributes electrical infrastructure in Australia and has a market cap of A$409.59 million.

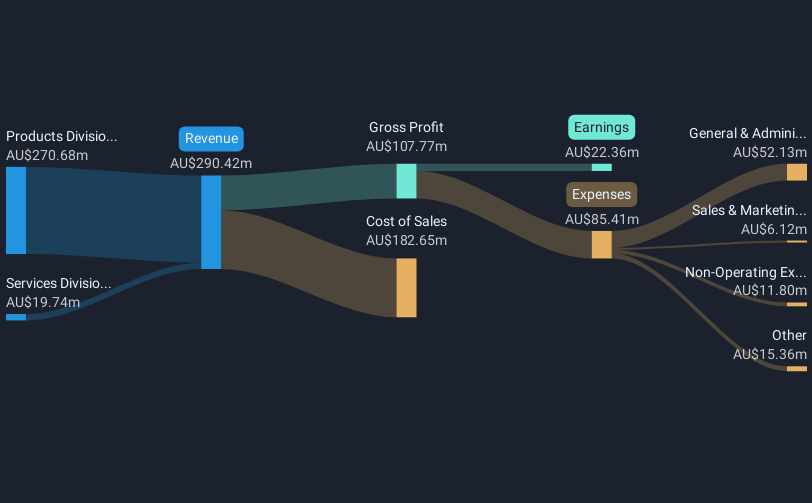

Operations: The company's revenue is derived from two main segments: the Products Division, which generated A$325.32 million, and the Services Division, contributing A$21.30 million.

Market Cap: A$409.59M

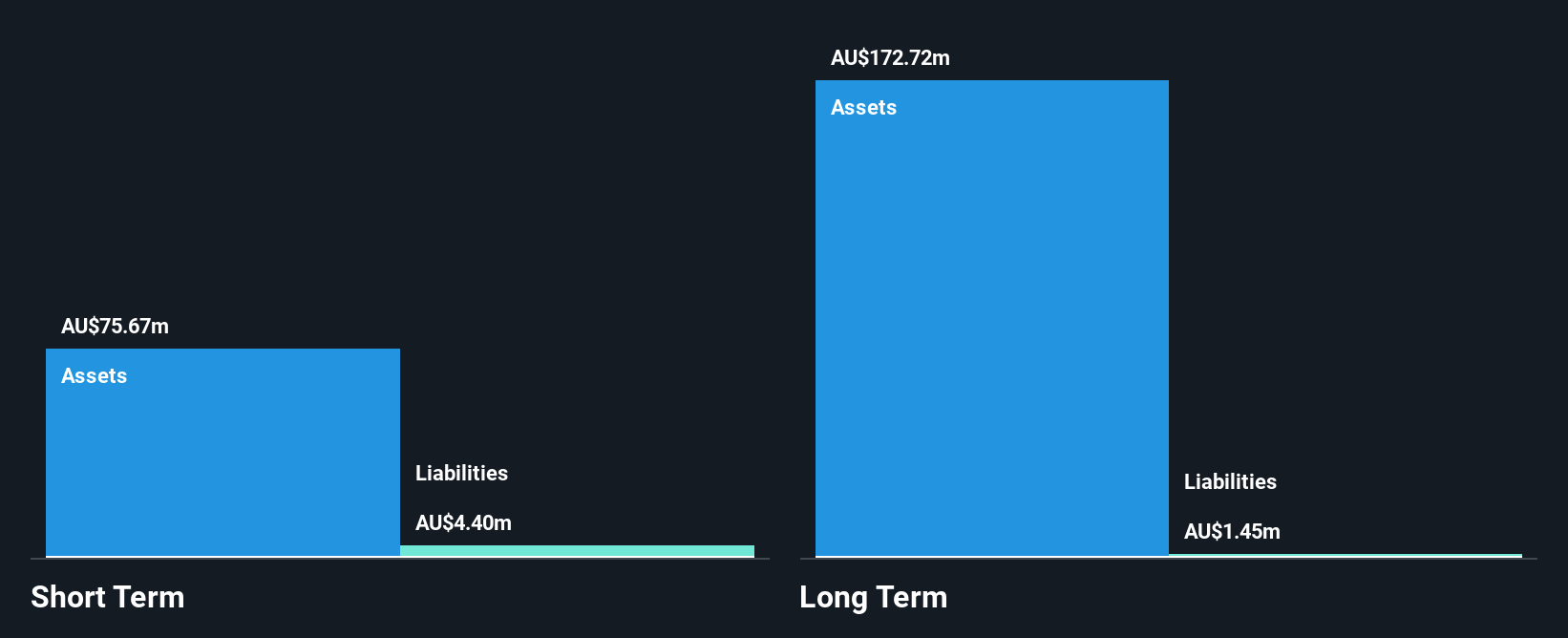

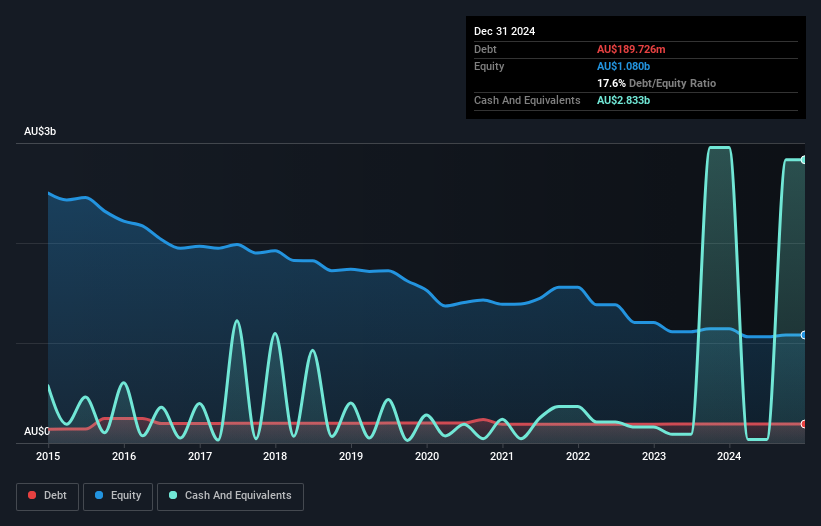

IPD Group, with a market cap of A$409.59 million, has demonstrated robust financial health and growth, particularly in its Products Division. The company reported significant earnings growth of 48.7% over the past year, surpassing industry averages. Its short-term assets comfortably cover both short- and long-term liabilities, while its debt is well-managed with strong cash flow coverage. Although trading below estimated fair value by 27%, IPD's Return on Equity remains relatively low at 16.5%. Recent earnings reports show increased sales and net income compared to the previous year, alongside a declared dividend of A$0.064 per share for shareholders.

- Navigate through the intricacies of IPD Group with our comprehensive balance sheet health report here.

- Evaluate IPD Group's prospects by accessing our earnings growth report.

Make It Happen

- Click this link to deep-dive into the 989 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DLI

Delta Lithium

Explores for and develops lithium and gold properties in Western Australia.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives