- Australia

- /

- Consumer Finance

- /

- ASX:CCP

October 2024's Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it has shown a robust 18% increase over the past year with earnings forecasted to grow by 12% annually. In this environment, identifying stocks that are perceived as undervalued and exhibit insider buying can be an effective strategy for investors seeking opportunities in smaller companies.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.6x | 1.6x | 41.10% | ★★★★★★ |

| Bigtincan Holdings | NA | 1.3x | 42.41% | ★★★★★☆ |

| Collins Foods | 18.1x | 0.7x | 7.15% | ★★★★☆☆ |

| Centuria Capital Group | 22.3x | 5.0x | 43.74% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 43.92% | ★★★★☆☆ |

| Corporate Travel Management | 21.3x | 2.5x | 0.56% | ★★★★☆☆ |

| Eagers Automotive | 10.9x | 0.3x | 37.47% | ★★★★☆☆ |

| Dicker Data | 21.1x | 0.8x | -73.38% | ★★★☆☆☆ |

| Coventry Group | 225.4x | 0.4x | -12.86% | ★★★☆☆☆ |

| Abacus Storage King | 12.5x | 7.8x | -32.19% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

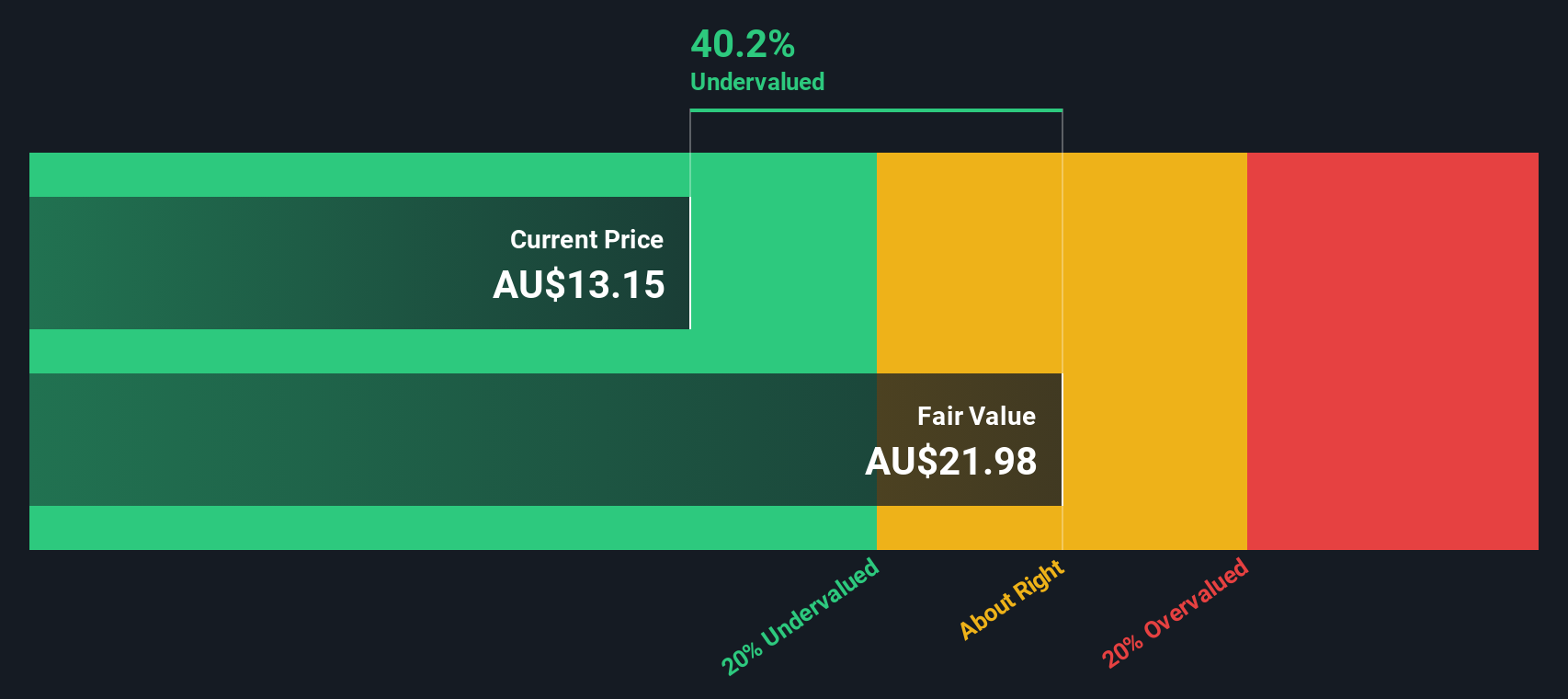

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Credit Corp Group is a financial services company specializing in debt ledger purchasing in the United States, Australia, and New Zealand, as well as consumer lending across these regions, with a market capitalization of A$2.06 billion.

Operations: The company's revenue streams are primarily derived from debt ledger purchasing in Australia, New Zealand, and the United States, as well as consumer lending across these regions. Over recent periods, the gross profit margin has shown a declining trend, reaching 87.09% by June 2024. Operating expenses have consistently been a significant portion of costs, with general and administrative expenses being the largest component.

PE: 22.5x

Credit Corp Group, a smaller player in Australia, presents intriguing potential for those eyeing undervalued stocks. Despite a dip in net income to A$50.71 million from last year’s A$91.25 million and profit margins shrinking from 23.1% to 13.4%, the company forecasts earnings growth of 13.46% annually. Recent insider confidence is evident with share purchases over the past year, hinting at optimism within management ranks amidst board renewal efforts like appointing Sarah Brennan as Non-Executive Director in September 2024.

- Get an in-depth perspective on Credit Corp Group's performance by reading our valuation report here.

Understand Credit Corp Group's track record by examining our Past report.

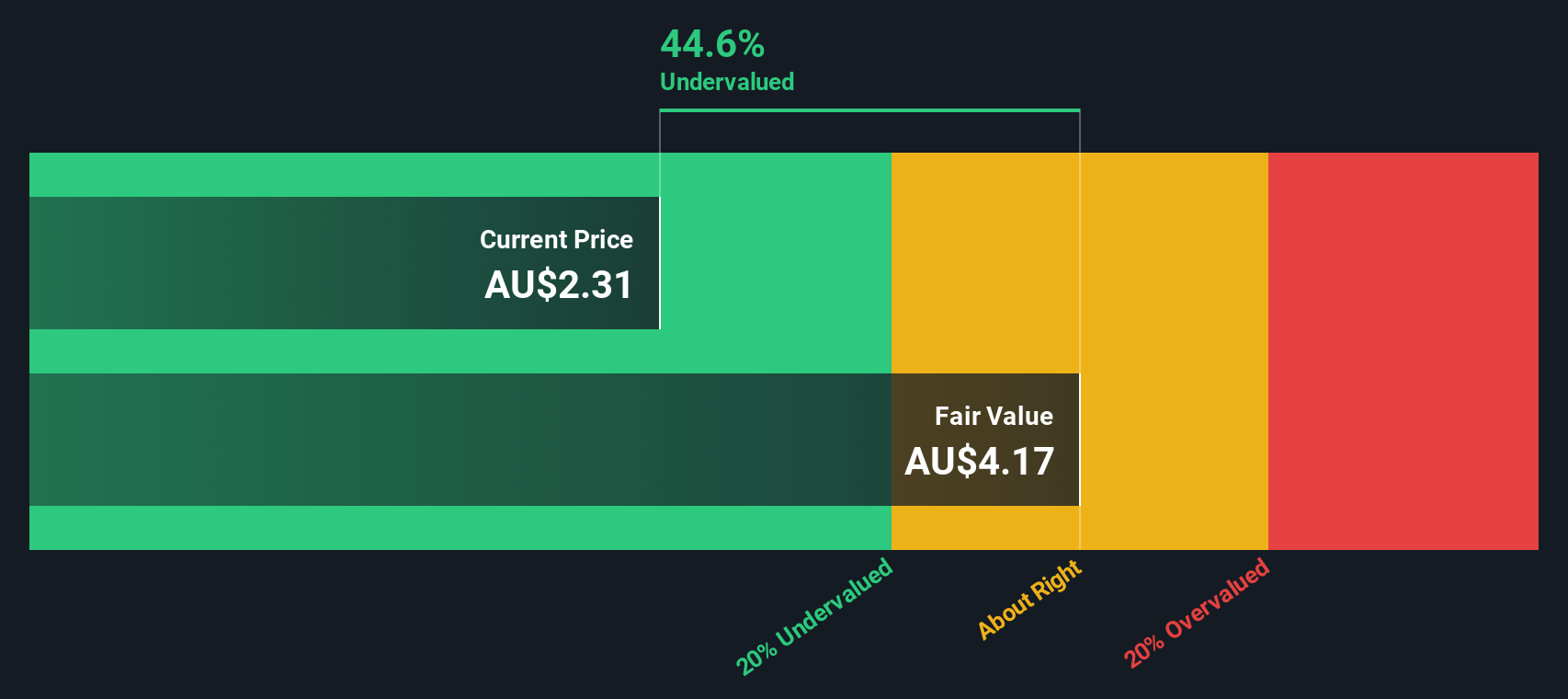

GWA Group (ASX:GWA)

Simply Wall St Value Rating: ★★★★★★

Overview: GWA Group is an Australian company specializing in water solutions, with a focus on the design and distribution of bathroom and kitchen fixtures, and it has a market capitalization of A$0.73 billion.

Operations: GWA Group generates revenue primarily from its Water Solutions segment, which accounts for A$413.49 million. The company's cost of goods sold (COGS) is A$251.14 million, leading to a gross profit margin of 39.26%. Operating expenses total A$96.32 million, including significant allocations to sales and marketing at A$49.07 million and general and administrative expenses at A$44.14 million. The net income margin stands at 9.34%, reflecting the efficiency in managing non-operating expenses of A$27.40 million alongside other operational costs.

PE: 16.6x

GWA Group stands out in Australia's small company landscape with a recent executive change, as Mr. McDonough steps down, to be succeeded by Bernadette Inglis on November 4, 2024. The company announced a dividend increase to A$0.08 per share for the six months ending June 30, 2024. Despite a slight dip in net income to A$38.63 million from A$43.16 million last year, earnings are projected to grow annually by over 11%.

- Delve into the full analysis valuation report here for a deeper understanding of GWA Group.

Evaluate GWA Group's historical performance by accessing our past performance report.

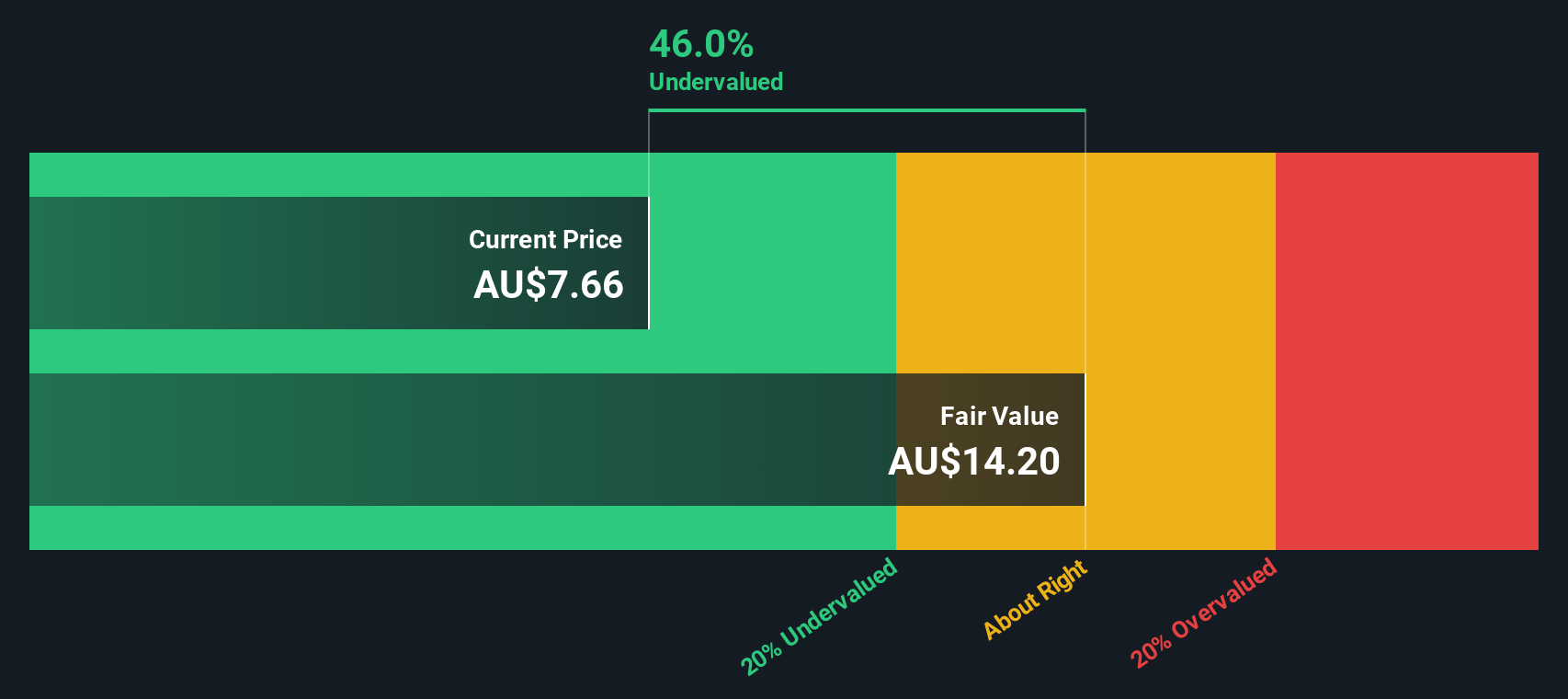

Smartgroup (ASX:SIQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Smartgroup is an Australian company that provides outsourced administration, vehicle services, and software distribution and group services, with a market cap of A$1.14 billion.

Operations: The company's revenue primarily comes from Outsourced Administration (OA) and Software, Distribution and Group Services (SDGS), with OA being the largest contributor. Over recent periods, the gross profit margin has shown a downward trend, decreasing to 54.90% as of June 2024.

PE: 16.5x

Smartgroup's recent financial performance highlights its potential within Australia's undervalued small companies. For the first half of 2024, they reported A$148.49 million in sales, up from A$116.62 million a year ago, with net income rising to A$34.26 million from A$28.94 million. Basic earnings per share increased to A$0.264 from A$0.223, reflecting solid growth despite relying on higher-risk external borrowing for funding needs. Insider confidence is evident through significant share purchases over the past six months, suggesting optimism about future prospects despite financial risks involved.

- Dive into the specifics of Smartgroup here with our thorough valuation report.

Explore historical data to track Smartgroup's performance over time in our Past section.

Key Takeaways

- Embark on your investment journey to our 25 Undervalued ASX Small Caps With Insider Buying selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCP

Credit Corp Group

Engages in the provision of debt ledger purchase and collection, and consumer lending services in Australia, New Zealand, and the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives