- Australia

- /

- Aerospace & Defense

- /

- ASX:HCL

Cautious Investors Not Rewarding HighCom Limited's (ASX:HCL) Performance Completely

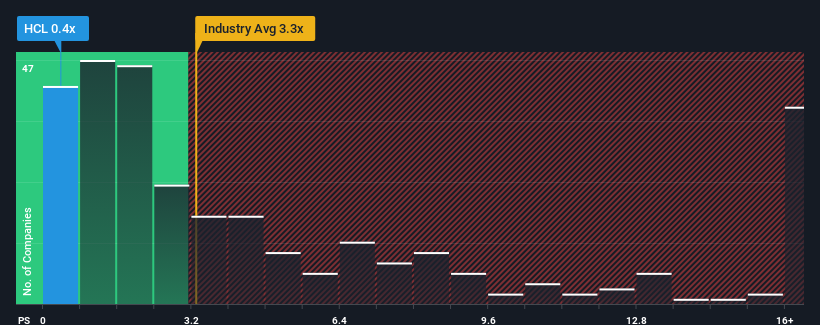

HighCom Limited's (ASX:HCL) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in Australia have P/S ratios greater than 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for HighCom

What Does HighCom's Recent Performance Look Like?

While the industry has experienced revenue growth lately, HighCom's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think HighCom's future stacks up against the industry? In that case, our free report is a great place to start.How Is HighCom's Revenue Growth Trending?

In order to justify its P/S ratio, HighCom would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 15% each year over the next three years. With the industry only predicted to deliver 10% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that HighCom is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On HighCom's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

HighCom's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for HighCom that you should be aware of.

If you're unsure about the strength of HighCom's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HighCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HCL

HighCom

Provides armors and technologies for defense sectors in Australia, the Asia Pacific, North America, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026